The distribution tables released Tuesday on Chairman Neal’s tax increase package tell us what we already knew – the Neal bill is an all-out assault on family-owned businesses, together with the thousands of communities and millions of employees that depend on them.

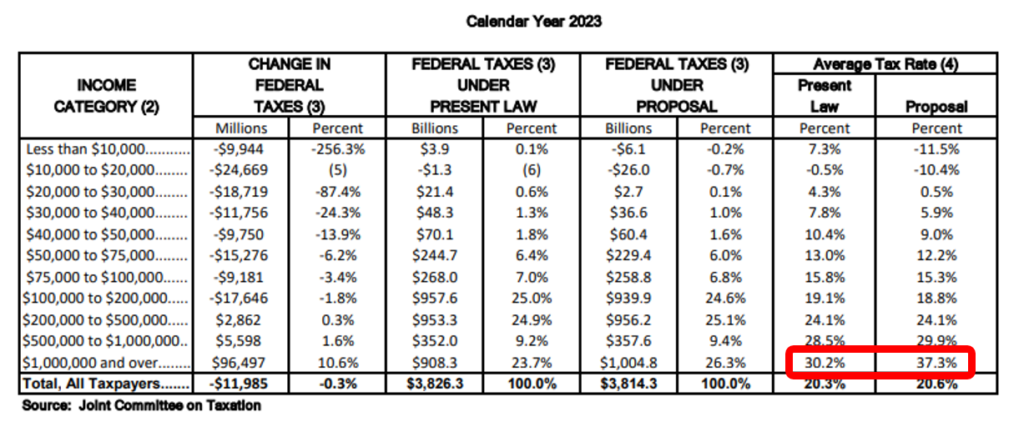

According to the tables, under the Neal bill taxpayers making more than $1 million a year would see their effective (average) rate rise from 30.2 percent 37.3 percent. Average rates are the taxes you pay on every dollar you earn and that is a massive increase at any time, let alone at the end of a pandemic.

How much of this affects Main Street? According to a 2011 Treasury study on small businesses, four out of five taxpayers with incomes exceeding $1 million were business owners. That proportion is likely higher today.

But wait, there’s more. Remember how the rich don’t pay their fair share? The tables show just how much of a lie that is. Not only is the Code obviously progressive, with low-income taxpayers paying negative rates and upper income taxpayers paying multiples of the rates paid by the middle-class, but according to the JCT, taxpayers making more than $100,000 will pay $3.2 trillion of the total $3.8 trillion expected to be collected in 2023 under current law.

That means families and businesses representing just 20 percent of all taxpayers pay over 80 percent of the total taxes paid. That’s more than fair, and that’s the law as it currently stands.

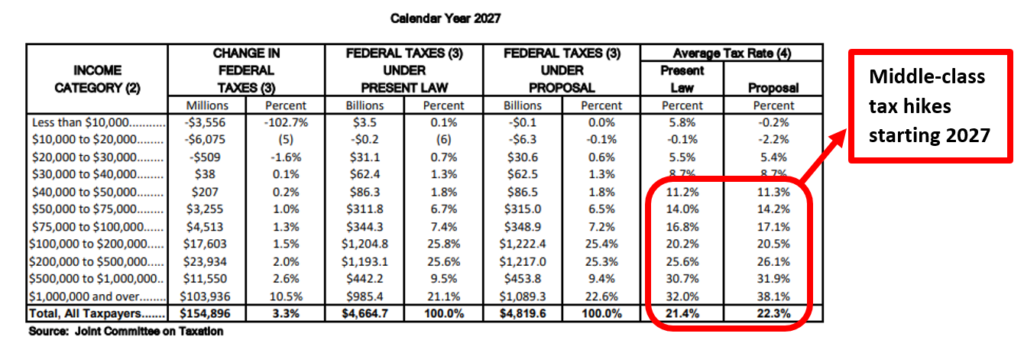

Finally, because the Ways and Means Committee draft would make permanent all the tax hikes but sunset most of the family tax relief, the bill would raise taxes on just about everybody starting in 2027. The TCJA was structured similarly, with the corporate changes made permanent while the cuts for families and pass-through businesses were sunset. Critics of the TCJA rightly pointed out that this would result in tax hikes on families and pass-through businesses starting 2026. Critics of the Ways and Means Committee draft can say the same thing – the bill is a massive tax hike on families making as little as $40,000 starting 2027.

The bill adopted by the Ways and Means Committee yesterday imposes a massive and historic tax hike on family businesses starting next year, it is based on a lie that wealthy taxpayers don’t pay their fair share, and beginning in 2027 the bill would raise taxes on millions of families with incomes as low as $40,000. It needs to be defeated.