Main Street Tax Certainty in the House (and Senate)

Earlier today Senator Steve Daines and Congressman Lloyd Smucker reintroduced their Main Street Tax Certainty Act, legislation to make permanent the Section 199A deduction. The bills mirror S. 1706 and H.R. 4706 from last Congress, meaning the campaign to protect Main Street from looming tax hikes is once again a bicameral and bipartisan effort.

The legislation introduced today builds on our prior success in a big way. Whereas the previous House bill garnered support from 91 original cosponsors – a significant feat in and of itself – Congressman Smucker’s bill was released today with the backing of 151 original cosponsors. It’s the same story in the Senate, with 36 original cosponsors signing onto Senator Daines’ legislation compared to 14 last time around.

Also notable is the fact that every member of the Senate Republican Leadership team backed the Main Street Tax Certainty Act, as well as the full roster of Republicans on the House Ways & Means Committee. That’s in addition to the more than 235 trade associations that joined our letter thanking Senator Daines and Congressman Smucker on this critical issue.

And it’s not just Congressional tax-writers who support 199A permanence, as we saw during yesterday’s Member Day hearing. Here’s what Congressman Tony Wied (R-WI) had to say:

I strongly support making the 199A tax deduction permanent to provide much needed relief to the small businesses, working families and farmers in my district and across the country. Should Congress fail to renew 199A, 52,230 small businesses in Wisconsin’s 8th District would be hit with an unconscionable 43.4% tax rate. Any limitation or reduction in 199A would unfairly target and hurt middle class taxpayers and the small businesses who are the lifeblood of our economy.

And Congressman Tom Barrett (R-MI):

Our small business owners, the backbone of our local economy, will face even greater challenges. For example, nearly 44,000 small businesses in mid-Michigan will see their tax rate rise to 43% if the Small Business Deduction expires… These numbers are not just statistics—they are stories of struggle and sacrifice. They represent families deciding between paying their bills or putting money aside for the future. Small business owners weighing whether they can afford to expand or hire.

And Congressman Tim Moore (R-NC):

Western North Carolina’s economy also relies on small businesses – our state is home to over 964,000 small businesses, which employ nearly half of our workforce. These business owners have told me that without the certainty of the TCJA’s small business deductions, their ability to invest in new equipment, hire workers, and expand operations would be at risk. Making these provisions permanent isn’t just good policy, it’s essential to their survival. Because if these provisions were to expire, North Carolina would lose 5.9 million jobs, $540 billion in wages, and $1.1 trillion in economic output.

The bottom line is that Section 199A is more than just a tax provision. It protects thousands of local communities from fewer jobs and more boarded up buildings, reduces the tax burden on local businesses to make them more competitive, and allows multi-generation businesses to stay family-owned.

We are extremely grateful to Congressman Smucker and Senator Daines for their leadership on this issue, as well as the dozens of lawmakers that supported the Main Street Tax Certainty Act today. S-Corp and the Main Street Employers Coalition are looking forward to working with all of you to get this critical legislation enacted, before it’s too late.

Main Street Rallies Around 199A Permanence

More than 230 trade associations came out in support today of legislation to make permanent the Section 199A deduction. Appropriately named the Main Street Tax Certainty Act, the bill is set to be reintroduced tomorrow by Senator Steve Daines (R-MT) and Representative Lloyd Smucker (R-PA), two of the Main Street business community’s staunchest allies.

The deduction was enacted in 2017 to encourage job creation and new investment by private businesses. It also helps private companies compete with public corporations. Without the deduction, pass-throughs would face rates up to 16 percentage points higher than their publicly-traded competitors. The challenge is Section 199A will expire at the end of this year absent congressional action.

The letter, led by our Main Street Employers Coalition, makes the case for permanence and was signed by more than two hundred and thirty trade associations, a strong show of support that highlights just how critical the provision is:

Pass-through businesses are the backbone of the American economy. They account for 95 percent of all businesses and employ 63 percent of all private sector workers. They also form the economic and social foundation for thousands of communities nationwide. Absent their efforts, those communities would face a future of lower growth, fewer jobs, and more boarded up buildings.

Despite its importance, the Section 199A deduction is scheduled to sunset at the end of 2025, even as the businesses it supports continue to struggle with rising prices, labor shortages, and supply chain disruptions. A recent EY study found the loss of Section 199A would put 2.6 million jobs at risk.

Making the Section 199A deduction permanent will help Main Street compete with large public corporations, lead to higher economic growth and more employment, and help prevent a significant tax hike on the very businesses we rely on to drive our economy. Numerous studies by economists Barro and Furman, the American Action Forum, DeBacker and Kasher, EY and others found Section 199A permanence would result in improved parity for Main Street businesses and higher levels of economic growth.

