A Post-Disinflationary World

Today’s meeting between Congressional leaders and the President is the first of many to come in what might be termed the post-disinflationary world.

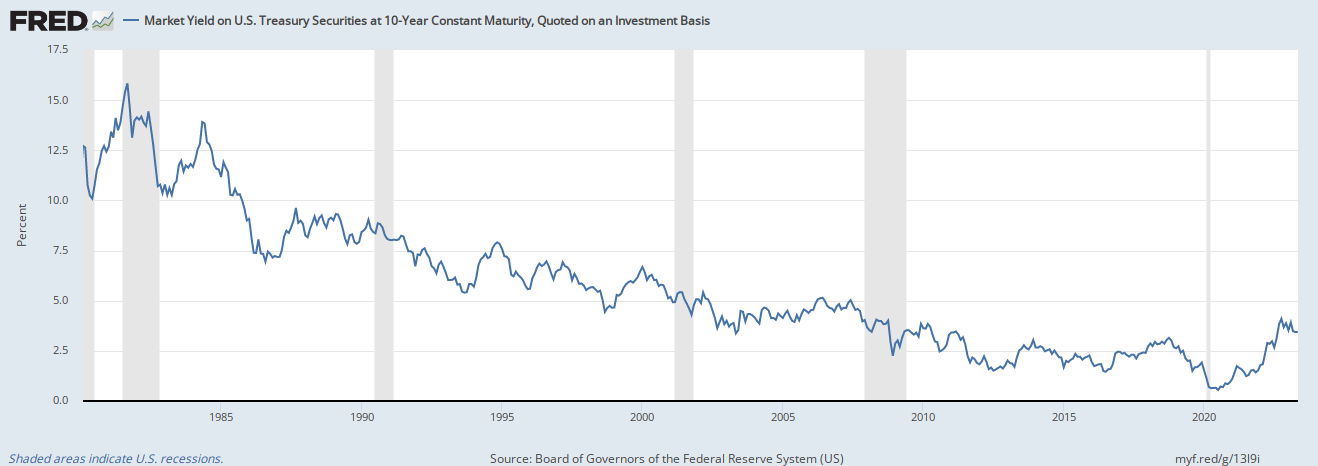

Interest rates peaked at 16 percent in the early 1980s and, following the Volker rate hikes and a nasty recession, the US embarked on an unprecedented 40-year disinflationary period where rates went from record highs to record lows.

Well, that’s over. Rising prices and record deficits are back and, absent a change of course, they are not going to get better. Hence the importance of today’s meeting.

Debt and Interest …

(Read More)