Reichert, Buchanan Present S Corp Tax Relief to Ways and Means

As our members know, S-Corp wears two hats when it comes to advocacy – one is defensive where we protect S corporations from bad tax policy. The other is proactive and seeks to improve the S corp rules.

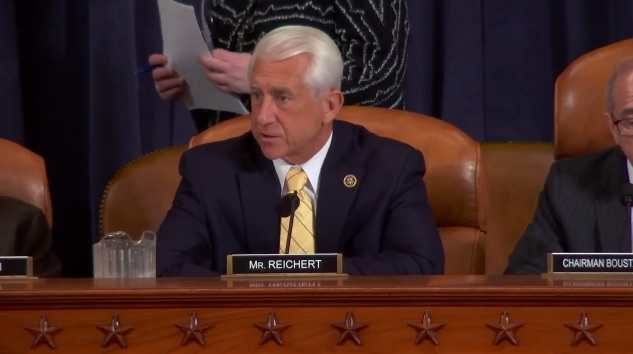

Both hats were on display this week before the House Ways & Means Committee. First, Rep. Dave Reichert (R-WA) discussed his S Corporation Modernization Act which makes a number of improvements to the S corporation rules, including opening the door to foreign investment into S corporations. As Rep. Reichert told the Committee:

Click on …

Click on …

(Read More)