The recent White House fact sheet on small businesses and tax hikes is highly misleading. It exaggerates the number of small businesses in order to minimize the harm President Biden’s tax hikes will inflict on Main Street, it ignores many of the tax hikes under consideration, and it dismisses the economic importance of those businesses targeted for higher taxes.

The reality is that the tax hikes moving through Congress target millions of business owners, putting tens of millions of jobs in danger:

- Somewhere between 2 and 3 million small and family-owned businesses will be subject to higher taxes under the Biden tax plan.

- These businesses are a significant source of employment, being responsible for up to 40 million private sector jobs.

- The tax hikes under consideration are substantial and comprehensive – they raise rates on businesses when they earn business income, when they are sold, and when they are passed on to the next generation.

- Combined with the significant base-broadening included in the Biden plan and the TCJA, tax burdens on affected small businesses will be higher than their pre-TCJA levels. The Biden plan is not a partial roll back of the Trump tax cuts – it goes well beyond that.

Here’s the reality behind Joe Biden’s assault on Main Street.

Fact Sheet – Assertion and Response

The White House Thursday posted a fact sheet claiming President Biden’s tax plan would be good for Main Street, protecting 97 percent of small businesses from tax hikes while reducing taxes on many of those same businesses.

According to a new Treasury Department analysis, the President’s Agenda will protect 97 percent of small business owners from income tax rate increases, while delivering tax cuts to more than 3.9 million entrepreneurs. [Emphasis added]

The White House refuses to release the analysis, but that hasn’t stopped a credulous press from seizing on these dubious claims:

- Reuters: “97 percent of small business owners won’t pay more income taxes under Biden plan – U.S. Treasury”

- The Hill: “Treasury: Few small business owners will see tax hikes under Biden proposal”

- Tax Notes: “White House, Treasury Claim Tax Hikes Will Spare Small Businesses”

With the White House looking to raise a record $3 trillion in new revenue over the next decade, how is it possible that America’s Main Street business community would be spared? It’s not. Here are some of the claims made in the fact sheet, together with the reality from Main Street:

“For example, President Biden’s proposal to restore the corporate tax rate halfway back to its pre-2018 level would not affect any small businesses that file taxes as a passthrough entity (LLCs, S-corps, and sole proprietorships). That’s nearly every small business in America.”

– The fact sheet is correct that pass-through businesses are unaffected by the corporate tax hike. The corporate rate hike would, however, affect the 1.4 million private businesses organized as C corporations that qualify as small businesses. These businesses employ 13 million workers, but under the Biden plan, their corporate tax rate is going up from 21 percent to 28 percent. For owners with higher incomes, any dividends they receive would be subject to higher rates too, rising from 23.8 percent to 43.4 percent, for a combined tax of nearly 60 percent. So that’s 1.4 million small business C corporations at risk of tax rates of up to 60 percent on their earnings. These small businesses are NOT counted in the fact sheet’s “3 percent.”

– The fact sheet emphasizes that the Biden plan raises the corporate rate “halfway back to its pre-2018 level” but ignores the significant base-broadening included in both the TCJA and the Biden plan. The combination of the higher, 28-percent rate and the broader tax base will raise corporate taxes well above their pre-TCJA levels. For the 1.4 million small business C corporations, this is far from a modest rate hike.

“Similarly, the President’s proposal to restore the top income tax bracket to its pre-2018 level – which would only raise taxes by 2.6 percentage points for the wealthiest households in America – would affect less than 3 percent of small business owners, according to the Treasury Department’s new analysis focused exclusively on small businesses filing as S-corporations, partnerships, and on individual income tax return Form 1040 Schedules C, E and F (as noted, nearly every small business falls in this category).”

– The White House hasn’t released the Treasury “analysis” but the numbers are obvious enough. To claim 3 percent, Treasury is using a broad definition of business owner that includes every taxpayer who receives a 1099, including those that might have a vacation home they occasionally rent out or an employee who gives a speech or two on the side. Most Americans don’t think of those taxpayers as “small business owners.”

