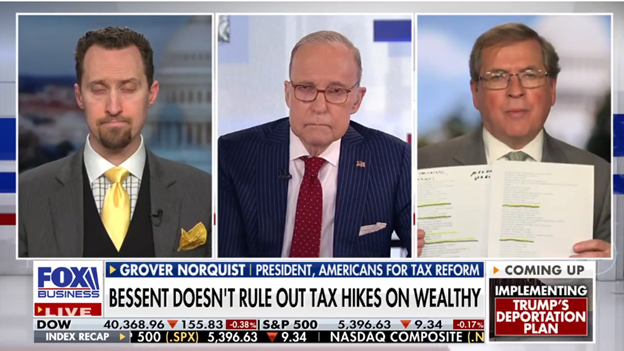

Rate Hikes Still in Play

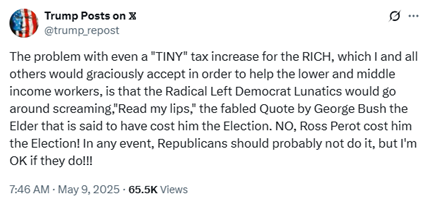

The White House as recently as yesterday was actively pushing lawmakers to include a rate hike in Tuesday’s Ways & Means markup, with Commerce Secretary Howard Lutnick telling reporters the rate hike was a “smart” move. Then this morning President Trump appeared to back off the effort, posting the following:

An hour later NEC Director Kevin Hassett appeared on CNBC and when asked about the proposal said the President is “not thrilled about it…it’s not high on the President’s list.”

So it’s anyone’s guess where things stand over at the …

(Read More)