According to POLITICO and numerous other news outlets, top White House advisors remain convinced that pushing policies to make wealthy individuals and corporations start “paying their fair share” is a winning strategy in its own right, and not just a means of paying for other programs:

With that in mind, the Democratic pollsters John Anzalone and Matt Hogan are urging the party’s candidates to focus on forcing the rich and corporations to pay more in taxes.

Just a few problems with that prescription. First, successful Americans already pay their fair share. According to the IRS, the top 50 percent of taxpayers paid 97 percent of all individual income taxes in 2019, while the top 1 percent paid around 40 percent.

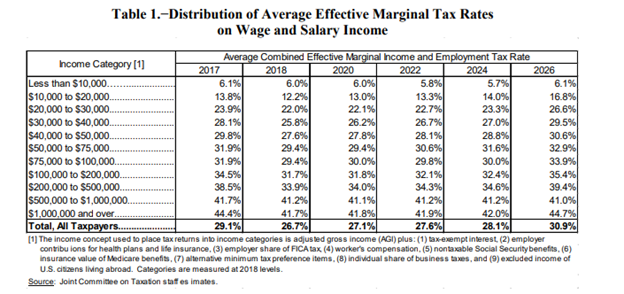

The story is very much the same when it comes to effective rates. According to JCT, top income earners pay effective marginal tax rates well above 40 percent, or about 12 points more than somebody making $75,000, and well above what voters think is fair:

Second, tax revenues in the last year have shot through the roof, primarily as a result of higher taxes being paid by wealthy individuals and corporations.

The table below compares the CBO’s revenue estimates for 2021 versus the actual revenue collected. Individual income tax receipts were 25 percent higher than expected, while corporate income taxes exceeded expectations by one-third. Overall, federal tax collections topped $4 trillion for the first time ever.

Corporations and the wealthy are already paying more.

Finally, raising taxes isn’t really that popular. While generic questions like “Do you support raising taxes on the wealthy?” might poll well in the abstract, the positive response rate falls sharply when any specifics are included. Americans are actually very modest in their expectations of what wealthy taxpayers should pay.

As we reported earlier, the Winston Group polled 1,000 registered voters last year about President Biden’s tax agenda. They were asked, “According to the IRS, the top 30% of income earners pay 90% of all the federal income taxes. Do you think that is more than their fair share, about right, less than their fair share, or don’t know?”

Twenty-six percent answered more than their fair share, 33 percent said it was about right, and only 22 percent said it was less than their fair share. That’s nearly three-to-one (59-22) against the idea that the rich need to pay more.

Another question observed that President Biden’s Build Back Better plan would impose a new 8 percent surtax on a taxpayer’s income exceeding $25 million and a 5 percent surtax on income exceeding $10 million. Respondents favored this policy by 52-32.

However, when people were told the surtax proposal would apply to individually and family-owned businesses, voters opposed this proposal 38-45. Among independents, support for the surtax proposal turned into 29-49 opposition.

What’s interesting about advice for the Feds to raise taxes is that it runs directly counter to what’s happening in the states. States are enjoying a revenue windfall too, but unlike DC pollsters, the states are reacting like rational people and reducing taxes. As Bruce Thompson points out in the Washington Examiner:

In 2021, 18 states enacted tax cuts, with most of them reducing corporate or personal taxes — or both. Arizona cut individual tax rates and small business taxes. Arkansas, Nebraska, and Oklahoma cut corporate tax rates, and North Carolina passed a bill phasing out all corporate taxes. So far this year, 19 states have proposed new tax cuts, including cuts in tax rates and reductions in gas and food taxes to fight inflation.

…All of these states are getting it right, doing the exact opposite of what Biden and Democrats want to do. Tax cuts will help fight inflation by increasing production and expanding supply. They will help businesses meet overseas competition and help offset the coming interest rate increases. As Democrats face a challenging 2022 election cycle, they would do well to look at the better example offered by many states.

Agreed. And the Administration and Congress would do well to pay less attention to advocates for higher taxes and more attention to what Americans really care about. As our Winston survey found, voters overwhelmingly agreed (68-21) that advancing the big tax-and-spend package should take a back seat to dealing with inflation, supply chain disruptions, and other pressing issues. Let’s start there.