Support for 199A Reaches New Heights

The effort to make permanent the Section 199A Main Street business deduction just hit a significant milestone.

In just two weeks the Main Street Tax Certainty Act (H.R. 4721), introduced by Congressman Lloyd Smucker, has garnered the support of more than 100 House cosponsors. Among those backing the legislation are Democratic Representatives Henry Cuellar (TX) and Josh Gottheimer (NJ), and all 25 Republican members of the Ways & Means Committee.

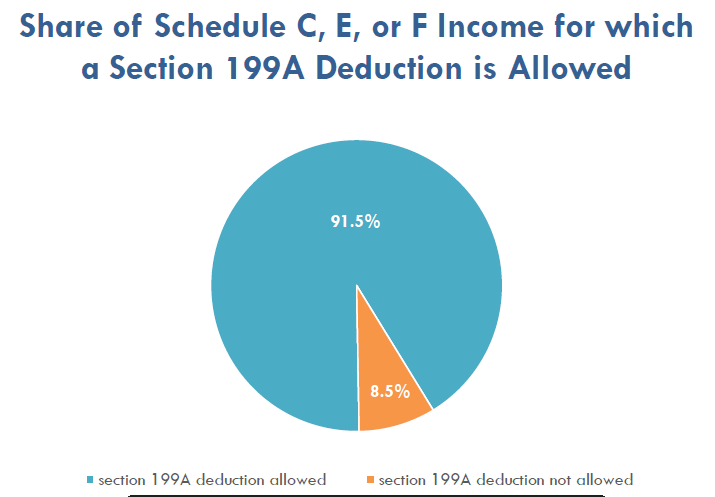

Section 199A was enacted in 2017 to encourage job creation and new investment by private businesses. It also helps private companies compete with large, publicly-traded corporations. Without the deduction, pass-throughs would …

(Read More)