S-Corp sent its members a new survey this Spring. The goal was to follow up the survey we did just after tax reform was enacted to see how things had evolved. Now that our members had a year to digest the new rules, where did they stand? Here are the key takeaways –

- Seven out of ten say their taxes went down or stayed about the same;

- Four out of five say making permanent the 20-percent 199A deduction is a priority; and

- Seven out of ten plan to remain S corporations in the near future.

That’s not bad, considering where we started.

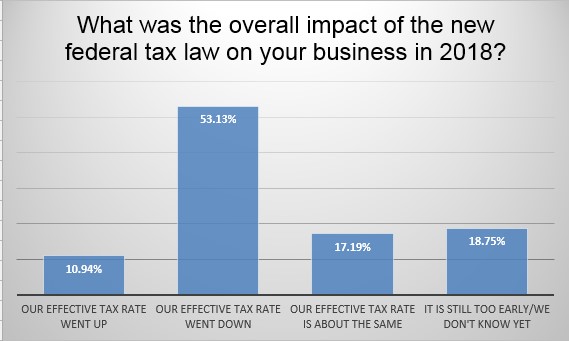

The first question we asked this year was how our members fared under tax reform. Did their taxes go up, down, or sideways. About half the respondents reported that their tax burden declined while 17 percent said their taxes remained about the same. Just one out of ten reported a tax hike.

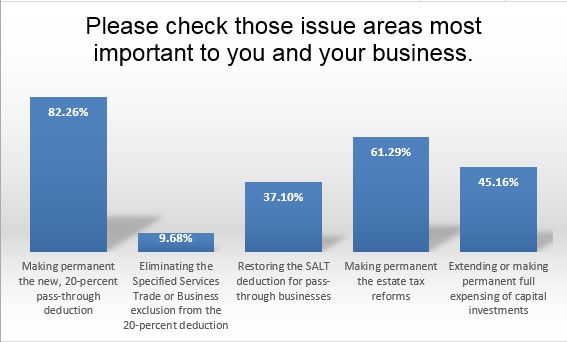

Eight out of ten reported that making the 199A deduction permanent is a priority. As our EY study shows, tax reform achieved rough parity for pass-throughs with the lower, 21-percent corporate rate, but only if the companies get the full 20-percent 199A deduction, and only if it stays in the Code. Based on these responses, making the 199A deduction permanent will continue to be the top legislative priority for the Association.

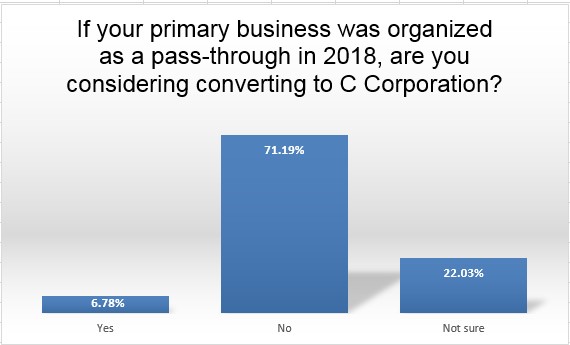

Are S corporations switching following tax reform? Harvard economists Robert Barro and Jason Furman estimate one-fifth of pass-through income will migrate to C corporation world in response to tax reform. That seems about right to us — S-Corp has already seen a number of members convert in 2018 and a few more are considering making a change this year. Responses to our survey fit that pattern, with seven out of ten S corporations staying put, while less than one-in-ten are considering switching.

On the other hand, two out of ten report not being sure if they are going to convert. That closely matches the two out of ten who aren’t sure if their taxes went up or down. Treasury is still working through some of the rules they need to calculate their taxes – particularly on international and for calculating the interest deduction cap – so this remaining uncertainty might stem from that. (We’re going in to see Treasury this week on a GILTI issue that could mean the difference between tax cuts and tax hikes for affected business.) For those companies, the jury is still out.

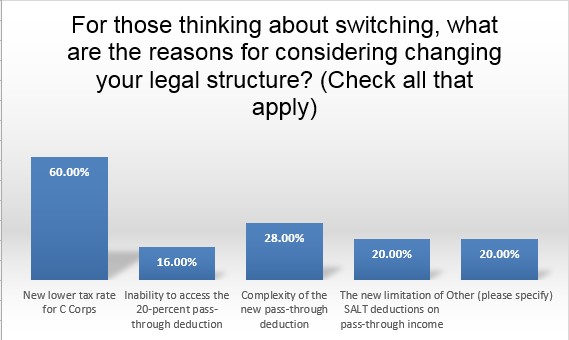

As to why a company might covert, the most cited reason is to access the new 21-percent rate. Inability to access the 199A deduction, complexity of the new deduction, and the loss of SALT all weighed in about equally as the second most important factor. The loss of the SALT deduction will fall more heavily on companies operating in high tax states, so we expect to see state-by-state differences in the response to that new policy.

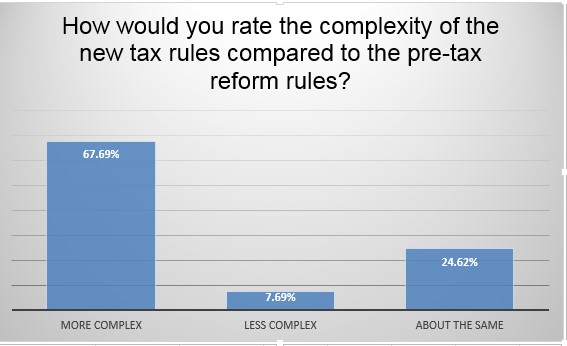

Finally, respondents made clear that complexity continues to be an issue. Two-thirds reported their taxes are more complex while less than one-out-of-ten reported less. The remaining one-fourth reported it was about the same. Tax reform simplified filing for many families, but for most S corporations, filing got more complex, not less.

The S-Corp survey was sent to companies organized as S corporations, with the survey respondents tending towards the larger size. Four out of five companies had revenues above $10 million and more than half had 50 or more employees. While the findings are by no means scientific, they do provide a useful window into how larger S corporations are doing under tax reform.

For the majority of respondents, the outlook is generally positive – their taxes went down or stayed the same. But that outcome depends entirely on making the 199A deduction permanent, and it did come at the cost of more complexity. Meanwhile, a significant minority are still working through the numbers, are not sure if their taxes went down or up, and are not even sure if they will remain S corporations next year. For those companies, the benefits of tax reform remain to be determined.