The Tax Foundation today released a great paper outlining the state of American pass-through businesses – S corps, partnerships, and sole props – and how the tax code currently treats those companies. According to the Foundation, those businesses account for more jobs and more business income than traditional C corps, making them the major player in the American economy. As the paper concludes:

One of the main goals of fundamental tax reform is to make U.S. businesses more competitive and to increase economic growth. This requires a reduction in taxes on businesses and investment. Most attention is given to traditional C corporations because they face high tax burdens by international standards and account for a large amount of economic activity. As a result, less attention has been given to pass-through businesses. Considering that pass-through businesses now account for more than half of the business income and employment in the United States, any business tax reform needs to address the individual income tax code as well as the corporate income tax code.

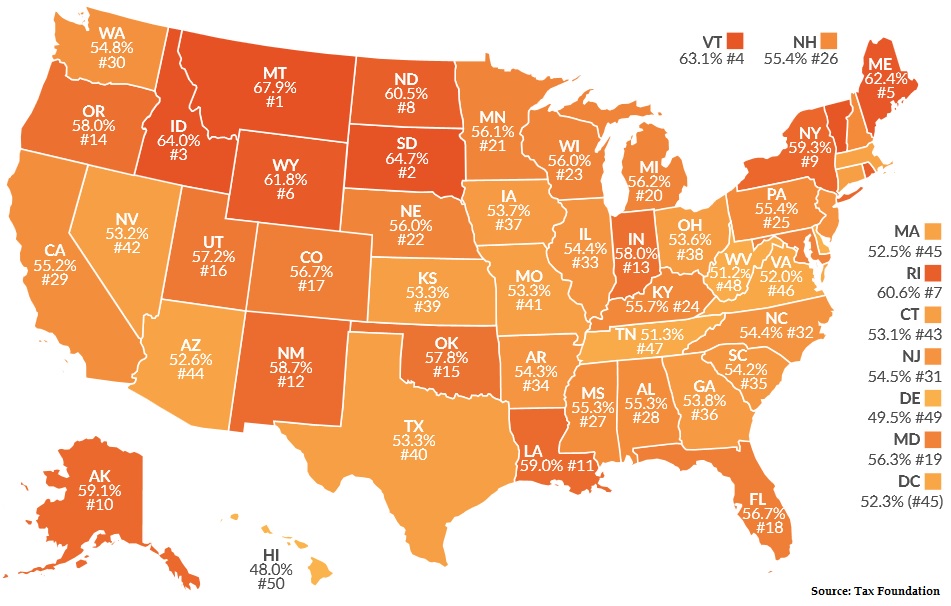

You can read the full paper here. But if you don’t have time, we recommend the map below (click to enlarge). It shows pass-through business employment by state and makes clear that, with the exception of Hawaii, pass-through businesses are the major employer in every state in the country. In Montana, they represent two out of every three jobs.

Rest assured we will be sharing this map and the full Tax Foundation paper with our friends on the Hill.