More Pushback on Rate Hikes

The Main Street Employers coalition organized a letter calling on tax-writers to reject rate hikes last week. More than 90 trades, including all our Main Street friends, signed on.

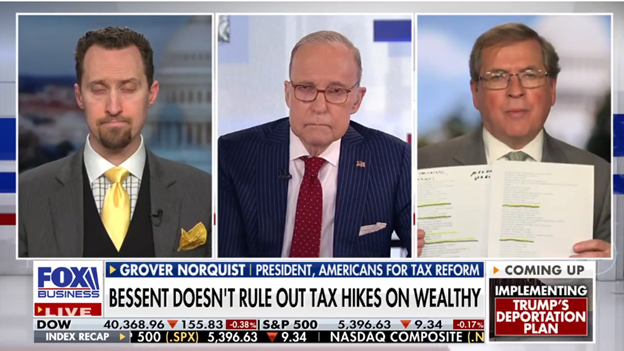

That effort caught the attention of Americans for Tax Reform’s Grover Norquist, who flagged it in a recent media appearance.

President Trump is not going to allow the top rate for income taxes to be increased. That is a direct hit on small businesses. There was a letter that went to the Hill from 90 trade associations that represent small businesses pointing …

(Read More)