Yesterday’s Finance Committee hearing on the tax bill was interesting, if only to remind viewers that it’s way too early to pass final judgement on the tax overhaul. Not that several Committee members didn’t try.

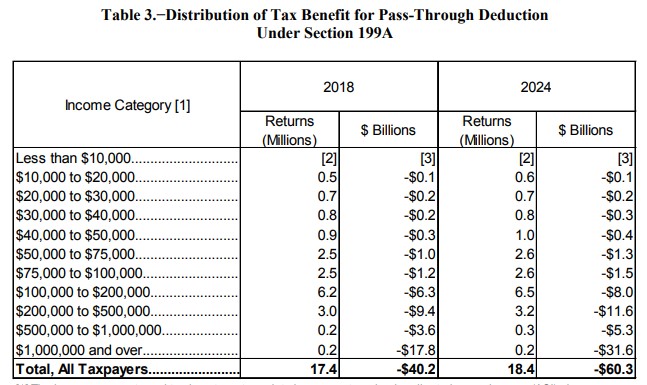

Exhibit A was a new Joint Committee on Taxation report with some selective analysis of the tax plan. Members repeatedly brought up Table 3 and the fact that so much of the “tax benefit” of the pass-through deduction will go to taxpayers making more than $1 million.

The goal of the pass-through deduction was to maintain tax parity between Main Street businesses and giant C corporations – pass-through businesses employ most of the private sector American workforce and they are an essential part of the American economy. With the top corporate rate dropping to 21 percent, something had to be done on the pass-through side.

The goal of the pass-through deduction was to maintain tax parity between Main Street businesses and giant C corporations – pass-through businesses employ most of the private sector American workforce and they are an essential part of the American economy. With the top corporate rate dropping to 21 percent, something had to be done on the pass-through side.

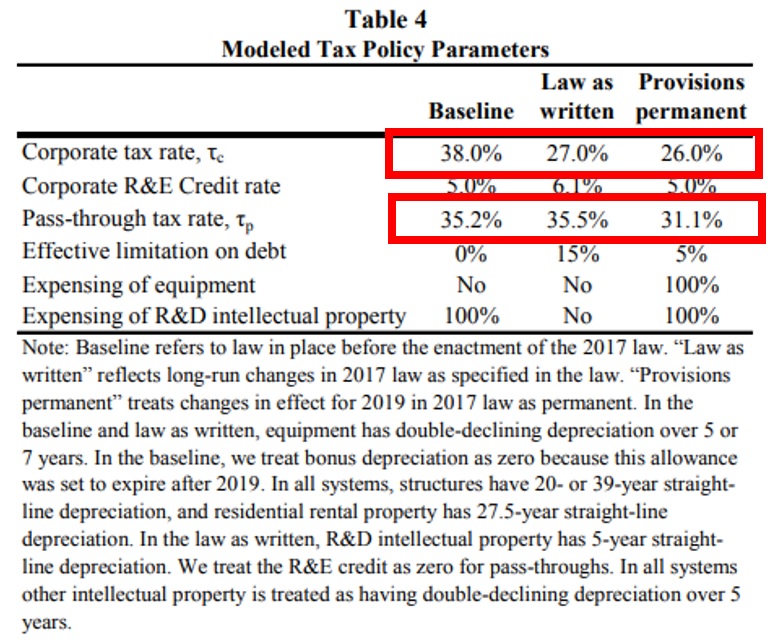

Even after the deduction, however, pass-through businesses will still be paying effective marginal rates well above the rates paid by C corporations – 31.1 percent verse 26.0 percent in the recent Barro-Furman paper.

One reason the effective rate for pass-through businesses continues to be so high is that the benefit of the pass-through deduction is offset by the base-broadening provisions included in the plan. Senators focusing exclusively on the pass-through tax benefit are ignoring the higher taxes those businesses will pay from other provisions the tax overhaul including the loss of the SALT deduction, the active income loss limitation, and other base broadening provisions.

One reason the effective rate for pass-through businesses continues to be so high is that the benefit of the pass-through deduction is offset by the base-broadening provisions included in the plan. Senators focusing exclusively on the pass-through tax benefit are ignoring the higher taxes those businesses will pay from other provisions the tax overhaul including the loss of the SALT deduction, the active income loss limitation, and other base broadening provisions.

