Senate Democrats released their FY 2022 budget resolution this morning. With the bipartisan infrastructure bill scheduled to be voted on early this week, we could see final passage on the budget resolution no later than this Friday. What does that mean for private employers and tax policy?

$1.75 Trillion in Tax Hikes

A budget resolution is a framework with lots of wiggle room built in. That said, if the Senate follows the resolution’s headline numbers, the business community can expect to be looking at $1.75 trillion in new taxes over the next decade. That’s a lot – one of the largest tax hikes in history.

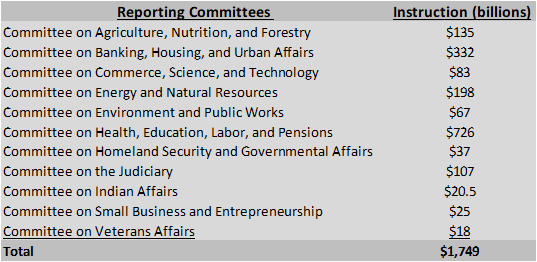

How did we arrive at $1.75 trillion? The Budget Committee and other sources have emphasized that they intend to increase mandatory federal spending by $3.5 trillion over the next ten years. Aside from the Finance Committee, the reconciliation instructions for the other 11 authorizing committees add up to $1.75 trillion in new mandatory spending.

Meanwhile, the Finance Committee’s instruction is for legislation to “reduce the deficit by at least $1 billion” over the next ten years. This suggests any new spending in the committee’s jurisdiction – including Medicare expansion, Paid Family Leave, Long-Term Care, etc. – would have to be offset with tax hikes on at least a dollar-per-dollar basis. As the summary states:

The framework includes a mix of policies within the jurisdiction of the Finance Committee that both increase and decrease outlays and increase and decrease revenues. In other words, the Finance Committee’s reconciliation product will both provide substantial portions of the investments contemplated by the $3.5 trillion package but also nearly all of the stated offsets.

As instructions for the other committees add up to about $1.75 trillion in deficit spending, to hit the overall spending target of $3.5 trillion, Finance would need to increase spending within its jurisdiction (and therefore also raise taxes) by $1.75 trillion. Finance could report fewer tax hikes, but that would mean the new spending is less than the advertised $3.5 trillion.

September 15th Reporting “Deadlines”

The reconciliation instructions call for committees to report their portions of the reconciliation bill by September 15th, suggesting that the instructed committees will be very busy over the August break and that the Senate intends to move on this massive package very quickly when it returns.

Don’t read too much into that. While it’s possible all the committees get their work done in time, the reconciliation “deadline” isn’t a real deadline and committees may continue to work well after the 15th. Given the size and complexity of the issues involved, most observers expect this process to go deep into the fall/winter.

Tax Hikes v. Tax Relief

One challenge the Finance Committee will face is balancing out any tax relief with additional tax hikes. For example, the summary document of the budget resolution outlines these areas within the Finance Committee’s jurisdiction for additional spending and/or tax relief:

- Paid Family and Medical Leave

- ACA expansion extension and filling the Medicaid Coverage Gap

- Expanding Medicare to include dental, vision, hearing benefits and lowering the eligibility age

- Addressing health care provider shortages (Graduate Medical Education)

- Child Tax Credit/EITC/CDCTC extension

- Long-term care for seniors and persons with disabilities (HCBS)

- Clean energy, manufacturing, and transportation tax incentives

- Pro-worker incentives and worker support

- Health equity (maternal, behavioral, and racial justice health investments)

- Housing incentives

- SALT cap relief

- Other investments within the jurisdiction of the Finance Committee

This is an illustrative list only and the Finance Committee will ultimately decide what policies to include, but you can see the dilemma – under the instruction, every dollar of tax relief will require a dollar of tax hikes. So any SALT relief included in the package will require higher taxes on somebody else. Same goes for the child tax credit and other tax benefits outlined. (For an example of what such a package might look like, see here.)

Bottom Line

The Senate budget resolution to be considered this week calls for $3.5 trillion in new spending, half of which is to be offset through higher taxes. Those numbers are so big, it is difficult to convey the scope of the policies being considered. Any one of them would be worth an entire session’s consideration. For obvious reasons, the business community is uniformly opposed to the tax hikes outlined by this budget resolution. As the Finance Committee begins its work, we will coordinate with our allies to highlight the threat this effort poses to Main Street and the people who work there. More to come.