S-Corp has had 24 hours to digest the Section 199A bill introduced by Senator Wyden yesterday, and the more we look, the less we like it. Here are some additional thoughts:

Not an Expansion

Wyden’s office says the bill would raise $147 billion over ten years. That is a large tax hike in anybody’s book, but you wouldn’t know that reading the media coverage, where the bill has largely been framed as an “expansion” of Section 199A, not a roll-back. For example, here’s Law360:

Sen. Ron Wyden introduced a bill Tuesday that would let owners of service businesses, like law firms and accounting firms, claim a pass-through tax deduction created in 2017.

The Small Business Tax Fairness Act would remove restrictions that prevented service business owners from taking the 20% deduction provided under Internal Revenue Code Section 199A for certain income from pass-through businesses. The change would allow owners of businesses such as law firms and accountant firms to claim the deduction while phasing out the incentives for individuals with incomes above $400,000. (Emphasis added)

That’s the equivalent of leading a report on the Titanic by observing that the iceberg survived. The point of the Wyden bill is to eliminate the Section 199A deduction for larger businesses and raise lots of revenue. That has to be the lede of any reasonable coverage. The expansion of the deduction for taxpayers making less than $400,000 is extremely limited and hardly worth the headline.

Less Than Meets the Eye

Just how limited? Section 199 applies to all qualified business income for businesses owners making less than an income threshold indexed to inflation. In 2022, accountants and lawyers making less than about $335,000 should be eligible for the full 199A deduction. The Wyden bill would increase the threshold to $400,000. That is it. As Richard Rubin with the Wall Street Journal tweeted yesterday:

This is good for some lawyer/accountants. Individual lawyer making $350k today gets no 20% break. Would under Wyden. Bad for very large pass-throughs that qualify now (big S corp manufacturers).

The only way the manufacturer identified by Rubin gets the 199A is if they have lots of employers and/or capital investment. Those employment limitations don’t apply to Wyden’s revised deduction, so Wyden favors accountants and lawyers who may or may not create jobs and punishes manufacturers who create lots of them?

Violates the Biden $400k Pledge

Another nuance that escaped our attention yesterday is that the Wyden bill would violate the President’s pledge not to raise taxes on taxpayers making less than $400,000 a year. How? His bill would preclude trusts and estates from the 199A deduction:

(ii) APPLICATION TO TRUSTS AND ESTATES. — Section of such Code is amended by adding at the end the following new subsection:

‘‘(j) DEDUCTION FOR QUALIFIED BUSINESS INCOME. — No deduction shall be allowed under section 199A to an estate or trust.’’

Including trusts and estates in the 199A deduction was a big fight during the TCJA debate (see here, here, and here) that wasn’t resolved until the conference report. The rationale for excluding trusts and estates was never articulated, whereas the case for including them is plain to anybody engaged in family businesses. As S-Corp wrote to the TCJA conferees:

Many family businesses will pay higher taxes under the Senate bill… because it precludes trusts and estates from using the deduction. This is not a small issue – every family business subject to the estate tax has these trusts. They are designed to help the business survive from one generation to the next and have nothing to do with income taxes. Most of these trusts already pay tax at the highest rates.

The conferees ultimately decided this issue in our favor. Now, four years later, Senator Wyden would reverse this policy and exclude trusts and estates from receiving the 199A deduction. But as practitioners know, having the stock of a family business held in a trust is common practice and is not limited to large businesses. Family businesses of all sizes use them, so excluding them from the deduction will inevitably hit smaller businesses and lower income owners – just the people President Biden promised to protect.

Massive Rate Hike

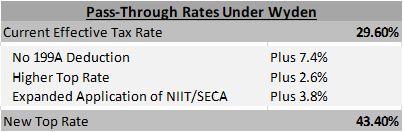

Also lost in the Wyden bill’s coverage is where it would leave tax rates on pass-through businesses. The bill is part of a larger package to be considered by Congress, including:

- Raising the top individual tax rate from 37 to 39.6 percent, while lowering the rate’s threshold to $509,300.

- Expand the application of 3.8 percent surtaxes (NIIT, SECA, HI) to all forms of business income, including LLCs and the active owners of S corporations and partnerships.

For a manufacturer over the threshold and getting the full deduction, their top tax rate would increase from 29.6 percent all the way up to 43.4 percent.

These new, higher rates would apply to a significantly larger tax base. Base broadening under consideration includes repealing like-kind exchanges and making permanent the TCJA’s loss-limitation rules, on top of prior base-broadening from the TCJA, including the new 163(J) interest deduction cap, the new Loss Limitation/NOL rules, the new cap on SALT deductions, repeal of the old 199 deduction, and repeal of the Section 212 deductions.

The net result is a top tax rate 13.8 percentage points higher imposed on a significantly expanded income tax base. This is not a modest policy. It is a direct assault on family businesses nationwide. Next time members of the press write about it, they might try interviewing some affected businesses. At the very least, they might avoid describing a massive tax hike merely as an expansion of an existing tax benefit.