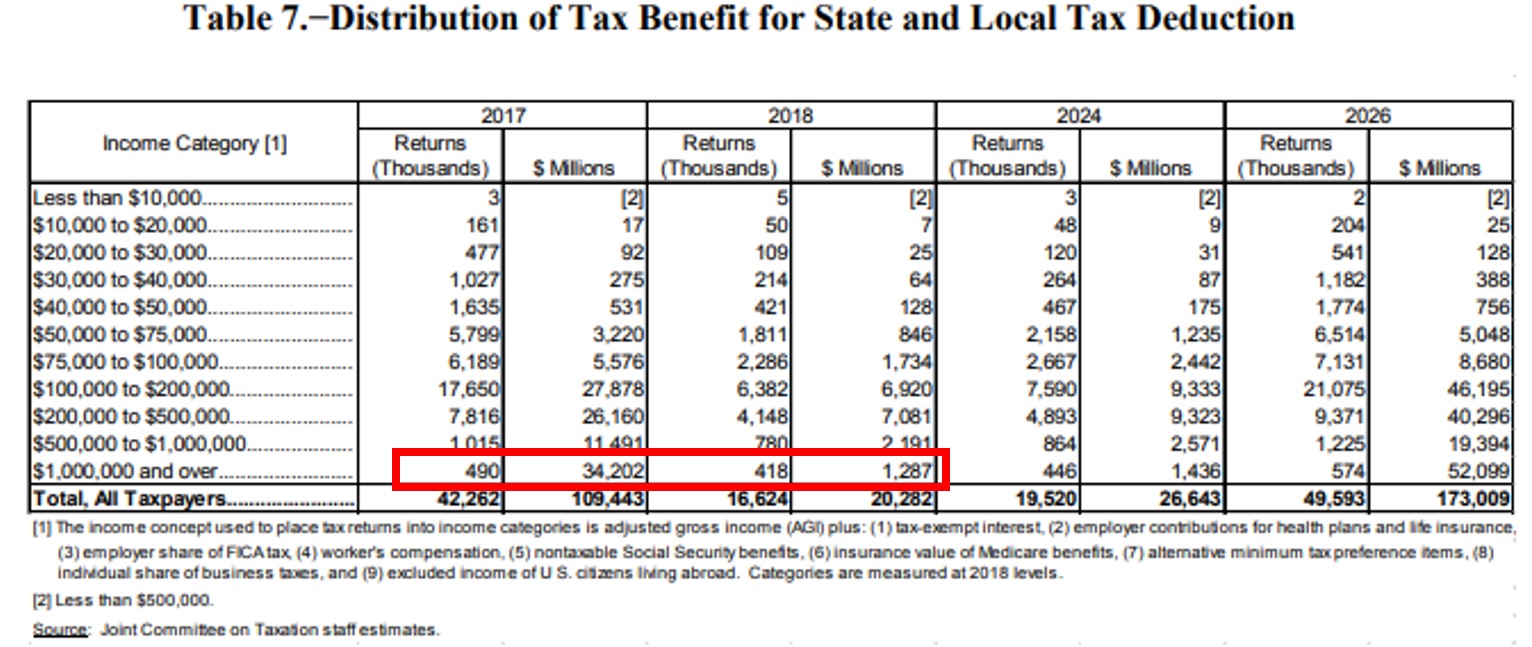

Table 7 makes this point. It shows the loss of the SALT deduction alone costs top earners $33 billion in 2018. That’s $15 billion more than the total pass-through deduction benefit to that same group of taxpayers.

In other words, yesterday’s tax cut critics were focusing on one provision out of this huge bill and claiming that one provision made the whole bill regressive and unfair, while ignoring all the other provisions.

In other words, yesterday’s tax cut critics were focusing on one provision out of this huge bill and claiming that one provision made the whole bill regressive and unfair, while ignoring all the other provisions.

That reality is demonstrated in Table 1 of the JCT report, which shows the tax code was and remains highly progressive, with lower income taxpayers paying low rates and high income taxpayers paying higher rates. How high? Last year, marginal effective rates on taxpayers making more than $500,000 exceeded 40 percent! That’s simply too high. Now, after tax reform, those taxpayers are still paying more than 40 percent.

As readers know, S-Corp has a number of concerns with the tax bill and, particularly, the pass-through deduction. But attempts to criticize the deduction as a give-away to the rich completely miss the point. The goal of the tax bill was to encourage job creation and investment. It’s hard for pass-through business owners to do that when the federal government is taking more than forty cents of every dollar they earn.