S-Corp continues its efforts to educate policymakers about the pending Section 385 rules and the harm they will cause to domestic employers and American jobs starting…well, now.

That’s the dirty little secret about the 385 rules. Released as part of a package of “anti-inversion and base erosion” tools, much of their impact will be on normal domestic business practices instead. All that is necessary to be subject to the rule is 1) a group of investors that controls two or more corporations and 2) a loan or cash pooling between members of the group.

That’s it. No international component required. And the portion of the rule that could damage S corporations the most – the so-called “bifurcation rule” — has no de minimis threshold, so businesses of all sizes could be subject to the new rule depending on how they are organized. As the Wall Street Journal noted on Tuesday:

… Treasury aims to solve this alleged problem by overturning decades-old interpretations of tax law and forcing many loans between related businesses to be treated as equity instead of debt. Businesses commonly pool the cash from various subsidiaries in one account, or they may fund one business with loans from an affiliate that has available cash. Recasting these transfers within a corporation as equity investments will trigger higher taxes for many firms unless they hire outside banks to provide the financing they used to do internally.

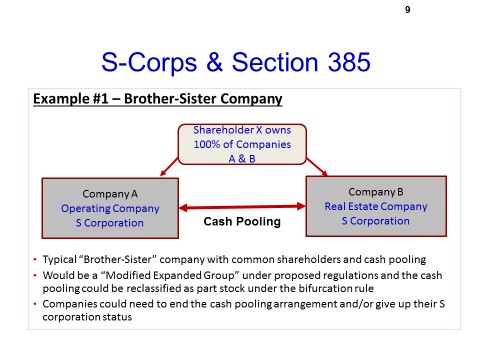

To give an example, the “Brother-Sister” company illustration below from our 385 Power Point is an extremely common means of organization, where the business operations are housed in one S corporation while the real estate assets are housed in another. How common? Impossible to say at this point, but with 4.5 million S corporations out there, our advisors tell us that such brother-sister arrangements are likely to number in the hundreds of thousands, or more.

Under the proposed rule, this business would need to end any cash pooling between the two companies or give up its S election. Neither is an attractive option, and to what purpose?

Base erosion is the practice of shifting profits overseas through loans and other pricing strategies. But S corporations, by definition, have to be domestic businesses with domestic ownership, and all S corporation income must be taxed here in the United States. Non-resident aliens are not permitted to own S corporation stock. Nor are foreign companies.

Moreover, unlike a C corporation, an S corporation that has foreign subsidiaries does not get a US tax credit for the foreign taxes the subsidiary pays. For this reason, the vast majority of S corporations use branches for their overseas operations, not separate corporations, which means that all of their income, whether earned here or overseas, is taxed immediately in the United States.

So if the Treasury wants to go after base erosion practices, looking at S corporations is simply the wrong place to start. There’s no there there.

Despite these realities, the draft rules include S corporations, putting them at risk along with the rest of the business community to having their debt converted into equity. But S corporations face an additional risk not shared by the broader business community. That is because S corporations are unique in the tax code in that they can lose their S election if they violate any of the following restrictions:

- S corporations may have only one class of stock;

- They are limited to 100 or fewer shareholders; and

- S corporation shareholders are restricted to US residents, estates and certain trusts and exempt entities.

Converting debt into equity could cause an S corporation to violate some or all of these requirements, which means years of additional fees, penalties, taxes, and reconfigured finances. It’s a very serious threat and one S corporation owners need to focus on now.

What should Treasury do to fix this? Based on outreach to our membership and feedback from meetings with the Hill and the relevant agencies, we have developed the following asks:

- Treasury should slow down the process and delay the effective date of the final rule. This rule is expansive and would in many cases force businesses to reconfigure how they finance their day-to-day operations. That would impose significant costs on them and take time to execute. Treasury should take time too and ensure it avoids any “innocent bystander” damage here.

- Treasury should make sure these regulations do not apply to S corporations. For the reasons articulated above, S corporations are the wrong place to look if you’re trying to clamp down on base erosion practices.

- Treasury should ensure that S corporations do not lose their S corporation status. Cash pooling and related party loans are not crimes, but losing an S election would impose criminal-level costs on these companies. Treasury needs to make clear that no S corporation will lose its election because of this rule.

The comment period for the proposed rules closes on July 7th, and the IRS has announced it will hold hearings on the matter the following week on July 14th. We plan to submit extensive comments and we encourage other business groups and S corporations to do the same. Treasury has made clear it intends to finalize these rules this year, so it is extremely important that S corporations act now to ensure the rules are fixed before they are made final.