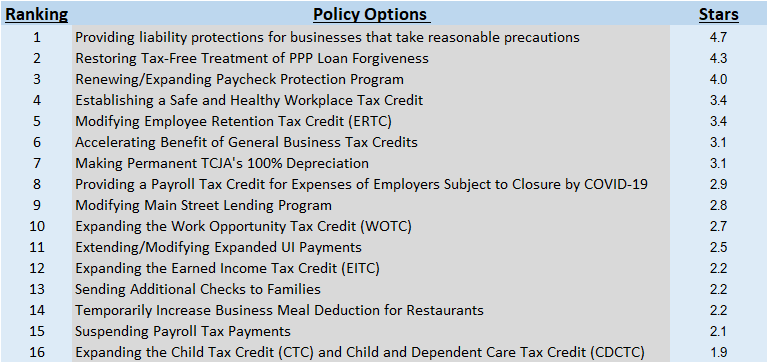

Priorities for Reopening Main Street

The Commerce Department last week revised its 2nd Quarter GDP estimates showing the economy shrunk by nearly one-third. In a $22 trillion economy, that translates into nearly $2 trillion in lost wages, profits, retirement savings, etc.

The threat of this precipitous decline was the catalyst for the business community letter dated back on March 18th. As Governors closed businesses and schools to slow the spread of COVID-19, one hundred and twenty national trade groups called on Congress to provide relief to families and employers that was on the same scale as the …

(Read More)