Treasury Expands CTA Relief

The millions of businesses that rode out the recent roller-coaster of court rulings and chose not to file their CTA reports to date should be feeling pretty good right now. Fresh on the heels of FinCEN’s announcement that it was pausing enforcement of the Corporate Transparency Act pending the enactment of new regulations, the Treasury Department yesterday shed some additional light on what the new reporting regime will look like. Here’s the press release:

The Treasury Department is announcing today that, with respect to the Corporate Transparency Act, not only will it not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines, but it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect either. The Treasury Department will further be issuing a proposed rulemaking that will narrow the scope of the rule to foreign reporting companies only. Treasury takes this step in the interest of supporting hard-working American taxpayers and small businesses and ensuring that the rule is appropriately tailored to advance the public interest.

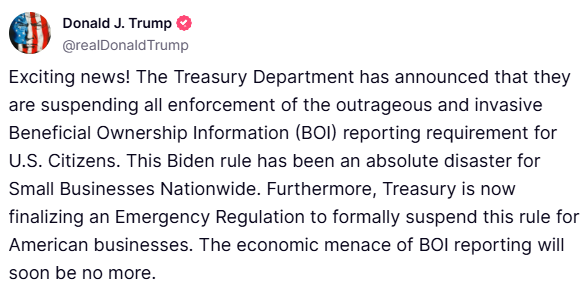

So anyone concerned about the Trump administration’s position on the CTA – particularly after FinCEN appealed a ruling that had prevented the reporting requirements from taking effect – can breathe a sigh of relief. Here’s how President Trump reacted to the announcement yesterday:

And Treasury Secretary Scott Bessent:

This is good news all around. Not only is Treasury taking aggressive action to limit the damage the CTA poses to the small business community, but it’s evident our concerns about the law are shared by some pretty important people.

There are, however, some open questions as to how things play out from here. The Administration clearly has the ability to amend regulations issued by their predecessor, but what about the underlying statute? And what about the many court cases pending that challenge the CTA based on fundamental constitutional issues?

Our plan is to press forward in supporting the court challenges while working with Congress on repeal language. Yesterday’s announcement provides the business community with immediate relief from this onerous and unconstitutional data grab. Now it’s our job to make that relief permanent.

Treasury Pauses CTA Enforcement!

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) announced yesterday that it is ceasing enforcement of the Corporate Transparency Act (CTA) while it crafts a new set of regulations that will ultimately narrow the scope of the reporting regime. It’s a huge win for Main Street, particularly as the CTA’s reporting requirements were scheduled to take effect once again beginning March 21st.

Here’s the key passage from FinCEN’s release:

FinCEN announced that it will not issue any fines or penalties or take any other enforcement actions against any companies based on any failure to file or update beneficial ownership information (BOI) reports pursuant to the Corporate Transparency Act by the current deadlines. No fines or penalties will be issued, and no enforcement actions will be taken, until a forthcoming interim final rule becomes effective and the new relevant due dates in the interim final rule have passed. This announcement continues Treasury’s commitment to reducing regulatory burden on businesses, as well as prioritizing under the Corporate Transparency Act reporting of BOI for those entities that pose the most significant law enforcement and national security risks. [Emphasis added.]

The agency also made clear that a new proposed rule will be unveiled next month, and will likely include significant changes to the existing reporting regime:

No later than March 21, 2025, FinCEN intends to issue an interim final rule that extends BOI reporting deadlines, recognizing the need to provide new guidance and clarity as quickly as possible, while ensuring that BOI that is highly useful to important national security, intelligence, and law enforcement activities is reported.

FinCEN also intends to solicit public comment on potential revisions to existing BOI reporting requirements. FinCEN will consider those comments as part of a notice of proposed rulemaking anticipated to be issued later this year to minimize burden on small businesses while ensuring that BOI is highly useful to important national security, intelligence, and law enforcement activities, as well to determine what, if any, modifications to the deadlines referenced here should be considered.

The relief is precisely what the Main Street business community requested earlier this month. So hats off to Treasury Secretary Scott Bessent for recognizing the significant burden the CTA places on millions of law-abiding Americans and for taking swift action.

In the meantime, we look forward to reviewing the proposed regulations and remain hopeful that they will risk-based protocol for enforcement, something we’ve advocated for since Day One.

