Legislative Outlook, Post-Boehner Announcement

Speaker Boehner’s announcement that he plans to retire at the end of October has implications for tax policy and next year’s spending levels. Here’s our outlook for both.

International Tax Reform: Lots of noise on the tax front. The latest rumors on the Ryan-Schumer plan to pair highway funding with international tax reforms are that:

- The plan is complete and has been sent up to the Administration for their review and sign-off;

- The plan is not finished and is hung up over a disagreement regarding how much to spend on highways;

- The plan will be presented to the Ways & Means Committee members this morning,

- Only options will be presented to Ways & Means Members this morning;

- All of the above; and/or

- None of the above

One rumor we’ve heard that does appear to be valid is that the innovation box and base erosion provisions have been redrafted to reflect the comments the Committee has received over the past couple months, including the addition of pass through businesses to the innovation box benefits.

Can a package of international reforms and highway funding pass? The ascension of Kevin McCarthy to Speaker should help. He had this to say on Morning Joe earlier this week:

“If we pass a highway bill with tax reform at the same time, that’s policy. That changes the inversion process; that means more money comes back to America. That puts a six-year highway bill on to the floor and starts moving and building roads that we need in American infrastructure.”

Not everyone is convinced. Politico reports this am that Finance Chair Orrin Hatch remains “doubtful” a deal can be struck in time:

“Frankly, I don’t see how you can do what they want to do in this length of time frame that we have,” said Hatch. “We need to solve the highway bill now.”

Meanwhile, taxwriters were targeted with competing letters on international reform, the first from left-leaning economists who dislike them and the second from a small group of US-based multi-nationals who support them, particularly the innovation box parts of the plan.

Where that leaves us is anybody’s guess, but the renewed focus on the larger tax reforms will once again push off action on the much needed extenders bill. It’s now October, and those provisions have been expired for more than nine months. Just saying.

Budget and Debt Limit: On the other side of the ledger, Boehner’s pending retirement freed him up to negotiate a short term spending bill to keep the government open through December 11th, and appears to set the stage for a Boehner-led year-long spending bill to move through Congress prior to the end of October. The goal is to get next year’s contentious spending and debt limit votes out of the way before McCarthy takes over as Speaker, to give him a clean start so to speak.

Treasury gave that effort a little momentum with their most recent debt limit letter, which suggests the government will run out of credit and need to shut down around November 5th, about a month earlier than previously thought. The earlier drop dead date is attributed to lower than expected tax revenue collections. Not good.

So two tracks for tax and spending for the month of October – track one is the on-going Ryan-Schumer effort to couple highways with international tax reforms, and track two is the effort to fund the government for 2016 coupled with raising the debt limit before the November deadline. It is possible these two negotiations are combined before the end of the month, but for the moment they appear to be taking place in two different rooms with two different groups of negotiators. Should be an interesting October.

New Treasury Effective Rate Study

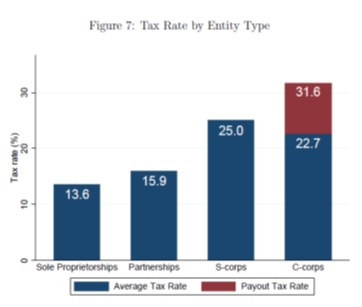

Economists at the Department of Treasury and NBER last week released a paper reviewing the average taxes paid on business income, by entity type. We went through a similar exercise several years ago (you can read our study here), so we printed up a copy and took a look. Here’s the headline graph:

As you can see, the average tax rates for S corporations and C corporations are in the same basic range, while the averages for sole proprietorships and partnerships are significantly lower. Below we itemize our initial thoughts regarding the substance of the paper and the quality of the estimates.

Click here to read the full post.