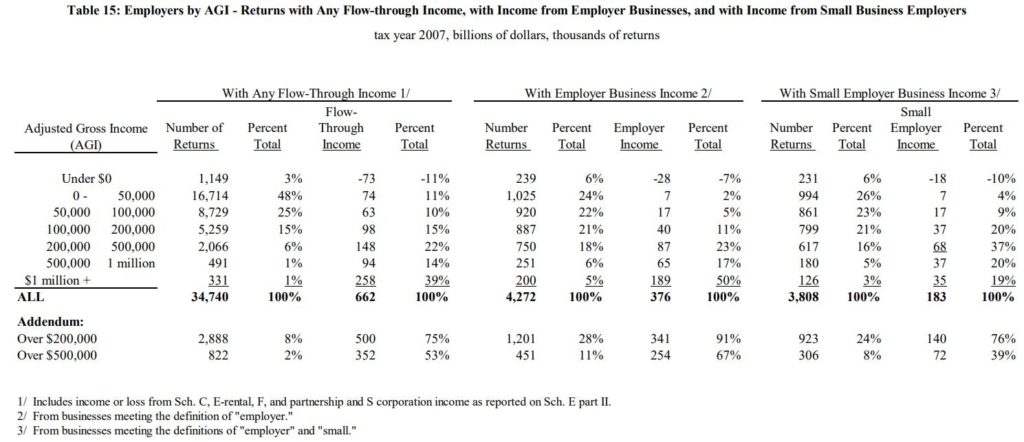

A more meaningful definition for purposes of this debate would look at those taxpayers whose business income represents a majority of their overall income, or whose businesses have actual employees. The Obama Treasury Department did this analysis back in 2011, and their numbers show that raising the top individual income tax rate (and reducing the income threshold) would affect a far higher percentage of small business employers.

For returns with “Employer Business Income,” Treasury found that owners with incomes exceeding $200,000 made up 28 percent of those returns and they earned 91 percent of all the employer business income. Owners with incomes exceeding $500,000 made up 11 percent of those returns and earned 67 percent of all employer business income. That’s between 450,000 and 1.2 million small business employers subject to higher individual tax rates under the Biden plan.

This data is almost a decade old, so the percentage of affected owners would be higher today. By any measure, it’s clear the Biden proposal to raise the top pass-through rate while lowering the income threshold will hit somewhere between 10 and 20 percent of small business employers.

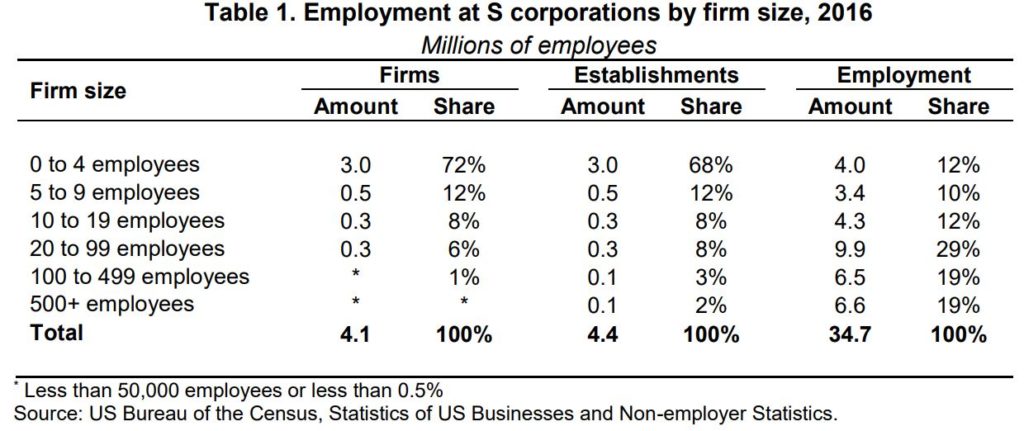

– Small businesses targeted by the Biden tax hikes earn a substantial portion of pass-through business income. They also employ more people. This table from our 2019 EY study shows that large S corporations employing more than 20 workers make up less than 13 percent of all S corporations but employ more than 20 million workers.

