The Section 199A deduction is under attack. Senate Finance Chair Ron Wyden’s Small Business Tax Fairness Act would phase-out the deduction for owners making between $400,000 and $500,000, while critics of the deduction continue to voice their concerns loudly and often.

This post addresses all these concerns and makes the case for why Congress should retain the full 199A deduction:

- Under the Wyden bill, up to one million pass-through employers are at risk of seeing a tax hike, putting at risk up to 28 million jobs.

- Coupled with the other rate hikes under consideration, including the higher corporate rate, between 2 to 3 million Main Street employers will be harmed, putting more than 40 million jobs at risk.

- The 199A deduction is necessary to balance the tax treatment of pass-through businesses with the lower corporate rate.

- Without the 199A deduction, large pass-throughs would pay rates 12 percentage points higher than the average C corporation.

- Capping the 199A deduction would hurt the economy and cost jobs, but it is just one of many tax hikes confronting pass-through businesses this fall.

The cumulative effect of these tax hikes will be to hurt millions of Main Street businesses, their employees, and the communities that depend on them.

Wyden Bill Targets 1 Million Businesses and 28 Million Jobs

If Congress were to adopt the Wyden cap on Section 199A, it would sharply raise taxes on pass-through businesses and endanger American jobs. How many businesses? How many jobs?

A 2019 Treasury study of the 199A deduction found there are about 1 million owners with incomes above $400,000 that benefit from 199A. Businesses that size are subject to so-called “guardrails” that strictly limit the 199A deduction. As Treasury notes:

For taxpayers with incomes above the top of the phase-in range, the guardrails eliminate the portion of the 199A deduction derived from businesses that either are “specified service trades or businesses” (SSTBs) or do not pay sufficient W-2 wages or own enough capital assets.

In other words, the businesses targeted by the Wyden bill are exclusively Main Street businesses who invest capital and employ lots of workers. How many workers? A 2015 report by the Tax Foundation says:

According to 2011 Census data, a combined 27.5 percent (18.1 million) of pass-through employment was at firms with more than 100 employees, and 15.9 percent (10.3 million) of pass-through employees work at large firms with 500 or more employees.

That’s 28.4 million workers at pass-throughs employing over 100 employees and as good an approximation as we’re going to get for the number of jobs at risk under the Wyden 199A bill. As the Tax Foundation data is 10 years old, it likely undercounts the actual number of jobs endangered by the Wyden bill.

Section 199A Necessary for Rate Parity

199A is necessary to level the playing field between pass-throughs and C corporations. That’s why it was made part of the Tax Cuts and Jobs Act (TCJA) and that’s why it’s important today. Not everyone agrees, of course. 199A critic Daniel Hemel says:

“Even without section 199A, the all-in tax rate on corporate profits distributed to shareholders is the same as the top rate on passthrough income. There was no inequity to remedy.”

But Hemel is wrong. It is true the all-in rate for a C corporation that immediately distributes all its earnings to fully taxable shareholders is similar (39.8 percent) to the top individual rate (37 percent), but it’s wrong to suggest that’s the typical case. As the Tax Policy Center reports:

- The share of stock held in taxable accounts has fallen from more than 80 percent to roughly one-quarter in the past fifty years; and

- Corporations forego paying dividends to defer the second layer of tax on their taxable shareholders. As the TPC notes, “Deferring the tax reduces the present value of its burden.”

In other words, the real marginal tax rate for C corporations is significantly less than the headline rate Hemel cites.

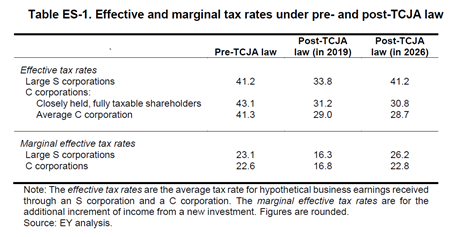

In 2019, we asked EY to estimate the marginal rates for C corporations and pass-through businesses, using all the available data. The results show that rough rate parity existed prior to the enactment of the TCJA and that it remained post-enactment of TCJA — but only as long as the 199A deduction stays in place. Without the 199A deduction, the average large S corporation would pay rates more than 12 percentage points higher than the average C corporation.

Why can’t the S corporation just convert to C? The resulting C corporation would pay the rates cited by Hemel, as private companies have to pay dividends and those dividends are paid, by definition, to taxable shareholders. In the C corporation world, public companies have all the advantages. This is the private company dilemma that caused Congress to create S corporations in the first place.

The 199A deduction is necessary to establish rate parity between C corporations and pass-through businesses. Without it, pass-through businesses will pay marginal rates almost half-again higher than even the largest C corporation.