Strong Business Community Support for House Budget Resolution

The Main Street business community has come out in strong support of the House Budget Resolution scheduled to be considered this week. The simple reality is there will be no tax bill unless Congress adopts a budget that calls for one. As Karen Kerrigan noted in her letter to House leaders:

This must be a priority for Congress…passing the budget resolution is a vital first step toward that end. Renewing expiring small business provisions in the TCJA such as the 20% small business deduction, lower individual income tax rates, higher threshold exemptions on death taxes, and restoring incentives such as immediate R&D expensing and bonus depreciation, are critical to America’s innovative entrepreneurs.

For that reason, more than 100 Main Street trades and business organizations signed a letter to Speaker Johnson and Democratic Leader Jeffries in support of the budget resolution before the House. As the letter argues:

Absent action, millions of Main Street businesses organized as S corporations, partnerships, and sole proprietorships will see their taxes go up sharply next year. Taxes on these pass-through businesses will go up when they earn profits, when they invest, and when they pass their businesses on to the next generation.

Signatories of the letter include manufacturers, roofers, wholesalers, franchisers, contractors, engineers, retailers, and just about every other part of the American economy. These member businesses are located in every community in the country, and they support every aspect of life in those communities.

House members thinking about opposing this budget are setting the table for a massive tax hike on these businesses that represent 95 percent of all businesses and employ 63 percent of all private sector workers.

Congress needs to act to stop that tax hike and it needs to do it quickly to give the business community the certainty it needs and deserves.

Is There a Silver Lining in the CTA Cloud?

Yesterday’s District Court decision lifting the injunction against the Corporate Transparency Act (CTA) is a setback for Main Street.

The Texas court lifted the second and only remaining injunction blocking filing under the CTA, again forcing millions of small (and not-so-small) businesses to report all their beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN) or face fines and jail time. As the Court ruled:

In light of the Supreme Court’s order in McHenry v. Texas Top Cop Shop, Inc., the Court has determined that the motion should be, and hereby is, GRANTED. The Court’s January 7, 2025 order granting preliminary relief is STAYED pending the disposition of the appeal.

The result is filing will resume in 30 days, per guidance posted on the FinCEN website today:

With the February 18, 2025, decision by the U.S. District Court for the Eastern District of Texas in Smith, et al. v. U.S. Department of the Treasury, et al., 6:24-cv-00336 (E.D. Tex.), beneficial ownership information (BOI) reporting requirements under the Corporate Transparency Act (CTA) are once again back in effect. However, because the Department of the Treasury recognizes that reporting companies may need additional time to comply with their BOI reporting obligations, FinCEN is generally extending the deadline 30 calendar days from February 19, 2025, for most companies.

So that’s the bad news – the CTA is back in effect.

What’s the silver lining? Several opportunities for success remain. First, bipartisan legislation recently passed the House that would delay filing until the end of the year. A companion bill has been introduced in the Senate by Banking Chair Tim Scott. This legislation is unlikely to move forward on its own, but it could catch a ride on a must-pass bill like the upcoming CR. Yesterday’s ruling could be the catalyst to get that done.

Second, today’s statement from FinCEN also opens the door for further administrative relief:

Notably, in keeping with Treasury’s commitment to reducing regulatory burden on businesses, during this 30-day period FinCEN will assess its options to further modify deadlines, while prioritizing reporting for those entities that pose the most significant national security risks. FinCEN also intends to initiate a process this year to revise the BOI reporting rule to reduce burden for lower-risk entities, including many U.S. small businesses.

What exactly they have in mind is unclear, but both the 30-day grace period and the recognition that the current CTA rules overreach is a massive step forward and a signal that the new Administration intends to take a more business-friendly approach to the CTA. Is a further filing deadline delay part under consideration?

Finally, yesterday’s ruling is not the final say in the courts either. By our count, there are eleven challenges to the CTA pending in federal courts and the lead case – NSBA v. Treasury – is awaiting a decision by the Eleventh Circuit any day now. We have a good chance to win that decision but the case is all but guaranteed to end up before the Supreme Court this year either way.

So the courts might save us from this poorly-conceived law in the end, but in the meantime we need help from the Administration. Vice President Vance and Secretary McMahon have already weighed in against the CTA. Yesterday’s court ruling means it’s time for our friends at Treasury to do the same in a meaningful way.