A similar dynamic applies to partnerships. A report on the pass-through sector by the Tax Foundation found that nearly half of all pass-through employment is at firms employing 20 or more workers (30 million). Add it all together and the private businesses targeted by President Biden’s tax plan employ around 40 million workers (13 million C corporation workers and 30 million pass-through workers). His tax hikes are substantial and they will put those jobs at risk.

– The fact sheet focuses on raising the top individual rate, but what about the other tax hikes? The Biden plan includes:

- Expanding the 3.8 percent Net Investment Income Tax (NIIT) and Self-Employment Tax (SECA) to apply to the S corporation and partnership income of active owners whose incomes exceed $400,000;

- Raising the capital gains rate from 23.8 to 43.4 percent for taxpayers with incomes exceeding $1 million; and

- Applying the higher capital gains rate to unrealized gains exceeding $1 million at death.

The net effect of these changes is to raise the top tax rate on pass-through businesses by at least 6 percentage points. This rate hike does not include the marginal cost of paying the higher capital gains rate or planning for the “capital gains at death” provision. Despite the President’s promises, there are a number of circumstances in which business owners making less than $400,000 a year would be subject to higher taxes under the Biden plan, including:

- Business Sales: Under the Biden plan, the higher 43.4 percent capital gains rate (the highest in US history) would apply to owners when they sell their business. Since the $1 million income threshold includes gains from the sale, owners who historically earn well below $400,000 but have a large, one-time gain when they sell their business would be subject to the higher capital gains tax.

- Capital Gains at Death: A similar analysis applies to businesses passed on from one generation to the next, only in this case, the tax owed is not the result of an actual sale, but rather a deemed one. As a result, this “double death tax” proposal will result in valuation and liquidity challenges for the affected small businesses. (The Biden plan calls for protections for family businesses and farms, but Treasury has yet to specify exactly how they would work. A similar attempt was made in the past – the Qualified Family-Owned Business Interest deduction – but was a huge bust.)

- 8 Percent Tax NOT Indexed: The expansion of the NIIT and SECA taxes applies to business income for owners whose incomes exceed $400,000. This threshold, however, is NOT indexed and, over time, the expanded 3.8 percent taxes would apply to small business owners making significantly less than $400,000 in today’s dollars. (With inflation accelerating, the erosion of the threshold’s value could happen very quickly.)

– The White House fact sheet also doesn’t review tax policies targeting small businesses that are under consideration by Congress. For example, the Chairman of the Senate Finance Committee introduced legislation to phase-out the Section 199A business deduction for owners making more than $400,000. As with the Biden proposals, however, small business owners making less than the threshold are also at risk, as Wyden would preclude small business income attributed to estates or trusts from the deduction. Far from being the exception, many family businesses have their ownership held in trusts in order to speed the transition from one generation to the next. The Wyden bill would raise their taxes by 5-7 percentage points, including owners making less than $400,000. Combined with the Biden rate hikes, pass-through business owners paying the top rate would see their rates rise by nearly 14 percentage points, or double the proposed C corporation rate hike.

“Not only will President Biden’s Build Back Better Agenda protect more than 97 percent of small business owners from income tax increases, it will also provide well-deserved tax cuts to Main Street entrepreneurs.”

– For comic relief, the White House claims 3.9 million small businesses will receive a “tax cut.” This surprised S-Corp, as we didn’t identify any meaningful small business tax cuts in the President’s $3 trillion tax hike plan. The tax cuts the White House is highlighting are (1) a ramped-up child credit and (2) increased subsidies for middle-income families on HealthCare.Gov. What’s notable about these two policies is neither is targeted at small business owners. The child credit only applies to families with children, while the health care subsidies are available to middle-income families and individuals. Any small business benefit is strictly incidental.

Bottom Line: The Biden tax plan is a direct assault on America’s privately-owned businesses. It will raise their taxes when they earn income, when they are sold, and when they are passed on from one generation to the next. This triple threat will hit millions of America’s small businesses, reducing employment, wages and investment in the communities they serve. It’s simply bad policy. No fact sheet is going to fix that.