Rate Parity Under Biden/Wyden

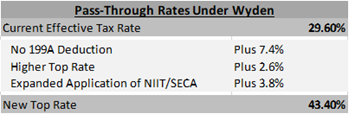

There are numerous tax hikes under consideration as part of reconciliation. On the corporate side, President Biden has proposed raising the rate from 21 to 28 percent. Others have argued for a 25 percent rate. On the pass-through side, in addition to capping 199A, they have proposed:

- Raising the top individual tax rate from 37 to 39.6 percent;

- Lowering the top rate’s threshold to $509,300; and

- Expanding the application of 3.8 percent surtaxes (NIIT, SECA) to all forms of business income, including LLC and active owners of S corporations and partnerships.

This trifecta of tax rate hikes would increase the pass-through business top rate from 29.6 percent all the way up to 43.4 percent:

Moreover, this higher rate would apply to a significantly larger tax base. Base broadening under consideration includes repealing like-kind exchanges and making permanent the TCJA’s Loss-Limitation rules. That would be on top of the base broadening already enacted in the TCJA, including the new 163(J) interest deduction cap, the new Loss Limitation/NOL rules, the new cap on SALT deductions, repeal of the old Section 199 deduction, and repeal of the Section 212 deductions.

So while much attention has been paid to a corporate rate that may jump up to 7 percentage points, pass-through businesses would see a top rate that’s 13.8 percentage points higher than they pay now – higher than many of them they paid pre-TCJA, actually — and it would apply to a significantly expanded tax base.

The breathtaking scale of these proposals is the reason S-Corp has come out opposed to any tax increase on Main Street employers this fall, regardless of how they are organized. C corporation, S corporation, it doesn’t matter. We need more jobs in the country, not higher taxes.

The Economic Impact of Taxing Main Street

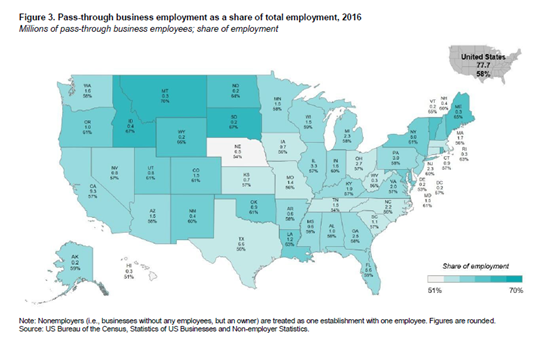

What’s the economic effect of all these rate hikes? Pass-through businesses employ the majority of private sector workers (58 percent) so any increase in their taxes should have broad negative effects on the economy.

The Tax Foundation recently reported that the Wyden bill would have little impact, but that’s not surprising. Their model, like their funding, is tilted towards public corporations.

The flaw in the Tax Foundation’s approach is the “current law” baseline they use. Since 199A is scheduled to sunset in 2026, capping the deduction now will have little long-term effect as the deduction is already scheduled to go away. But real businesses don’t use a current law baseline. They live under a “current policy” baseline and, under that baseline, their taxes are going up. Way up.

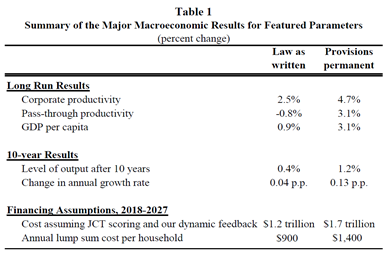

For a more realistic estimate of the economics, a Brookings paper authored by Robert Barro and Jason Furman isolates the economic impact of the sunsetting TCJA provisions, including the 199A deduction, the lower individual rates, and expensing.

As you can see, pass-through business productivity turns negative following the sunset of the 199A deduction and other provisions in 2026. This is due, in part, to the TCJA’s base broadening that doesn’t sunset in 2026, while all the pass-through tax benefits do.

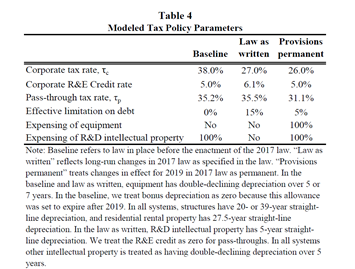

Barro-Furman also estimates the effect on rates of the sunsetting provisions. Similar to our EY study, Table 4 shows that rough rate parity existed between pass-throughs and C corporations prior to the TCJA and again under the TCJA, but only as long as the 199A deduction is in place. Without the deduction and lower individual rate, pass-through rates are almost 9 percentage points higher.

Conclusion

The 199A deduction is necessary to maintain parity with the C corporation rate. The Wyden plan to cap the 199A deduction will hurt one million employers and endanger up to 28 million jobs. Coupled with the other tax hikes under consideration, the plan would raise rates on private businesses organized as pass-throughs and C corporations, impose those higher rates on a broader base of business income, harm 2.5 to 3 million employers, and endanger more than 40 million jobs. These are not modest proposals, and they would harm private businesses organized as pass-throughs and C corporations. Congress should reject them and focus instead on rebuilding the economy.