Main Street (Still) Opposes Rate Hikes

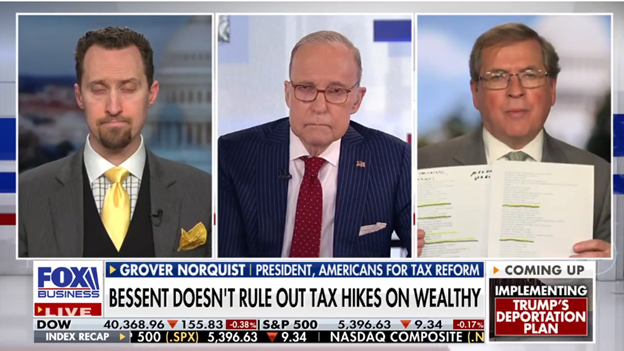

The buzz on K Street is that the White House has resumed its push for Congress to raise the top tax rate as part of the upcoming tax package. If you’re confused by this (possible) development, so are we. Just a couple of weeks ago, the President signaled his opposition to rate hikes. Now they might be back on the table.

While that may be the case, it’s hard to envision a world in which a rate hike can pass either the House or the Senate this year. Most Republicans vigorously oppose such a move, as does Main Street. Our …

(Read More)