You can read the entire letter here. For more information about the Main Street Employers coalition and our efforts to make Section 199A permanent, click here.

The C SALT Loophole

Last month, the Bipartisan Policy Center put forward some suggestions on how to address the pending sunset of the State and Local Tax (SALT) cap, including rolling back the pass-through “SALT Parity” laws we helped enact in 36 states. A couple of thoughts.

Pass-Through Parity

First, the SALT cap played a big role in our efforts to ensure pass-through businesses were treated fairly under the TCJA. The SALT cap raises huge amounts of revenue ($100 billion-plus per year) and about 20-30 percent of that is paid on pass-through income. For comparison, that’s about half the total revenue impact of the 199A deduction, so the loss of SALT deductions significantly undercut any 199A benefit.

For reasons unknown, the TCJA did not extend the SALT cap to so-called “C SALT” — state income taxes paid by C corporations. Those taxes remain fully deductible.

This imbalance – C corporations deduct their SALT, S corporations subject to the cap — exacerbated the rate disparity already imbedded in the TCJA. As we wrote at the time:

[The Senate bill] ignores the effects of repealing the SALT income tax deduction for S corporations while preserving it for C corporations. Preventing businesses from deducting this business expense could raise marginal rates on S corporations significantly, depending on which state they reside in. Those in Wyoming, for example, would see no effect, while those doing business in California would see their marginal rates increased by five-percentage points. On average, SALT repeal raises effective marginal rates by between two- and three-percentage points.

The initial Senate draft called for a top corporate rate of 20 percent, whereas the top pass-through rate was 38.5 percent. Add in the NIIT and the disparate SALT treatment, and the top pass-through rate was around 45 percent. Even companies that received the new 199A deduction paid close to 40 percent – or about twice the corporate rate. (For those worried about the double corporate tax, we addressed that here.)

During Senate consideration, S-Corp and its allies worked to 1) lower the top individual rate and 2) increase and broaden the 199A deduction, resulting in more equitable treatment. We were unable, however, to get the bill’s sponsors to budge on the SALT disparity.

So our Main Street Employer coalition worked with the states to allow S corporations and other pass-throughs to elect to pay their SALT at the entity level, thus restoring their SALT deduction by affording them the same treatment that C corporations receive. Thirty-six states (out of forty-one where they would be applicable) have adopted these laws. (What is your damage, Pennsylvania?)

Which brings us to our first quibble with the BPC write-up. Here’s what they say:

Since the SALT cap was enacted in 2017, pass-through business owners have taken advantage of state government level workarounds to deduct more than the allowed $10,000 in SALT from their federal taxes. Thirty-five states allow pass-throughs to pay SALT at the entity level, meaning individual owners avoid the $10,000 SALT deduction cap. This violates the spirit of TCJA’s SALT cap. Closing state workarounds for pass-through entities would ensure that pass-throughs are subject to the same caps as individuals.

Au contraire. The SALT Parity bills don’t violate the “spirit” or any other aspect of the law. The difference is they can now elect to have their SALT paid by the entity and deductible as a business expense – just like C corporations. Here’s the operative argument in the legal analysis we did for Treasury:

The Internal Revenue Service (the “Service”) has consistently held that income and other taxes imposed upon and paid by pass-through entities are simply subtracted in calculating nonseparately computed income at the entity level, and are not separately passed through or incorporated into the various provisions and calculations applicable to itemized deductions at the individual level, such as the standard deduction, alternative minimum tax and the Pease reduction. In discussing the final provisions of the Tax Cuts and Jobs Act,1 the Conference Committee Report explicitly reiterated and relied upon this principle in describing the scope of new section 164(b)(6) of the Code.

The TCJA’s SALT policy was not that pass-throughs don’t get their deduction anymore, but that SALT paid by individuals would now subject to the cap. SALT paid by pass-throughs directly would still be deducted as business expenses. The Treasury Department agreed with our analysis in Revenue Ruling 2020-75, stating:

In enacting section 164(b)(6), Congress provided that “taxes imposed at the entity level, such as a business tax imposed on pass-through entities, that are reflected in a partner’s or S corporation shareholder’s distributive or pro-rata share of income or loss on a Schedule K-1 (or similar form), will continue to reduce such partner’s or shareholder’s distributive or pro-rata share of income as under present law.”

Long story short, our SALT Parity laws are consistent with the spirit, the letter, and every other aspect of the TCJA.

