Since the Tax Cuts and Jobs Act’s passage at the end of 2017, some have seized on the Section 199A deduction as a “loophole” that stacks the deck in favor of pass-through businesses.

We’ve heard – and responded to – various criticisms of the provision over the years. But the brief Twitter exchange below caught our eye:

It’s an interesting question, but is the premise correct? Is the tax bill for the independent contractor (IC) really 20 percent lower than the employee?

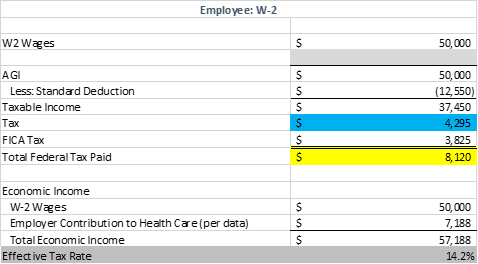

Keep in mind that an employee making $50,000 has certain advantages over the IC. Half their Social Security taxes are paid by their employer, and many benefits they receive – health care, retirement – are not included in their W-2 wages. So the typical employee making $50,000 actually has economic income significantly higher than what shows up on their paystub. Here’s a representative example:

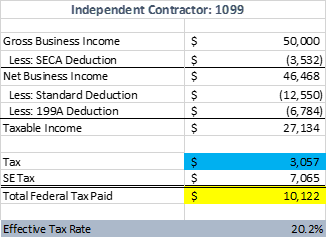

Here’s a similar breakdown of the IC:

Obviously, there are many assumptions built into these two examples, but the simple fact is that using reasonable assumptions, it’s clear that Scott’s premise is wrong – the IC contractor doesn’t pay less in taxes. He/she pays more, even without adjusting for real economic income. Paying the full boat on the SE tax really drives up the effective rates of ICs.

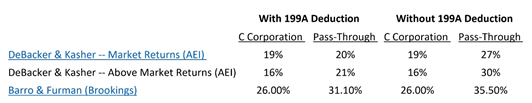

The bottom line is there’s a lot of hate for the 199A deduction in the tax policy world. To a certain extent, that understandable – it’s complicated and can be arbitrary. But to date the haters have failed to successfully attack the underlying rationale for the deduction: to level out the tax treatment of pass-through businesses with public C corporations or, in this case, median wage earners.

Our EY study demonstrated that without 199A, pass-through businesses would be at a competitive disadvantage with the 21 percent corporate rate. EY’s findings were consistent with the work of other economists:

That’s why more than 80 trade organizations recently called on Congress to make this critical provision permanent. By contrast, repealing or rolling back Section 199A would sharply raise taxes on pass-through businesses of all shapes and sizes, putting them at a disadvantage and endangering the jobs of 18 million Americans.

This example shows 199A helps balance out tax treatment for the self-employed too.