Last month’s elections so dramatically changed the outlook for tax policy in 2017 that we’re still trying to catch up. The outlook for the proposed 2704 regulations in particular has done an about-face, going from appearing almost inevitable to having the Chairman of the Ways and Means Committee, along with others, targeting them for elimination quickly next year.

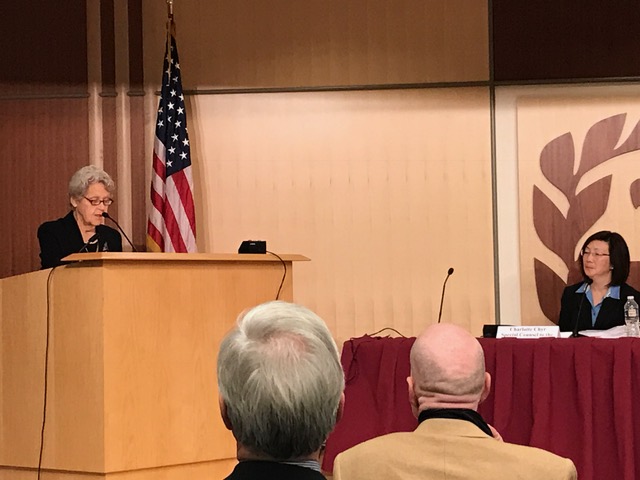

But they are not dead yet, and the regulatory process moves on. Today, the IRS hosted its public hearing on the proposed rules, and the family business community arrived in force—S-CORP in particular. We submitted our formal comments back on October 17th, which you can read here, while today we had four witnesses address the panel – S-Corp President Brian Reardon, Board Member Clarene Law, and Board Advisors Chris Treharne and John Porter.

Nearly 40 tax attorneys, CPAs, and other tax experts weighed in on the rules, but the real star was Clarene Law. She was one of the few business owners to make the trip to DC to testify, and her story of building a successful hotel business in Jackson, Wyoming over the past half century got directly to the challenge these rules pose to real business owners. As she told the panel:

I started Elk Country Motels as a 28-year old back in 1962. My funding came from my mother and father — a housewife and blue collar road construction worker – who had little money but lots of pride. They trusted me with their life savings of $10,000 and enabled me to purchase a small, 17-room motel- 12 cabins and rooms above the office…,

Over 50 years later, our small business has grown and provided my extended family and employees with a stable living. Today we manage 450 rooms, all in Jackson and employ over 100 people.

Continuing this family business is of the utmost importance to me. I have high hopes of passing it onto my children and grandchildren. I feel we can only accomplish my wish for succession with favorable tax consideration which acknowledges legacy businesses such as ours….

The proposed regulations under Section 2704 have the potential to severely disrupt these plans. Ownership of Elk Country Motels and our other limited liability companies is divided between my 3 children, myself, my husband and our trusts—all minority interests.

The IRS’ application of family attribution could result in all these interests being valued as if they were controlling, preventing the use of legitimate valuation discounts and leading to estate tax increases that the next generation would have to bear.

This could force my descendants to sell the business in order to pay the taxes. After 55 years of operation, this family would like to stay in business and not just sell out to corporate America.

Longtime S-Corp advisor Chris Treharne of Gibraltar Business Valuations focused his remarks on the technical challenges the rules would pose to appraisers:

“While I understand Treasury’s perception of abuses associated with third-party owners inasmuch they may affect the inability to liquidate an ownership interest or the entity, I am again concerned that inflexible, “bright-line” rules may be potentially abusive, too… I encourage Treasury to identify and adopt alternate, more flexible language that accomplishes its goals of preventing taxpayer abuse without imparting inflexible constraints on legitimate ownership structures and strategies.”

The remainder of comments were almost universally opposed, with a number of speakers recommending that Treasury radically revise and then reissue the proposed rules in order to give stakeholders another opportunity to weigh in with comments.

For his part, S-Corp President Brian Reardon focused his comments on what happens next year:

“Looking forward, it is clear these rules need to be withdrawn. Over 28,000 comments have been received by Treasury during the comment period, and with few exceptions, they all were opposed. That is an extraordinary outpouring of opposition by the business community and Treasury needs to be responsive.

It is also clear that Congress needs to rewrite section 2704. Family attribution is a fatally flawed concept, whether it’s applied broadly, per our reading of these rules, or narrowly, as written into the underlying 2704 statute.

The S Corporation Association intends to continue to work with stakeholders and tax writers to achieve both of these goals, and we appreciate the willingness of both Treasury and the Congressional tax writers to listen to our concerns.”

With the comment period officially over, Treasury is now tasked with wading through the 28,000 comments and either adjusting the rules to reflect the concerns raised, or explain in detail why they went in a different direction. It’s a laborious process that could literally take years, which is a frightening notion. Meanwhile, the new Administration is expected to kill these rules quickly upon taking office. We hope so. Innumerable hours and dollars already have been wasted trying to protect family businesses from an unwarranted change in how they are valued. It’s time for closure and moving on.