Tax Breaks for Job Creators

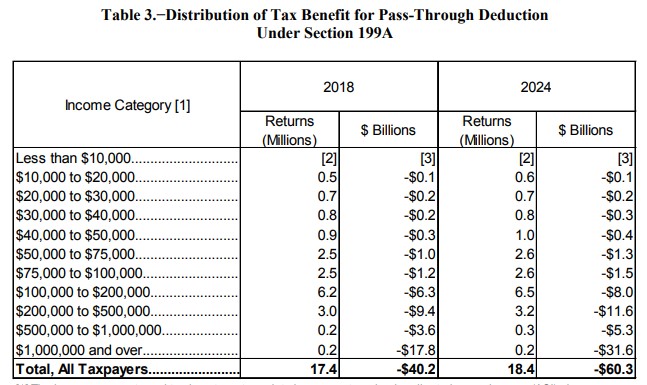

Center for Budget and Policy Priorities (CBPP) got itself into a lather the other day noting that the new, 20-percent deduction for pass-through businesses will reduce revenues by twice what the federal government spends on Pell Grants.

What’s the link between the Pell Grant program and the business income deduction? None. There is no link. The CBPP could have just as easily compared the deduction to spending on our national defense or agriculture programs.

Moreover, while the CBPP makes certain to highlight the 7.7 million beneficiaries of the Pell Grant program, they ignore the 73 million employees who work for pass-through businesses. …

(Read More)