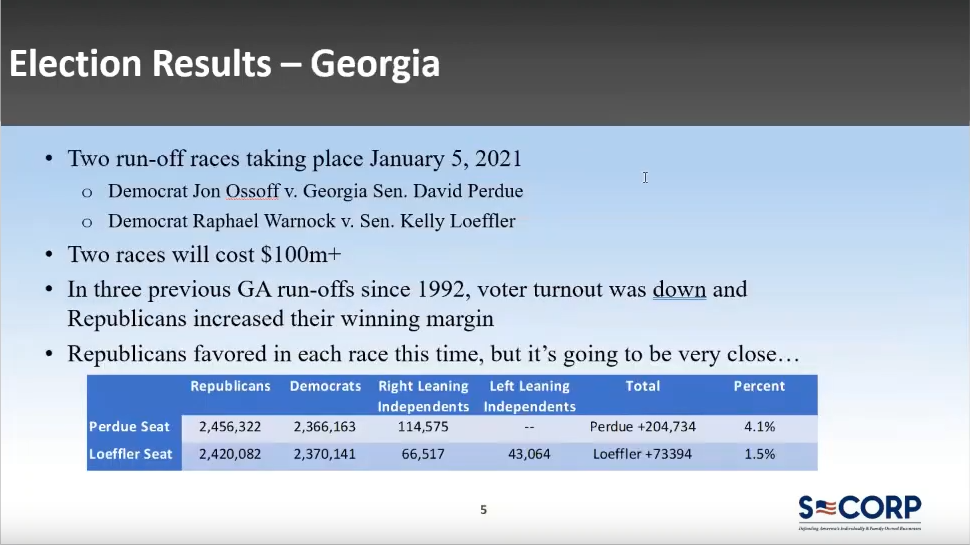

The 2020 Elections and their Implications for Private Businesses

Are you a fan of the Progressive Insurance commercials making fun of mismanaged Zoom calls? Then you’ll love the blank Zoom screen for the first 10 minutes of our most recent S-Corp Member call covering the 2020 election results and what they mean for private companies. You can access the full video here. You can access the slide deck here.

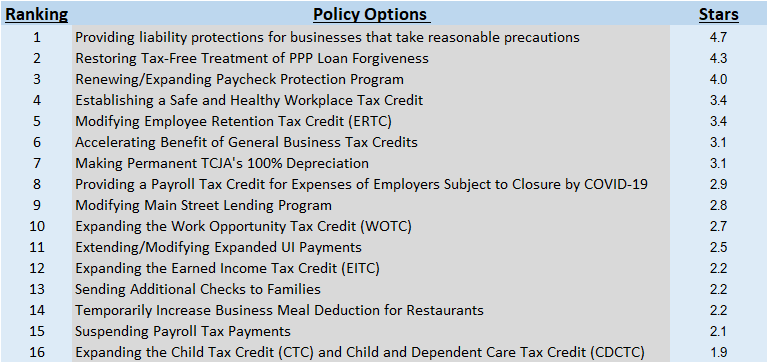

We’re biased, obviously, but we think it’s well worth watching, particularly the portion focused on what companies can expect moving forward, as well as the BIG news (covered at the …

(Read More)