The House tax package would hit private companies twice as hard as public C corporations. It would impose marginal rates of 46.4 percent or more on private companies, while taxing public corporations as little as 26.5 percent. No business structure can survive such an imbalance, so the net effect would be to encourage further economic consolidation away from Main Street and towards Wall Street.

Why should policy makers care? Because private companies are where the jobs are.

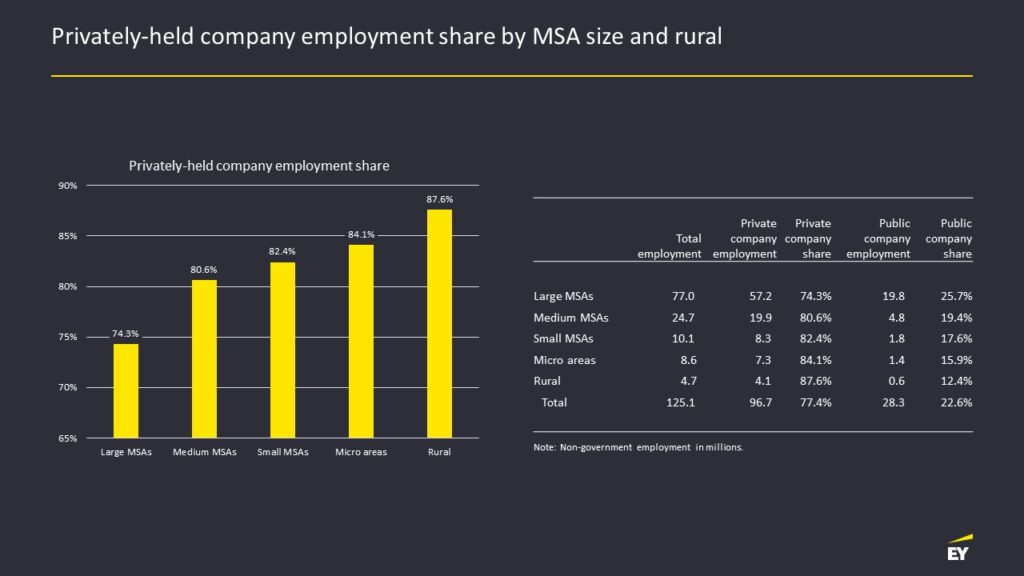

A new study from EY demonstrates that private companies supply the vast majority of jobs nationally – 77 percent of them. Public companies supply just 23 percent.

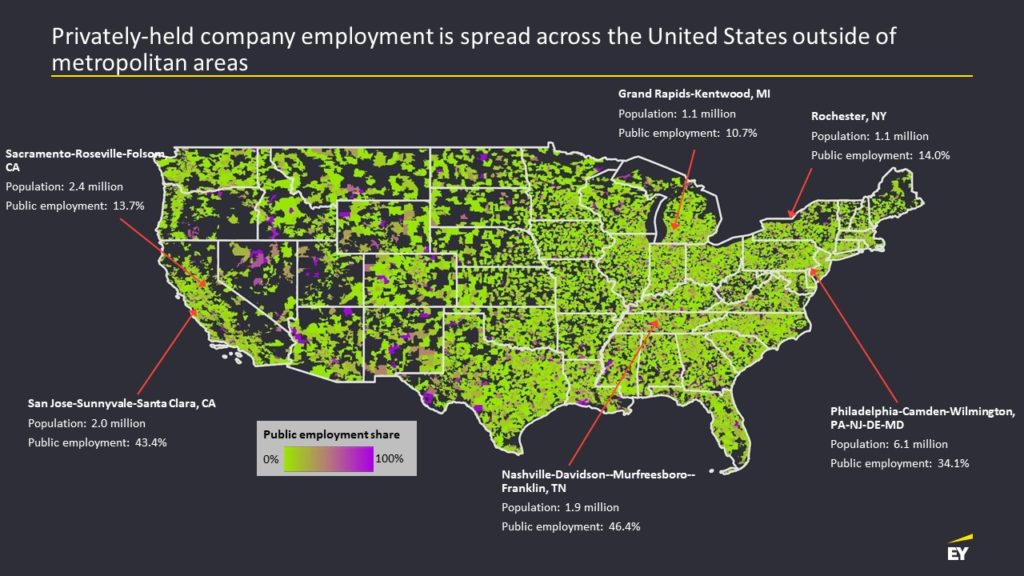

Just as importantly, private company employment is spread evenly across the country while public company jobs tended to be concentrated in a few cities and states. If you are worried about the economic decline in numerous regions of our country in recent years, you should oppose the Neal bill. It would accelerate that decline and make things worse.

So why is a bill marketed as making billionaires and multinational C corporations “pay their fair share” targeting family businesses instead? No idea, but the fact that the House bill completely misses its purported target is one of the better ironies underpinning this whole debate. Billionaires like Warren Buffett won’t pay much more under the House bill than they do now, but the family business down the street will. Here’s the breakdown:

- Pass-throughs: The bill authored by Chairman Neal would 1) increase their top rate, 2) apply the 3.8 percent Net Investment Income Tax to all their profits, 3) cap the 199A deduction, and 4) impose a new 3-percent Surtax on their income. That adds up to 46.4 percent, or 17 percentage points more than they pay now. Neal claims only companies making millions would pay this rate, but not for family businesses. For them, that top 46.4 percent rate kicks in when they make as little as $500,000.

- Private C Corporation: For private C corporations, the corporate rate increases to 26.5 percent, while the top rate on capital gains and dividends increases to 31.8 percent. Since most private company shareholders pay taxes, the combined rate would be 49.9 percent, or worse than staying as a pass-through. When people ask us why they can’t just convert, this is the reason. Either as pass-throughs or C corporations, private companies get hit hard. And that doesn’t include the estate tax.

- Public C Corporation: The rate on Amazon and other public C corporations would rise to just 26.5 percent, and while the rate on capital gains and dividends increases too, most public company shareholders don’t pay taxes, or pay sharply reduced rates. The result is that second layer of tax is deeply discounted if it’s paid at all. EY estimated the second layer for public companies was about 8 percentage points, so the combined rate for public C corporations is somewhere in the mid-30s, or about 12 percentage points less that the private company rate.

46.4 percent does not equal 26.5 percent. That’s not parity for Main Street businesses, and the sponsors of the House bill know it.

One interesting result from the EY study is just how much public employment varies state-by-state and city-by-city. For example, public companies account for nearly half of all jobs in Nashville, but fewer than one in five jobs in Portland. Chairman Wyden might want to consider that when crafting his Senate alternative to the House bill.

Finally, here’s the breakdown of all 50 states and where they rank in terms of private company employment. There are 22 states where private companies account for more than four out of five workers, including Maine, Montana, Oregon, New Hampshire, and Wisconsin.

The Neal bill would hurt private companies and the workers that rely on them. It would accelerate the consolidation of economic power and decision making into the C-suites of a few thousand public companies, leaving thousands of communities worse off. The bill is bad for Main Street and bad for the country.