The Tax Foundation published its annual piece on pass through businesses this week, and as usual, there’s lots of great material in there. To begin, the Foundation updates its numbers on pass through employment and marginal tax rates. As in past years, pass through businesses employ the majority of private sector workers even though they face marginal tax rates that often exceed 50 percent! Talk about shooting yourself in the foot, economically speaking.

Robert Samuelson at the Washington Post noticed. In an op-ed last week, he highlighted some of the key metrics found in the Foundation’s report:

“Here are some of the key findings in the report:

- More than 90 percent of businesses in America are pass-through enterprises. In 2014, that was 28.3 million out of 30.8 million business establishments.

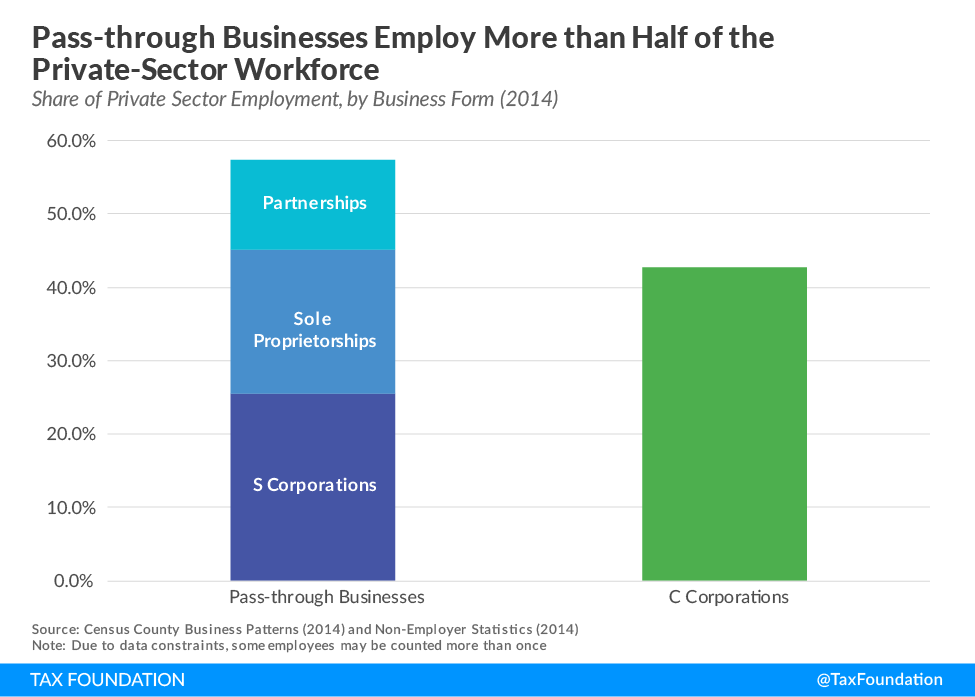

- Pass-through firms account for more than half of U.S. private-sector employment. In 2014, the number of workers at these firms totaled 73 million, compared with 54 million at C corporations.

