The S Corporation Association participated in a Hill briefing Tuesday highlighting new work for Ernst & Young on the challenge of establishing parity for pass-through taxation.

The analysis, authored by Robert Carroll of EY, focused on all the complexities confronting pass-through businesses under the Tax Cuts and Jobs Act, and the resulting matrix of possible tax outcomes for pass-through businesses. As the table shows. Effective tax rates on successful S corporations (and other pass-through businesses) are consistently higher than the average C corporation, even after adjusting for the double corporate tax and other variables.

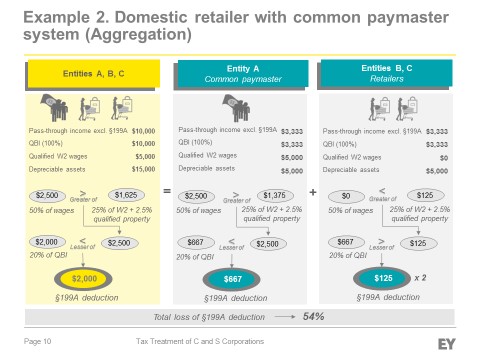

These findings are particularly important right now, as Treasury and the Office of Management and budget are working on regulations that would detail how business owners are to calculate the new 20-percent pass-through deduction under Section 199A. The EY analysis demonstrates that how Treasury determines the deduction should be calculated could mean the difference between getting the full deduction or none at all for some businesses.

These findings are particularly important right now, as Treasury and the Office of Management and budget are working on regulations that would detail how business owners are to calculate the new 20-percent pass-through deduction under Section 199A. The EY analysis demonstrates that how Treasury determines the deduction should be calculated could mean the difference between getting the full deduction or none at all for some businesses.

The briefing, held in the Capitol Visitors Center with about 75 attendees, began with Senator Ron Johnson (R-WI) summarizing the last fall’s tax debate and the need for Congress to continue to focus on reforming how businesses are taxed. As summarized in BNA:

The briefing, held in the Capitol Visitors Center with about 75 attendees, began with Senator Ron Johnson (R-WI) summarizing the last fall’s tax debate and the need for Congress to continue to focus on reforming how businesses are taxed. As summarized in BNA:

Congress should consider taxing C corporations like pass-through businesses—at the individual owner level—to create a more level playing field between the two types of entities, Sen. Ron Johnson (R-Wis.) said July 31 at an event on Capitol Hill.

The 2017 tax law (Pub. L. No. 115-97) didn’t take this approach, but Johnson said he still believes that such a change would offer the best solution for simplifying and rationalizing the tax code. The senator said he hasn’t received a revenue score for the proposal but expects it would raise money that could be put toward other tax code changes.

Dr. Carroll then presented his analysis, followed by a panel of discussants including Richard Rubin of the Wall Street Journal, Doug Holtz-Eakin of the Americans for Tax Reform, and Brian Reardon of the S Corporation Association. You can watch the entire briefing here: