Webinar Recap: Delivering for Main Street

The One Big Beautiful Bill is delivering real benefits for millions of small and family-owned businesses, but how many taxpayers know they benefitted, and how should Main Street advocates best communicate those benefits?

That was the central focus of our latest webinar featuring longtime allies David Winston and Myra Miller of The Winston Group, who walked through fresh national and Georgia-specific survey results focused on the new tax bill.

Key takeaways included:

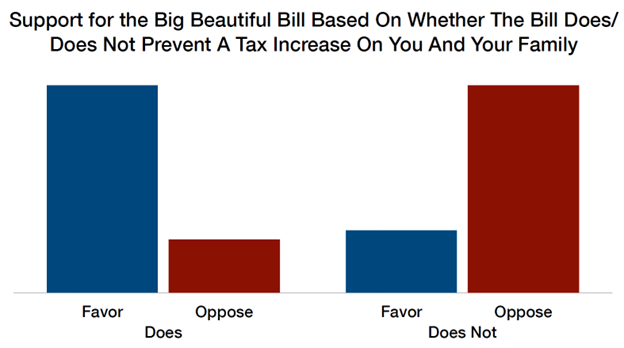

- Taxpayers strongly support the tax bill, but only when they understand how they benefit from its provisions. Main Street advocates need to discuss the specifics of the bill and avoid assuming their audience knows they saw tax relief.

- Taxpayers responded most positively to the three core Main Street provisions – permanent Section 199A, preserving SALT parity, and avoiding rate hikes.

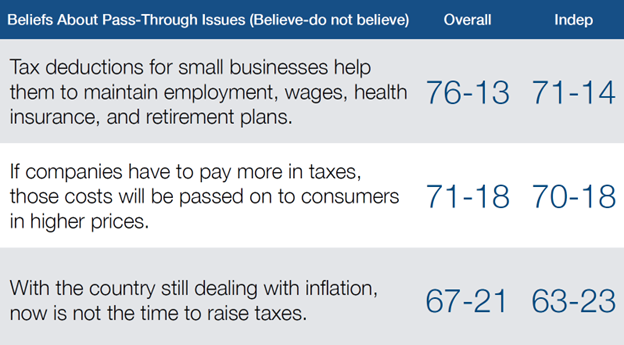

- Finally, while taxpayers are not convinced that inflation is under control, they do fear raising taxes on Main Street businesses would result in higher prices, as the cost of those tax hikes would be passed on to consumers.

So the big tax bill might be signed into law, but the debate over its merits has only begun. For Main Street advocates, you can’t assume business owners know they got a tax cut – you have to be specific and make the case. That’s exactly what we intend to do at S-Corp: highlight how the One Big Beautiful Bill is helping Main Street businesses invest, hire, and grow.

<A full recording of the webinar is available here>

Talking Taxes in a Truck Episode 44: The Shutdown Edition

Joe Lieber is a founder and co-managing partner of Capitol Policy Partners, a veteran DC insider and a longtime friend of the TTT podcast. With a government shutdown all but inevitable at this point, we asked Joe how long we can expect this fight to play out, whether a grand bargain is in the offing, and the implications of a prolonged funding lapse. Later we get into the prospects of a year-end tax package and whether businesses should or should not expect a second reconciliation bill (Too Big, Too Beautiful?).

This episode of the Talking Taxes in a Truck Podcast was recorded on September 30, 2025.

Tax Cuts Don’t Sell Themselves

In Washington, passing major tax legislation is hard. Convincing Americans they actually benefited from it is often even harder.

That’s the central argument David Winston – founder of the polling and research firm The Winston Group and a longtime S-Corp ally – makes in a recent Roll Call op-ed, and it rings especially true for Main Street employers. Despite the significance of the One Big Beautiful Bill (now being referred to as the “Working Families Tax Cut”), public perception hasn’t quite caught up to reality. As David notes, tax cuts don’t often get the credit they deserve, and people may notice their tax bills have shrunk, but they rarely attribute that to congressional action:

These across-the-board tax cuts were going to expire at the end of this year, and if that had happened, most people in the country would have seen their taxes go up. Yet sadly, a kind of cynicism has settled over many voters who remain unconvinced of almost anything they hear from politicians and the media these days.

This is hardly a new phenomenon. Following the 2017 tax reform bill, the data clearly showed that most taxpayers received tax relief, but research by The Winston Group showed only about a third of Americans believed they had. And that was despite clear, measurable savings. Likewise, our EY study found that tax relief for pass-through businesses (particularly 199A) translates into higher wages, more jobs, and increased investment. In short, the policies worked, but the politics and messaging lagged.

