Lynn Mucenski-Keck, a Partner at the accounting firm The Bonadio Group, has a fantastic piece in Forbes that makes the pass-through case against the framework’s tax increases.

“Pass-Through Owners Bear the Hit with Proposed Federal Tax Law Changes,” explains how a bill purportedly targeting billionaires and large corporations instead goes after Main Street businesses organized as pass-throughs. The excerpt below sums things up perfectly:

Unfortunately, when you follow the money, the picture starts to reveal that the taxpayers bearing the burden for the revenue are disproportionately pass-through entity owners, and not the large multinational companies and estates as many believed.

… While both pass-through entity owners and C corporations are seeing tax increases, keep in mind the type of businesses that are being impacted. In order for the corporate minimum tax to apply, book earnings must exceed $1 billion for a three-year period and the GILTI provisions generally apply to large multinational corporations. On the other hand, the proposal to extend the net investment income tax will impact S Corporations shareholders and select partners with an adjusted gross income over $500,000 and the permanence of the excess business loss limitation rule can apply to individuals operating trades or businesses, no matter their AGI. Even though the C Corporation and pass-through entity proposals will create similar revenue streams, the burden of the pass-through entity proposals will impact a much broader base of small businesses with AGI as little as $500,000 while the C Corporation impact primarily targets large multinational companies with more than $ 1 billion in book earnings, estimated to be less than 120 companies.

Mucenski-Keck further illustrates this point by breaking down the White House’s own revenue estimates:

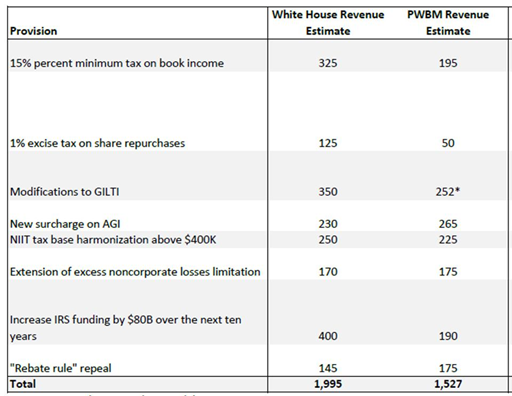

While reviewing the list of what remains in the tax proposals versus what was removed, some may conclude the highlights above are fair to both corporations, pass-through entities, and individuals. Everyone got a bit of the “compromise”. But to understand the weight of some of these proposals, and the type of taxpayers being affected, you must follow the money. The preliminary estimated revenue effects of selected provisions provided by White House and the University of Pennsylvania in the Penn Wharton Budget Model (PWBM) can be found below.

If you add the federal revenue creation from both the net investment income tax expansion and permanently establishing the excess business loss limitation, both directly impacting pass-through entity owners, the revenue being raised under the White House Estimate is $420 billion or $400 billion, respectively, under the PWBM estimate. The total Build Back America proposal is now estimated to be $1.75 trillion, resulting in 23% being born on the backs of pass-through entity owners. Reviewing the same PWBM revenue estimates for the corporate minimum tax and modifications to GILTI, which generally impacts large multinational C Corporations, will only create $447 billion or roughly 25% of the proposal.

Mucenski-Keck makes a critical point that needs to be emphasized. The C corporation tax hikes in the framework affect a large percentage of C corporation income, as almost all C corporation income is earned by the large, multi-national corporations subject to the minimum tax and international changes in the draft. The pass-through tax hikes, on the other hand, are larger (if you include the surtax) but will fall on a comparatively small percentage of pass-throughs in terms of the income they represent. These tax hikes are just going to hit them harder.

The latest version of the Build Back Better Act implements a series of backdoor tax hikes, surtaxes, and base-broadeners which are disproportionately borne by Main Street businesses, resulting in tax rates well above 50 percent. The will hurt Main Street and the people who live there, and they need to be defeated.