Ken Kies is out with an excellent piece today that breaks down how bad of a deal the House-passed Build Back Better Act is for pass-through businesses. As the former Joint Committee on Taxation head explains, even though this latest bill abandons efforts to repeal the 199A deduction, the tax hikes that remain create an “extreme disparate treatment” for pass-throughs compared to C corporations.

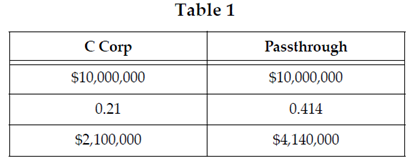

Kies focuses on the House bill’s new surtaxes (5 percent on pass-through income over $10 million, and 8 percent over $25 million) and the expansion of the 3.8 percent Net Investment Income Tax. Together, these changes raise the top pass-through rate to 41.4 percent, assuming the 199A deduction is received. Here’s Kies:

The following illustrates how an increment of $10 million of income of a passthrough business subject to this 41.4 percent compares with a similar $10 million increment of income for a C corporation:

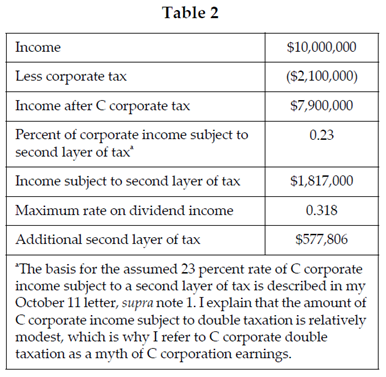

Now let’s consider the tax on current and subsequent distributions of C corporate income as dividends under the tax regime before Congress:

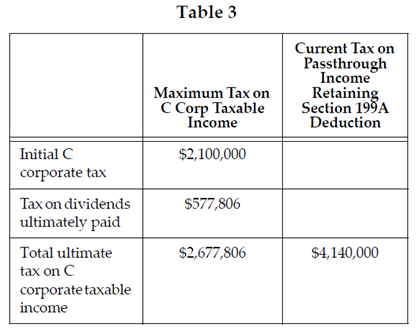

Now let’s compare the total tax burden on the same increment of $10 million of income for a passthrough business and a C corporation:

The comparison is truly astonishing. The same $10 million increment of income of a C corporation will bear a total ultimate tax of $2,677,806 while a passthrough business with the same increment of income will bear a total and immediate tax of $4,140,000, a burden 54.6 percent.

What could possibly be the policy rationale for such disparate tax treatment? Kies posits that it must be a misunderstanding:

Experience in the tax legislative process teaches that late-breaking ideas frequently have consequences that are not understood and that, also frequently, they may have a limited useful life. Exhibit A in the limited useful life category would be the ill-fated and poorly thought-out wealth tax that had a useful life of about 18 hours over October 24-25. House Speaker Nancy Pelosi, D-Calif., described its proposal as a publicity stunt. Surely, the surtax proposal’s consequences regarding the disparate treatment of passthrough businesses were also not understood. If Congress is going to pursue surtax proposals, the problem of extreme disparate treatment should be addressed.

With Majority Leader Schumer setting a Christmas deadline for passage of the BBB, Senators will have just over a month to decide whether they want a tax system that encourages economic growth and employment, or one that consolidates economic power and decision making into the C-suites of a few thousand public companies, leaving thousands family-owned businesses and the communities they serve worse off.