The “Experts” Get 199A Wrong

When Congress finishes work on the tax package pending in the Senate, we expect the conversation to pivot rapidly to what we should do about all those expiring TCJA provisions at the end of 2025.

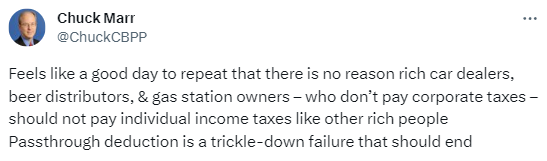

For S-Corp and its allies, our priority is to make the Section 199A deduction permanent and a big hurdle there is the lack of understanding of how pass-throughs are taxed and why the Section 199A small business deduction is critical to their success.

For example, of all the Republicans who served on Ways and Means during the TCJA debate, only five remain today. The staff …

(Read More)