The S Corporation Association today submitted comments on Treasury’s proposed rules implementing the new, 20-percent pass-through deduction.

S-Corp readers know the 20-percent deduction was designed to preserve rate parity between pass-through businesses and the new, 21-percent rate on S corporations. But how is the deduction going to be calculated? How many pass-through businesses will qualify? Our comments kick off by emphasizing just how important the deduction is to keeping Main Street competitive.

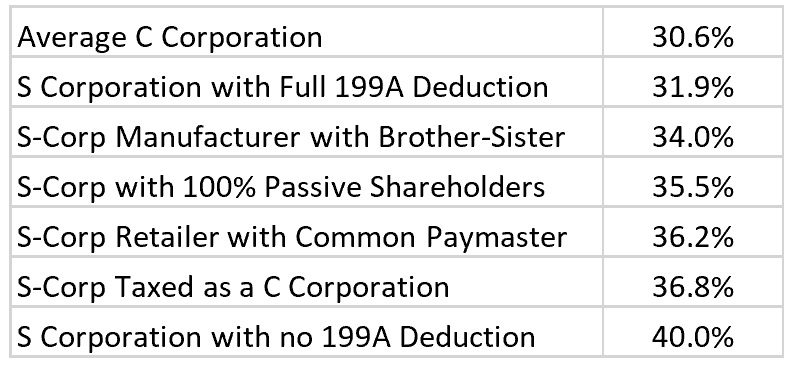

As our recent EY study made clear, pass-through businesses receiving the full deduction still will pay an effective tax rate that is 1.3-percent higher than the rate paid by the average C corporation. Pass-through businesses not receiving the full deduction, or those precluded from receiving any deduction, will pay rates significantly higher.

Broad access to the Section 199A deduction is also pivotal in order for Tax Reform to achieve its fundamental goals of job creation and economic growth. Pass-through businesses represent 95-percent of all business entities, employ over half of private sector workers in the United States, and contribute a majority of business income to our gross domestic product. Much of the economic potential of Tax Reform will be lost if the Main Street community is not a full partner in the reforms.

So the rules out of Treasury on how to calculate the new 199A deduction are critical. How did they do? Generally, the S-Corp comments paint a positive picture of the proposed rules. Treasury made a good-faith effort to get the new regime right. But with any new proposal this big, there are lots of details to work out, and the S-Corp comments include a number of recommendations as to how Treasury can improve the final rules.

You can click here to read the full S-Corp comments. And stay tuned for more on this topic. These rules have to be in place before the New Year, so we expect Treasury to move fast.