What’s Next for 199A?

Enactment of the Big Beautiful Bill was a big beautiful win for Main Street – making permanent the lower tax rates, 20-percent deduction for small and family-owned businesses, and the higher estate tax exemptions. All these provisions help pass-through businesses compete with their larger, publicly-owned competition and they help to protect the 2.6 million jobs that depend on the 199A deduction.

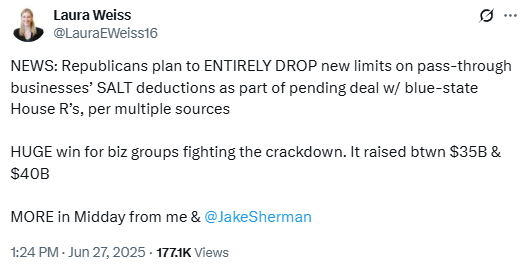

With the bill signed into law, what’s next? This from Bloomberg:

“Everyone’s been coming off the momentum, because we’ve had a lot of wins, and so I think that’s what’s been pushing this idea that we’re going to maybe …

(Read More)