Do family businesses still need to worry about the 2704 valuation rules? These rules have consumed the attention and resources of family businesses nationwide since they were first proposed back in August. While we have been assured there is no plan to finalize the rules before the end of the current administration, many families are still wary of their potential impact if they were allowed to take effect. So, will the rules move forward in 2017? Or will the new tax leadership taking control ensure they go away?

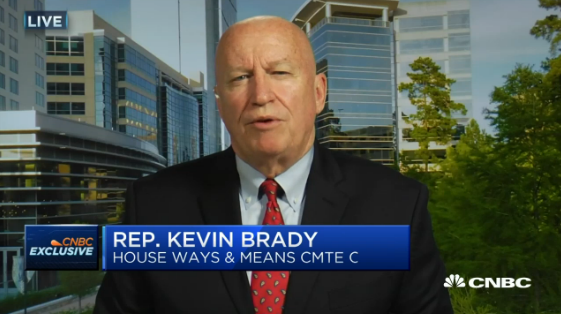

Ways & Means Chairman Kevin Brady (R-TX) helped provide clarity on that question this week on CNBC. Chairman Brady covered the congressional outlook, including the prospects for tax reform next year, making clear that any pro-growth tax plan moving through Congress would need to be comprehensive, including individuals, pass-through businesses and corporations. (Yea!)

But the headline of his comments was reserved until the end. Asked about the regulatory outlook, he made a point of noting that President-elect Trump and he have set their sights on rolling back numerous harmful regulations immediately, and specifically cited the proposed 2704 rules:

“After eight years, we finally have a way to stop these job-killing regulations coming out of Washington. This [incoming] President and the Treasury Secretary will have a chance to stop on day one regulations such as the new proposal on death tax in family-owned businesses (sic) as well as the Treasury 385 regulations.”

The Brady interview comes the same week as a new video released by President-elect Trump outlined initial executive actions he plans to take once inaugurated. While 2704 was not specifically mentioned, he did promise to issue Executive Orders on “day one” to block or roll back pending regulatory actions.

The combination of Chairman Brady’s comments above and President-elect Trump’s emphasis on rolling back harmful regulations “day one” is a strong signal that these rules should be on the chopping block early next year. S-Corp will continue to work with other business groups to make the case against treating family-owned businesses differently for valuation purposes, but we will do so with the knowledge that relief from this particular challenge may be near.