Section 199A Deduction Needed to Provide Pass-Throughs Tax Parity with C Corporations

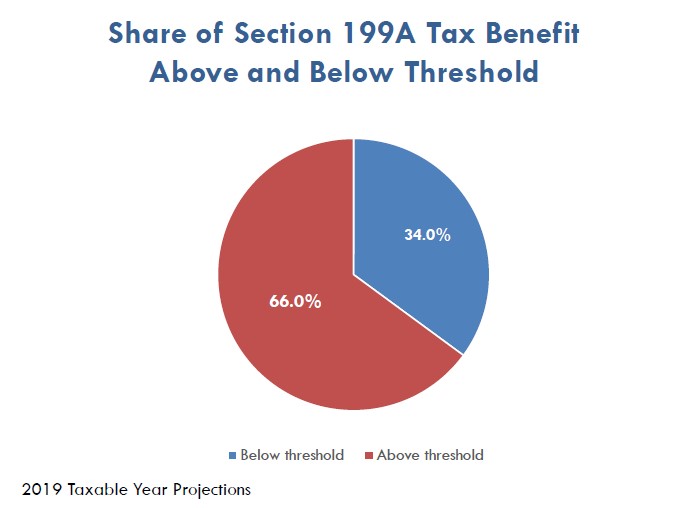

A new presentation on the Section 199A deduction from the Joint Committee on Taxation has gotten people’s attention, particularly this slide:

The slide prompted Senator Ron Wyden, the Ranking Member on the Senate Finance Committee, to observe, “These are not the struggling small business owners we were told this provision would benefit.”

The Ranking Member’s response is misdirected, however. The 199A deduction was not an effort to reduce taxes on small businesses, but rather an attempt to maintain tax parity for pass-through businesses of all sizes. Without 199A, Main Street …

(Read More)