Last week’s election changed everything in the tax world, from who’s running Treasury to the prospects for tax reform. We’re still trying to get our heads around all the implications, but the short summary is that S-Corp just went from playing defense all the time (which is not fun, as you can imagine) to being able to focus our efforts on a more positive and proactive agenda (which is much better).

First and foremost, comprehensive tax reform is now on the table, whereas before it was simply not going to happen. Sure, people talked about doing tax reform under a prospective Clinton Administration, but exactly how it was all supposed to work was entirely unclear. Would President Clinton be willing to reduce individual rates after having just run a campaign to raise them? Could a Democratic Senate vote to reduce the corporate tax rate after the waves of support Socialist Senator Bernie Sanders got during the Democratic primaries? Would a Paul Ryan-led House go along with a massive increase in spending in exchange for tax policies that offended his base? None of that seemed likely.

Now, tax reform seems almost (almost!) inevitable. It would take a remarkable set of circumstances to stop the reform steamroller warming up in the House and Senate. The Ways & Means Committee has spent the past few months refining their Blueprint and are now poised to move very quickly in the new Congress. As you’ll recall, S-Corp welcomed the Blueprint when it was released as a significant step towards rational business taxation. At the time, we wrote:

From the S-Corp perspective, the headline is the plan would make progress on all three of the key “pass-through principles” we’ve been championing since 2011 – that is, it takes a comprehensive approach to reform, it reduces both the corporate and pass-through rates to more reasonable and similar levels, and it makes progress on reducing the harmful double tax imposed on corporations. It also gets rid of the dreaded estate tax, which hits private companies much more acutely than publicly-owned ones.

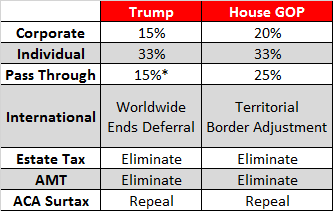

The new Trump economic team will obviously have a strong voice in the process, but we are optimistic those talks should go smoothly. The Blueprint and the Trump plan are really not that far apart, at least when viewed from 30,000 feet, and both sides have committed to treating the Main Street business community as an equal partner in tax reform.

Meanwhile, Senator Hatch appears set to release his corporate integration plan and, with Republicans holding the Senate, he is now in a position to champion this idea when Congress returns in 2017. For years, Main Street businesses have called on tax writers to fix the corporate code by eliminating the double corporate tax. That would move the C corporation world towards pass-through treatment rather than the other way around, and it would eliminate one of the more distortionary and economically-damaging features of the current code.

So now we have plans being developed in both Houses that move us toward the ultimate goal of taxing all business income once, taxing it at the same reasonable top rates, and taxing it when it is earned. That is the correct way to tax businesses, and we’re looking forward to spreading this message in the coming months as Congress works with the Trump Administration to finalize the plan.

Our second proactive agenda will be to press for additional improvements to the rules that govern S corporations. Our S Corporation Modernization Act has widespread, bipartisan support in both the House and the Senate. The general goal of the package is to make it easier for business owners to operate under the S corporation banner. Existing rules, like the prohibition against foreign shareholders, discriminate against S corporations by making it more difficult for them to raise and retain their capital. S Corp Mod would help to level the playing field for existing and new S corporation owners alike.

And finally, the entire business community, including the S Corporation Association, can stop spending all their waking hours responding to the various regulatory initiatives coming out of the Obama Administration. This year has been literally consumed with reading, analyzing, educating, and advocating against Treasury’s 385 and 2704 regulations. It was an enormous expenditure of time and resources that now can be redirected, at least in part, to more proactive efforts.

Those regulations are still with us in some form, however, and the 2704 regulations in particular will continue to be a focus of our advocacy in the coming months to make certain the incoming tax folks on both sides of Pennsylvania Avenue understand the family business community’s concerns and deal with them directly. We have a number of representatives testifying at the December 1st IRS hearing and are reaching out to the Trump transition team to make certain they understand the challenge. If we do our jobs correctly, family businesses will not have to worry about these regulations next year.

So that’s it. One day, we’re preparing for battle, the next we’re preparing for reform. Who knew tax policy could be so fast-moving? There’s obviously much to do over the next couple months to ensure a happy outcome for pass-through businesses, but the nature of the challenge has changed, as has the direction of the policy. Offense is so much more fun than defense.

Tax Reform & Reconciliation

Trump adviser Steve Moore made headlines the other day by suggesting that tax reform could be divided up, with business tax reform moving quickly next year and individual reforms coming after. As Politico reported:

At a tax-reform panel sponsored by POLITICO, Steve Moore said Congress should first tackle a rewrite of the business tax code, leaving the individual side for later.

Lawmakers will have a much easier time agreeing on the business code, he said, especially if they include infrastructure funding.

“The business reform is a lot easier to get done — I would label this a jobs bill,” said Moore. “And we need some kind of anti-recession insurance policy.”

A rewrite of the individual code by contrast would be “incredibly thorny,” he said, predicting that Trump’s plan to cap itemized deductions, for example, will have the housing industry “after us.”

“It just becomes very difficult,” he said.

Will Congress will divide tax reform into two parts? We doubt it. A similar effort failed to gain traction several years ago for a variety of reasons, and those reasons still apply now. Moreover, moving business-only tax reform is no slam dunk. It’s really complicated, and will need support from taxpayers beyond the business community to get through Congress. The other panelists at the Politico event pushed back on Steve’s idea, and he did soften his thoughts, but the underlying question remains: What is the timing and process for tax reform next year? Here’s how we see this playing out.

Congressional leadership has made clear they intend to 1) make significant changes to the Affordable Care Act (ACA), including repeal of the individual mandate and other provisions unpopular with Republican voters, and 2) enact a significant tax reform package. Both these items would be controversial and would be subject to opposition and delay, particularly in the Senate where any controversial bill with less than 60 votes of support would be subject to a filibuster.

So how will they do it? We expect Congress to move quickly to address the ACA, possibly using the reconciliation process to avoid filibusters and speed the bill along. Quickly in this case means they get started on a FY2017 budget resolution as soon as the budget committees are able to meet early next year, include reconciliation instructions to roll back parts of the ACA, and then move the actual repeal bill through the appropriate committees. That should take about two months.

As that process is moving along, the tax writers will be working with the Trump team to refine and finalize their tax reform plan, with a goal of moving the bill outside reconciliation. Moving tax reform outside reconciliation has a number of advantages, including giving the reform bipartisan support, allowing provisions that would not be in order under reconciliation, and making the reforms permanent rather than having them sunset at the end of the budget window. The Fiscal Cliff fiasco was a good lesson in why that’s important.

Under this scenario, reconciliation becomes the fallback plan. If bipartisan support for tax reform emerges, great. If it fails to emerge, Congress retains the ability to move reforms with a simple majority and an expedited process. That suggests the tax reform effort would begin in earnest sometime in the early spring and could last into the summer, similar to the time-frame for the big tax bills in 2001 and 2003, and it means Congress would complete its two big priorities for 2017 prior to the August recess. That is certainly an optimistic view, but it’s also very doable.