The Corporate SALT Loophole

Our second quibble with the BPC recommendation is they separate the question of SALT deductions for pass-throughs and C corporations. Their write-up argues:

Closing SALT workarounds for pass-through businesses without addressing C-SALT could lead to more inequitable tax treatment. To address this imbalance, policymakers could eliminate deductibility for SALT on corporate income taxes while continuing to allow corporate deductions for wage, sales, and property taxes paid.

Well amen for somebody recognizing that allowing C SALT deductions while capping everybody else is patently inconsistent. Why should the SALT cap apply to the local hardware store but not Home Depot?

Beyond that, the BPC comes close to the truth but doesn’t quite grasp it. The only reason our SALT Parity reforms work is because C corporations still deduct all their SALT. If Congress were to cap C SALT deductions, they would also cap the deductions of pass-throughs, even for those taxes paid at the entity level.

It’s a C corporation loophole, not a pass-through loophole.

Conclusion

So if the new Congress wants to stop disadvantaging Main Street, it can take one of two approaches. Either keep the status quo where individuals are subject to the SALT cap but businesses – all businesses – are not, or extend the SALT cap to include all taxpayers, including C corporations.

We prefer the first approach as it promises lower taxes for all businesses. If Congress chooses the second approach, on the other hand, it would raise enormous amounts of revenue, all of which should be used to offset the cost to making the 199A deduction permanent. It’s only fair.

CTA Update | January 16, 2025

Notable Developments

- S-Corp files amicus with SCOTUS

- Main Street backs repeal bill

- Second injunction issued

* * *

SCOTUS Review Should Compel Administrative Relief

Last week the S Corporation Association filed an amicus brief with the Supreme Court urging retention of the nationwide injunction against the CTA. The brief was one of more than a dozen filed by the state attorneys general, trade associations, and other stakeholders, all of which can be accessed here.

With millions of affected businesses watching, now would be a perfect time for the incoming Trump administration to announce it will administratively delay filing under the CTA, thus providing these law-abiding businesses with some much-needed certainty.

We know we have important allies in the incoming Administration, including:

- Vice President JD Vance

- Education Secretary Nominee / Transition Team Co-Chair Linda McMahon

- DOGE Co-Chair Vivek Ramaswamy

The Trump Administration has pledged to take action to protect American businesses starting Day One. A one-year delay in CTA filing needs to be the centerpiece of that effort.

* * *

Main Street Backs Repeal Bill

Yesterday Representative Warren Davidson (R-OH) and Senator Tommy Tuberville (R-AL) reintroduced their bicameral CTA repeal bill, dubbed the Repealing Big Brother Overreach Act. In a sign of growing concern over the CTA, the House bill was introduced with sixty-eight original cosponsors.

S-Corp joined dozens of its trade association allies in a letter backing the legislation. The letter was spearheaded by our friends at NFIB and reads in part:

Small businesses are not criminals and do not wish to be treated as such by the federal government. We are not opposed to efforts to fight criminal activity, but these efforts must be targeted and tailored. The CTA is not. It is a sledgehammer that imposes exorbitant fines that could close down millions of small businesses forever and penalties that may criminalize tens of millions of law-abiding small business owners.

* * *

Second Filing Delay Issued

While the Fifth Circuit Court of Appeals drama was unfolding, another Texas District Court judge ruled against the CTA in the case of Samantha Smith and Robert Means v Treasury. The good news for Main Street is the court stayed the CTA’s filing deadline while the case proceeds. So we now have two rulings delaying the filing deadline for everyone, pending further review.

As a reminder, there are (by our count) eleven cases in various courts across the country challenging the validity of the CTA. Here are the links:

- Alabama (appealed): NSBA et al v. Yellen (11/15/2022)

- Ohio: Robert J. Gargasz Co., L.P.A. et al v. Yellen (12/29/2023)

- Michigan: Small Business Association of Michigan et al v. Yellen (3/1/2024)

- Maine: William Boyle v. Yellen (3/15/2024)

- Texas: NFIB et al v Yellen (5/28/2024)

- Massachusetts: BECMA et al v Yellen (5/29/2024)

- Oregon: Firestone v Yellen (6/27/2024)

- Utah: Taylor v Yellen (7/29/2024)

- Virginia: Community Associations Institute v. Janet Yellen (9/10/2024)

- Texas: Samantha Smith and Robert Means v. Treasury (9/12/2024)

- Texas: Association of American Physicians & Surgeons et al v Yellen (10/28/2024)

And for those looking for a full recap on where things stand, be sure to check out this helpful post from two attorneys at the firm Farella Braun + Martel LLP.

