Talking Taxes in a Truck Episode 26: “Testifying Ain’t Easy”

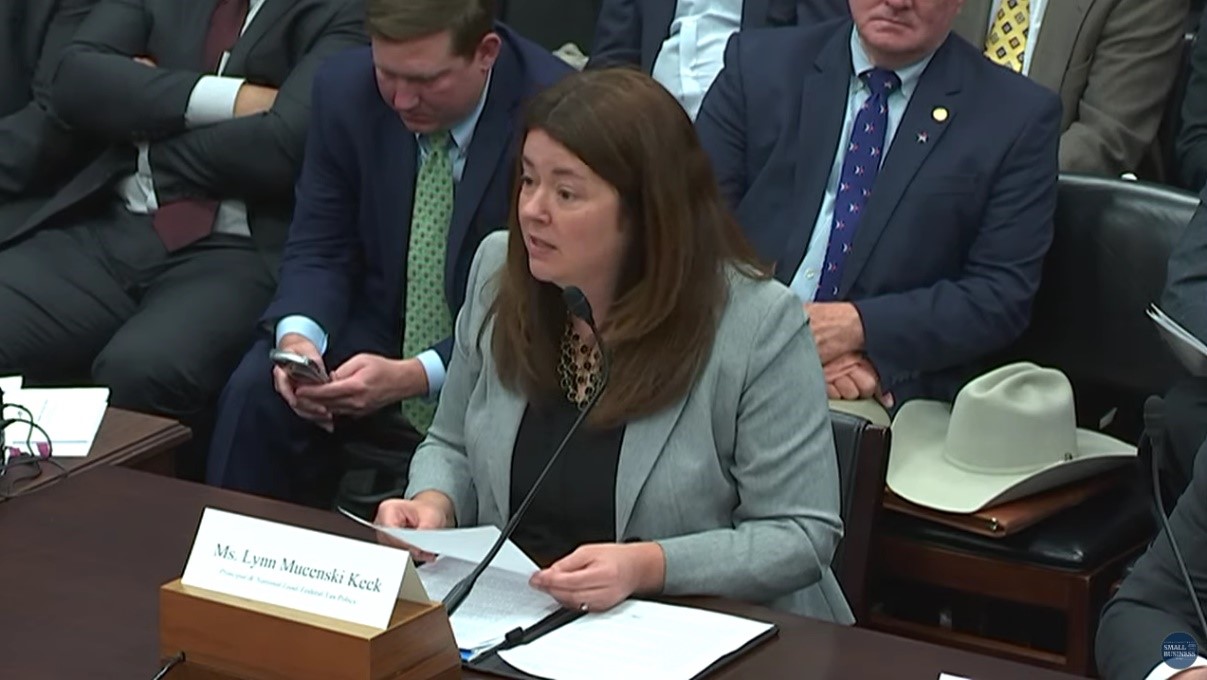

Fresh off of her triumphant visit to Capitol Hill we’re joined by Lynn Mucenski-Keck, an S-CORP Advisor and Principal at top-25 public accounting firm Withum. Lynn recaps her appearance before the House Small Business Committee, including the specific tax provisions discussed, her back and forth with some of the panel’s members, and her thoughts on the whole experience. Later we discuss IRS funding, advice for aspiring CPAs, and how Artificial Intelligence might shape the accounting profession in the years to come.

This episode of the Talking Taxes in a Truck podcast was recorded on April 21, 2023, and runs 27 minutes long.