Business Community Rallies Against Surprise PPP Tax Hike

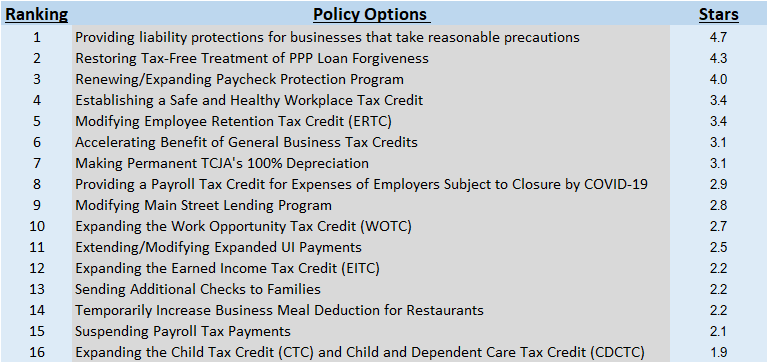

Negotiations over the next COVID-19 relief package are in full swing – finally! – and the business community has united around one key must-pass item: Restoring congressional intent and avoiding a $120 billion tax hike on Main Street business by clarifying the correct tax treatment of PPP loans.

That’s the message conveyed today by today’s letter initiated by the Associated General Contractors and signed by 564 national and state-based trade groups. 564! That’s got to be a record, and the fact those signatories were gathered in the matter of just two days should send a very emphatic signal to Congress …

(Read More)