199A Permanence Dominates Tax Hearing

The House Ways & Means Committee today kicked off the new Congress with a hearing focused on the family and business provisions included in the Tax Cuts and Jobs Act. But the topic that took center stage is one that’s near and dear to the hearts of millions of Main Street businesses nationwide – addressing the looming expiration of the Section 199A deduction.

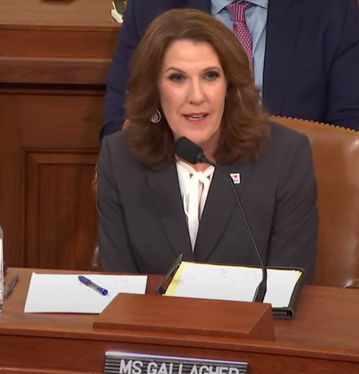

The panel first heard testimony from Michelle Gallagher, an S-Corp Advisor and accountant with decades of experience serving individual and family-owned businesses (and who can be seen sporting our “I Love 199A pin!”).

Her opening statement began by calling on lawmakers to not just extend 199A, but to do so swiftly:

The 199A deduction has been critical for businesses organized as [pass-throughs] which represent 99 percent of my business clients, and the vast majority of businesses in Michigan and nationwide. They also employ most of the country’s workers. 199A helped many small business clients stay competitive with large corporations on wages and hiring when inflation was skyrocketing…If the 199A deduction expires, the tax on pass-throughs will go up sharply, while C corps and publicly-traded companies will continue to enjoy their lower, 21-percent permanent rate. This simply is not fair to the Main Street businesses and farmers of our country.

Michelle wasn’t the only person in the room to bring up the importance of extending 199A and the Tax Cuts and Jobs Act. Throughout the course of the hearing, the issue was raised countless times by lawmakers and witnesses. Here’s Chairman Jason Smith (R-MO):

Small businesses are facing a 43.4 percent tax rate if the 199A small business deduction, as I refer to it, expires. This looming threat impacts decisions they’re making today about whether to invest, grow, hire…If Congress doesn’t act soon, family-owned farms and Main Street businesses will have to start calling estate planners and accountants to figure out how they navigate the potential increases in their tax burdens.

And Rep. Vern Buchannan (R-FL):

As chairman of the Florida Chamber I can tell you we had 130,000 businesses, 90 to 95 percent of them were pass-through entities. And you’re dealing with these potential tax hikes, that’s what scares a lot of people.

And Rep. Jodey Arrington (R-TX):

Everyone benefitted. And those on the lower income spectrum benefitted the most. Actually, the top 1 percent paid more. So we got more progressive in that sense. But all boats rose on the tide of prosperity as the result of good, low, competitive tax rates for our country and for our families.

And Rep. Kevin Hern (R-MO):

Certainty is important. And we’re getting ready to see the largest tax increase in American history starting January 2026 if we don’t do something…199A, it puts parity between small business pass-throughs and C corporations, and 99 percent of businesses in America are pass-throughs. Are there some larger than others? Absolutely. Are we going to be punitive to those who have fought, and grown their businesses as I did, from one person to 1,200 employees? Are we evil because we created jobs?

And Rep. Greg Steube (R-FL):

With many of the TCJA’s provisions expiring, it’s imperative that Congress act this year to ensure we continue to enact pro-growth policies that help American families. In my district the consequences of inaction would be devastating – my constituents on average would experience a 24 percent tax increase if the TCA is allowed to expire.

Finally, here’s Rep. Beth Van Duyne (R-TX) referencing the 199A roundtable we held with her last year:

As part of my work on the Main Street Tax Team we were able to get out of DC and talk to real business owners. We heard about the successes of policies such as Section 199A, which created over $66 billion in savings for Main Street businesses. One of the businesses I met with was Republic National Distributing Company, where I held a roundtable including 25 small businesses including roofers, community banks, and realtors. These are the businesses across the U.S. who are benefitting from this, and this is why Congress must act.

These excerpts are just a small snippet of the support for 199A heard throughout the hearing, and we urge readers to listen to the full recording to get the complete story.

The bottom line is that it’s hard to overstate the importance of making permanent the Section 199A deduction. As the testimony and comments from lawmakers in the hearing made clear, this deduction is a lifeline for millions of Main Street businesses that form the backbone of the American economy. Without it, these job creators face a starkly uneven playing field, with higher tax burdens that could hinder growth, investment, and job creation.

We look forward to working with our allies on Capitol Hill to ensure Section 199A is made a permanent fixture of the Tax Code and thank the members of the Ways & Means Committee for holding this important hearing.