CTA Update | July 16, 2024

Notable Developments

- Appeals court sets hearing date

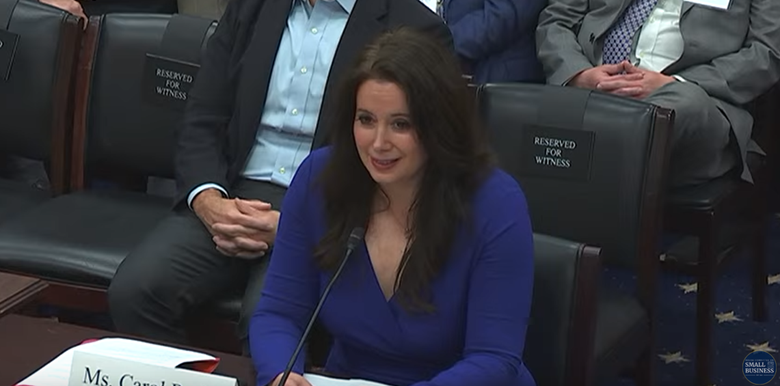

- Yellen grilled by House lawmakers

- New FinCEN guidance expands CTA’s reach

Legal Update

The Eleventh Circuit Court of Appeals announced a hearing in NSBA v Yellen, the case challenging the constitutionality of the CTA, will take place on September 27. While the court is working under an expedited timeline, that date is just three months ahead of the year-end filing deadline for existing entities.

To recap our latest alert, the total number of pending CTA challenges is currently at six nationwide:

- Massachusetts: BECMA et al v Yellen (5/29/2024)

- Texas: NFIB et al …

(Read More)