Extenders and Immigration

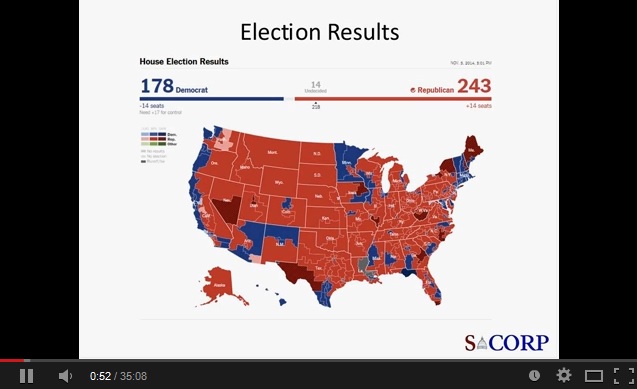

Last week, we did a post-election analysis that highlighted the broad implications of the new Republican Congress. A return to “regular order” and increased legislative activity overall, including in the tax space, was our basic conclusion.

One wild card at the time was the possibility of President Obama issuing an Executive Order on immigration. He’s promised to do so and, despite pushback from Republicans and many members of his own party, he appears poised to release something on Friday.

What are the implications of such an action on tax extenders in the Lame Duck? Absent action on immigration, the …

(Read More)