The Commerce Department last week revised its 2nd Quarter GDP estimates showing the economy shrunk by nearly one-third. In a $22 trillion economy, that translates into nearly $2 trillion in lost wages, profits, retirement savings, etc.

The threat of this precipitous decline was the catalyst for the business community letter dated back on March 18th. As Governors closed businesses and schools to slow the spread of COVID-19, one hundred and twenty national trade groups called on Congress to provide relief to families and employers that was on the same scale as the nationwide shutdown.

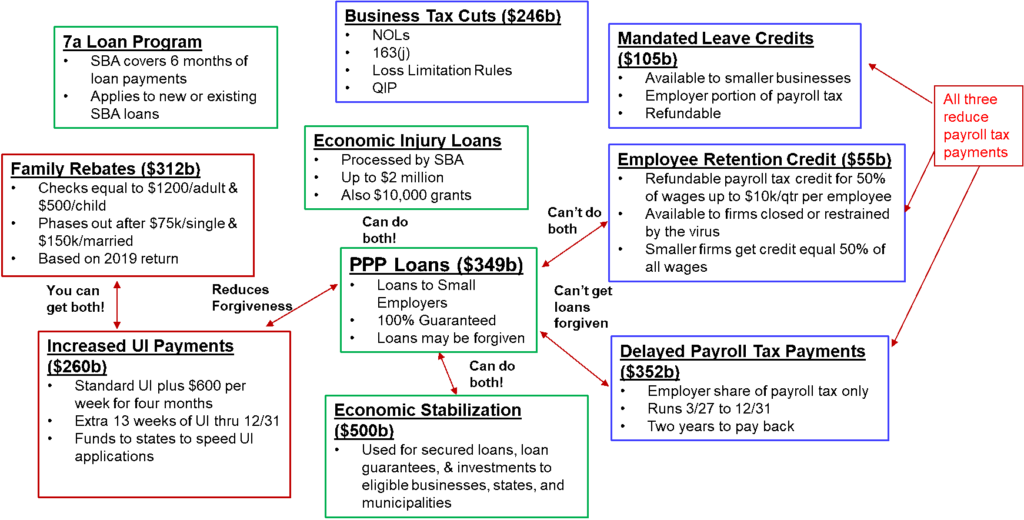

The result was the CARES Act, which provided trillions in checks, tax benefits, and credit to families and businesses through a myriad of programs. The chart below depicts the CARES Act as a somewhat shotgun response, but it also reflected a good-faith effort on the part of Congress and the Administration to find new solutions to an unprecedented challenge.

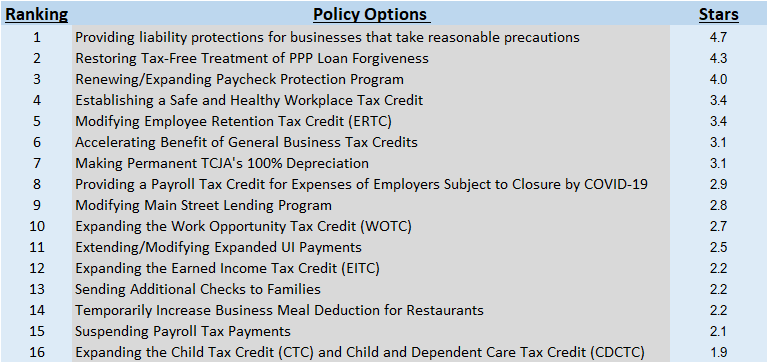

As Congress debates the contents of another CARES-type bill with literally dozens of competing policies on the table, S-Corp thought some indication of which policies are most important to business community might be helpful.

The survey described here asked trades to rank sixteen distinct policies on a five-star scale along the following lines:

- 5 Stars: Our Top Priority

- 4 Stars: Important to Our Members

- 3 Stars: Good Policy

- 2 Stars: Doesn’t Hurt

- 1 Star: Not Important

The polices listed are largely limited to those directly affecting businesses and the workers they employ. These policies were included in the House-passed HEROES Act, the proposed Senate Republican Phase IV bill, and the Administration’s stated priorities. They lean primarily to tax policy, but not entirely.

Of the hundreds of groups contacted, sixty-two responded, providing what appears to be well-rounded answer to the critical question of what is most important to employers as Congress continues to grapple with COVID-19.

The top priority is for Congress to provide employers with liability protection when they reopen while taking reasonable precautions to protect their employees. This policy scored an almost perfect 4.7 Stars, suggesting that the business community is beginning to shift its focus from helping employers and workers during the shutdown to taking the steps necessary to reopen the economy.

Other policies that scored 4 Stars or better related to the Paycheck Protection Program (PPP). No program has been as widely utilized. Despite several missteps, the program provided more than $500 billion in needed capital to over five million businesses, helping to preserve those businesses and jobs of the workers they employ.

For the next COVID-19 bill, business trades strongly support restoring the tax deductibility of PPP loan forgiveness. This was clearly Congress’ intent when it enacted the PPP, and it continues to be a priority. The cost to existing PPP borrowers would exceed $100 billion if Congress fails to act. Trade groups also strongly support extending the PPP while making its benefits more accessible.

At the other end of the scale, the Administration’s plan to defer payroll tax payments scored poorly. The lack of clarity about how it would work, who would have to repay the deferred taxes, and whether Congress would act to make the deferral permanent all likely contributed to the low score. These concerns were outlined in a US Chamber letter earlier this month and, despite the guidance released late last week, many of those concerns remain.

Last week’s GDP estimates demonstrate that Congress was correct to go big with the CARES Act, while the continuing shutdowns and business closures make clear that more is needed. As Congress considers another COVID-19 response bill, we hope the this survey helps focus their efforts.