Last month, over 100 trade associations voiced their strong opposition to changes to the Section 199A pass-through deduction. Their message was clear: now, more than ever, businesses across the country are relying on Section 199A to stay afloat.

Despite this broad opposition, Finance Committee Chair Ron Wyden today announced that he was pressing ahead with a bill to phase out the deduction for taxpayers with incomes over $400,000, while eliminating it altogether for those with incomes exceeding $500,000.

Section 199A offers business owners a 20-percent deduction on their qualified business income, but the benefit is phased out for “specified service” trade or business owners (such as lawyers and doctors) making over $315,000 (joint filers in 2018). For qualified businesses whose owners’ incomes exceed those thresholds, the deduction is limited to half of the W-2 wages paid, or 25 percent of W-2 wages plus a portion of the company’s capital expenditures.

In other words, Section 199A is designed to be laser-focused on job creation and investment. For business owners above the threshold, the only way to receive the deduction is to go out, invest and create jobs. According to the Senator, however:

Few policies showcase Republicans’ commitment to giveaways to the top 1% like the pass-through deduction created in their 2017 bill. The mega-millionaires get to write-off 20% of their income while middle-class accountants are cut out. This makes no sense, and my bill would overhaul the deduction to ensure it’s benefiting Main Street small businesses.

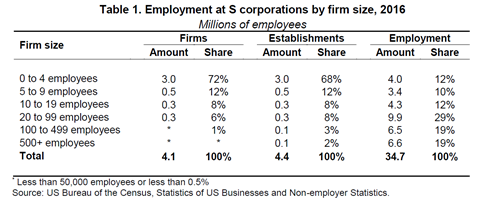

Senator Wyden would divide the business world into two divergent groups: billionaires on one end and small startups on the other. That simply is not how the business community is organized, and his bill will hurt the employers – and their workers – who occupy the middle. These businesses number in the hundreds of thousands and they employ millions of workers. The 199A deduction is designed to reduce their effective tax rates, but only to the extent they employ people and/or have significant levels of investment.

Meanwhile, although the bill is advertised as expanding the credit to middle-class accountants and other service providers by doing away with the rules that block service businesses from receiving the deduction, those restrictions don’t apply to business owners making less than about $325,000 (joint filer), and the restrictions are phased out as income dips below $425,000, so the population of actual beneficiaries is going to be limited to a very small range of service providers.

Finally, the bill includes other changes that should alarm business owners. For example, estates and trusts would no longer be eligible for the deduction. This restriction was part of the original Senate bill back in 2017, but it was removed when the sponsors realized just how many family businesses are held in trusts – not for tax purposes, but to ease the transition from one generation to the next. Eliminating trusts would punish thousands of established, family-owned businesses for no good reason, and it will hit a large number of owners whose incomes are well below $400,000 a year.

Pass-throughs comprise 95 percent of all businesses in this country and employ the majority of private-sector workers. For these firms, Section 199A enables them to keep more of what they earn and to reinvest in their employees and the communities they serve.

Rather than “overhauling” and improving the deduction, Sen. Wyden is seeking to do away with the very features that make it effective. The changes he proposes won’t bring fairness to the tax code; instead, they amount to a direct tax hike on America’s Main Street businesses and would result in fewer jobs, lower wages, and less economic growth.