CTA Update | February 11, 2025

Notable Developments

- Smith ruling appealed

- FinCEN promises relief amid shifting legal landscape

- NFIB files amicus brief

- Delay bill sails through House

* * *

Smith Ruling Appealed

On February 5, the DOJ filed a notice of appeal of a District Court’s ruling in Smith v Treasury, the case that led FinCEN last month to once again pause data collection under the CTA. However, the government also asked the appellate court to stay the nationwide injunction against the CTA’s reporting requirements pending a ruling in the case, meaning the current pause could be undone by the courts at any point.

Main Street businesses had hoped that the new Trump administration would not appeal the Smith ruling and instead allow its injunction to remain in place, but that unfortunately is not how things played out. Whether the Supreme Court weighs in – as it did in the Texas Top Cop Shop case last month after the DOJ filed an emergency petition with the high court – will depend on how the DOJ handles things from here.

* * *

FinCEN Promises 30-Day Grace Period and Unspecified Relief

Shortly after the Smith appeal was filed, FinCEN posted the following announcement on its website:

On February 5, 2025, the Department of Justice—on behalf of the Department of the Treasury (Treasury)—filed a notice of appeal of the district court’s order and, in parallel, has sought to stay that order as the appeal proceeds.

If the district court’s order is stayed, thereby allowing FinCEN’s Reporting Rule to come back into effect, FinCEN intends to extend the reporting deadline for all reporting companies 30 days from the date the stay is granted. Further, in keeping with Treasury’s commitment to reducing regulatory burden on businesses, FinCEN, during that 30-day period, will assess its options to modify further deadlines or reporting requirements for lower-risk entities, including many U.S. small businesses, while prioritizing reporting for those entities that pose the most significant national security risks. [Emphasis added.]

The good news is that if the courts reinstate CTA filing, FinCEN will grant entities a 30-day grace period to do so. It’s also encouraging to see that Treasury is considering putting in place a risk-based protocol for enforcement, something we’ve advocated for since Day 1.

The bad news is that the announcement still leaves much up in the air. As we pointed out in our trade association letter last week, Treasury has the authority to unilaterally delay the 1/1/25 filing deadline to the end of this year. We hope that, regardless of what happens in the courts, regulators will take that action and provide Main Street with much needed certainty.

* * *

Delay Bill Sails Through House

Yesterday the House voted unanimously to advance the Protect Small Businesses from Excessive Paperwork Act of 2025 (H.R. 736), legislation that seeks to delay the CTA’s filing deadline for existing entities (those created prior to 2024). The strong show of support is a clear indication that there is bipartisan interest in at least delaying the CTA, and that affected businesses are calling their elected officials to spread the word. The bill now heads to the Senate.

* * *

Court Recap

While their Texas case remains pending, our friends at the National Federation of Independent Business recent filed an amicus brief with the Fourth Circuit in the case of Community Associations Institute v Treasury. Here’s the key passage from their press release:

NFIB’s brief argues three main points: 1) the CTA does not regulate activity and cannot pass muster under the Commerce Clause, 2) to pass the substantial effects test under the Commerce Clause, Congress must be regulating economic activity, which is the introduction, production, or exchange of goods or services, and 3) because the Act regulates noneconomic activity, it fails the Commerce Clause’s substantial effects test.

The case brought forth by CAI, which represents thousands of homeowners associations across the country, is yet another reminder of the CTA’s staggering overreach – as everyone knows, HOA’s are not engaged in commerce.

Meanwhile, we continue to eagerly await the Eleventh Circuit ruling in NSBA et al v. Yellen and the initial ruling out of Michigan, where the judge has made some very pointed remarks about the validity of the CTA. All told, there are (by our count) eleven cases in various courts across the country challenging the validity of the CTA. Here are the links:

- Alabama (appealed): NSBA et al v. Yellen (11/15/2022)

- Ohio: Robert J. Gargasz Co., L.P.A. et al v. Yellen (12/29/2023)

- Michigan: Small Business Association of Michigan et al v. Yellen (3/1/2024)

- Maine: William Boyle v. Yellen (3/15/2024)

- Texas: NFIB et al v Yellen (5/28/2024)

- Massachusetts: BECMA et al v Yellen (5/29/2024)

- Oregon: Firestone v Yellen (6/27/2024)

- Utah: Taylor v Yellen (7/29/2024)

- Virginia: Community Associations Institute v. Janet Yellen (9/10/2024)

- Texas: Samantha Smith and Robert Means v. Treasury (9/12/2024)

- Texas: Association of American Physicians & Surgeons et al v Yellen (10/28/2024)