The same dynamic is at play today. The Working Families Tax Cut delivers the most significant set of Main Street-focused tax reforms in over a decade. Permanent extension of Section 199A (which directly supports 2.6 million American jobs), higher estate tax exemptions (critical to ensuring future generations doesn’t have to buy the whole business back from the government), R&E expensing (which prevents massive, unexpected tax bills), and other pro-growth policies all go straight to the heart of how family-owned companies grow and transition. These provisions also help ensure parity between pass-throughs and their publicly-owned corporate competitors, which pay far lower rates, and ultimately drive down costs for consumers. Yet, as David points out, voters’ default assumption is that their taxes are going up, not down.

That creates a messaging gap and a political risk. If people don’t know they got a tax cut, they won’t reward the policymakers who made it happen. Worse, they may be swayed by opponents who characterize the reforms as giveaways to someone else. This is exactly what happened post-2017 — despite widespread tax relief, the reforms never enjoyed majority public support.

The solution, as David argues, is sustained follow-through. That means telling the stories of Main Street businesses that are using the tax relief to hire more workers, reinvest in plant and equipment, and continuing their community support. Those are the stories S-Corp and its Main Street allies will be telling in the months and years ahead, and we encourage the rest of the business community to do the same.

In the end, the success of the reconciliation package will hinge on whether Americans fully understand how it benefits them.

Talking Taxes in a Truck Episode 43: EY’s Dianne Mehany Decodes the Big Beautiful Bill

With the One Big Beautiful Bill Act (Working Families Tax Cut?) officially the law of the land, how are private companies responding? And where does tax policy go from here? We invited EY Private National Tax Leader Dianne Mehany to the podcast to discuss those questions and more. Dianne breaks down the key provisions and how they’re playing with clients (199A, SALT, estate tax). Later we discuss the legislative outlook, new country-by-country reporting requirements, and the advantages of a Ford F-150 over Uber.

House Hearing on CTA Regs, Database Purge

Earlier this week we covered the latest effort in Congress to make things right when it comes to the Corporate Transparency Act. That starts with deleting the beneficial owner database that’s not just unnecessary but actively puts millions of Americans’ sensitive information at risk.

Thanks in large part to Congressman Warren Davidson, who chairs the Financial Services Committee’s Subcommittee on National Security, Illicit Finance, and International Financial Institutions, we now have a bit more clarity on where things stand. At a hearing convened Tuesday, FinCEN Director Andrea Gacki offered the following response to a question from the panel:

Along with the resolution of this rule, we also intend to resolve questions around the data that we have collected, and dispose of data that is no longer legally required.

That statement comes on the heels of a letter sent by several dozen federal lawmakers calling for a data purge, and is the first time FinCEN has confirmed they’ll comply with the request.

In terms of the rule referenced by Director Gacki, readers will recall that FinCEN in March issued interim regulations that narrow the scope of the CTA’s reporting requirements to apply only to foreign entities and non-US citizens. Here’s Chair Davidson describing that action:

I want to highlight Beneficial Ownership disclosure. It seems that you’ve made a decision to collect information on US citizens differently than you do about non-citizens. And I think that’s important because our constitution limits the ability to presume that someone is guilty of a crime – you’re supposed to have probable cause and a warrant to get information from them. The beneficial ownership [rules] as drafted under the previous administration basically assumed every business was engaged in illicit finance.

That interim rule provided much needed relief and guidance to more than 30 million entities covered under this onerous statute, but still needs to be finalized. When can we expect that process to wrap up? Here’s Director Gacki again:

We intend to finalize this rule in the upcoming year – that’s our public commitment. We’re making sure we have administration guidance, and are working through a number of comments that we received to the interim final rule.

But what if there was a better approach to all of this that doesn’t rely on tweaking the flawed CTA statute? Congressman French Hill, who chairs the full committee, offered his thoughts:

Isn’t there a better way than creating a new database that can be breached or hacked…for 32 million small businesses? Every heating and cooling repairman out there with a truck and three employees is going to be captured by this. I think there’s a better way, which is simply using the existing Form 1065, which every pass-through entity has to file, and the resulting K-1s that are issued. And let me say in front of the whole committee: why was that not treated as a real possibility?

Number one, Ways & Means and Treasury said, we don’t want any more exceptions to sharing IRS data. Well, there are 35 or so now. And if this is so essential to national security, why wouldn’t this be a worthy, additional exception? Under the CTA, companies are required to file four key pieces of information – full legal name, date of birth, current address, and a unique identifier. And that’s all available, except for the birthdate, which I think we can figure out. I think this is a better approach.

We couldn’t agree more. The whole point of the CTA was to give law enforcement access to ownership information about illicit activity, not to create a sprawling new database sweeping in every family-owned business and local employer in the country.

So good news on multiple fronts when it comes to Treasury regulations and the database purge. It’s also encouraging to see lawmakers starting to rethink the Corporate Transparency Act from the ground up – not just trimming around the edges of a flawed statute, but exploring what a truly workable approach would look like. That means designing a system that protects Main Street businesses while focusing government resources on bad actors.