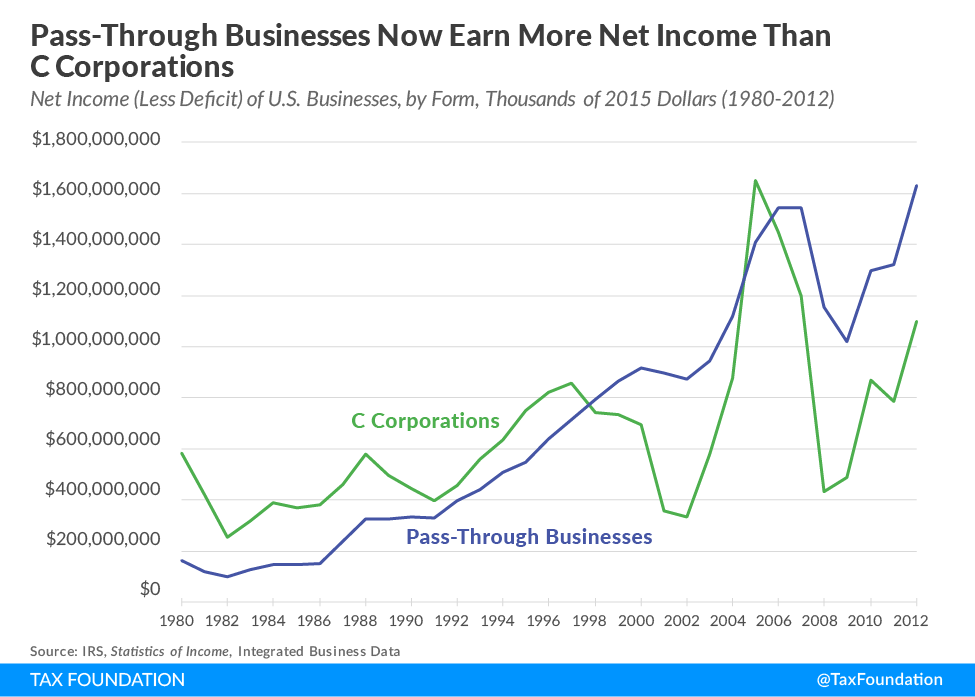

- The total profits of pass-through firms have surpassed the profits of C corporations. In 2012, the net income was $1.6 trillion for pass-through firms and $1.1 trillion for C corporations.”

The employment figure in particular is worth emphasizing. Back in 2011, EY estimated that pass through businesses employed 54 percent of the private sector workforce. According to the Tax Foundation, that number rose to 57 percent by 2014. That’s a big jump in just three years.

The Tax Foundation report makes clear that far from being second-class citizens, pass through businesses are the dominant business structure and they are clearly the way all businesses should be taxed in the future. Here’s a nice paragraph on how pass through tax treatment should be the model for tax policy moving forward.

Proponents of [forcing large S corporations into the C corporation tax] argue that some pass-through businesses are just as large and economically significant as C corporations, and that there is little justification for creating two separate tax regimes for similar types of businesses. There is merit to this line of argument, but instead of forcing pass-throughs into the problematic double tax regime faced by C corporations, lawmakers should work to improve the C corporate tax regime, to move it closer to a single layer of tax at the same rates that apply to wages and salaries.[24] In short, the tax code should treat C corporations more like pass-through businesses, not the other way around.

Tax it once, tax it when it’s earned, tax it at the same reasonable, low rate, and then leave it alone! We’re glad the Tax Foundation agrees.

One concern is how the Foundation continues to miss headline material right in front of them. Years ago, they did a piece on the “erosion of the corporate tax base” since 1986 that wholly ignored the fact that their numbers showed the “business tax base” (pass throughs and C corporations combined) had actually grown over that time. That statistic has become one of our principle talking points for tax reform, and we source the Tax Foundation when we use it, even though they never spelled it out.

This year’s report offers a similar opportunity for acknowledging that the glass is half-full. Consider this chart on business income.

You can see how pass through businesses have consistently earned more than C corporations in recent years. This chart fits with the Foundation’s past focus on the corporate tax base and its decline.

But think about a different chart – a better, more informative chart using the same data. One that compares business income subject to a single layer of tax versus business income subject to two layers of tax. As we know, pass throughs pay a single layer of tax on their income when they earn it, so the income represented in the blue line falls into that category.

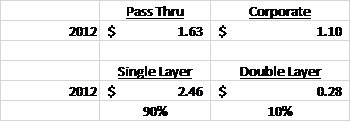

But we also know that most – 75 percent! – of C corporation shareholders are tax-exempt or tax-deferred. They are pension funds, charities, foreign shareholders and retirement accounts. So upwards of 3/4s of the green line is actually taxed once, too. In order to measure how much business income avoids the double corporate tax, you should take three-quarters of the green line and add it to the blue line. Here are the new numbers:

So there you have it. The business community has voted with its feet for single-layer taxation, and it wasn’t close. It was a landslide of historic proportions – 9 to one!

You can quibble that not all tax-deferred shareholder income escapes the second layer of tax, but that misses the point. Single-layer taxation is the new norm for US companies. Any analysis of business taxation should begin with that premise. The double corporate tax is still harmful to jobs and investment, but only because companies and investors take such great pains to avoid it. The “classic” corporate tax structure is no longer the base case, which means we need to transition to a new way of examining business taxation that reflects the underlying reality of how businesses are taxed today.