Congressman Yakym Hosts 199A Roundtable

Members of the Main Street Employers Coalition convened in South Bend, Indiana, today for a roundtable discussion with Congressman Rudy Yakym, who represents the state’s Second District and sits on the tax-writing Ways & Means Committee. The sole focus of the event was the Section 199A deduction, a provision that is central to tens of millions of Main Street businesses organized as pass-throughs.

Photo Credit: James Payne, NECA

Photo Credit: James Payne, NECA

The roundtable took place at the offices of electrical services provider Koontz-Wagner, a more than 100-year-old firm that is also a member of the National Electrical Contractors Association, which helped spearhead the effort. During the discussion, business owners from across the region shared their perspectives on how the Section 199A deduction has helped them reinvest in their businesses, hire more employees, and give back to their communities. Many attendees also emphasized that the deduction provides parity between pass-through entities and large, publicly-traded corporations, which benefit from significantly lower tax rates.

As we’ve said several times before, privately-held companies are the backbone of countless local economies nationwide, and the data backs this up. In Congressman Yakym’s district, pass-through businesses employ around 6 out of every 10 workers. That’s not an aberration, either. Nationwide, private companies are responsible for 62.3 percent of all private sector jobs.

For more data showing the economic contribution of the pass-through sector be sure to download our mobile app

Congressman Yakym reaffirmed his commitment to fighting for Main Street businesses, highlighting the importance of making the Section 199A deduction permanent. He also acknowledged that the provision’s looming expiration – and the massive tax hike it represents – heightens the urgency when it comes to swift passage of a tax bill.

Fortunately, today’s roundtable shows that lawmakers are serious about preserving 199A and ensuring Main Street can continue to thrive and lift up the communities in which they operate. We thank Congressman Yakym for hosting this event and keeping the spotlight on 199A, and look forward to working with him to ensure a successful outcome.

Privacy Fight in Australia, Courts Continues

The actions by the new Administration last week to curtail reporting under the Corporate Transparency Act were a huge victory for millions of Main Street businesses, but they were by no means the final word on the subject. To ultimately kill this ill-conceived statute, we need help from Congress or the Courts. On that front, here’s three key events in the last two weeks worth highlighting.

First, any legislative effort to repeal the CTA will have to go through the Senate and get the support of at least 60 lawmakers. Last week’s letter from Senators Sheldon Whitehouse (D-RI) and Chuck Grassley (R-IA) makes clear we have lots of work to do there. Addressed to Treasury Secretary Scott Bessent, the letter challenges the recent decision to suspend enforcement of the CTA and shift to a risk-based regulatory framework:

We acknowledge that the CTA creates a process by which the Secretary of the Treasury may exclude “an entity or a class of entities” from BOI reporting requirements so long as four conditions are met…We request that you provide us the legal basis for the Treasury Department’s policy decision to categorically suspend enforcement of the CTA’s reporting requirements for all U.S. citizens and domestic reporting companies. In addition, we request that you provide us with information about how you intend to satisfy the policy goals of the CTA.

Faced with overwhelming evidence that the CTA is ineffective and unconstitutional, some lawmakers still view it as a useful law enforcement tool (it’s not). The good news is that this letter confirms Treasury does, in fact, have the authority to exempt companies from the CTA. Here’s the statutory text alluded to in the excerpt above, which describes the exemption:

(xxiv) any entity or class of entities that the Secretary of the Treasury, with the written concurrence of the Attorney General and the Secretary of Homeland Security, has, by regulation, determined should be exempt from the requirements of subsection (b) because requiring beneficial ownership information from the entity or class of entities

(I)would not serve the public interest; and

(II)would not be highly useful in national security, intelligence, and law enforcement agency efforts to detect, prevent, or prosecute money laundering, the financing of terrorism, proliferation finance, serious tax fraud, or other crimes. [Emphasis added.]

Second, the court battle continues, with lawsuits pending in a dozen jurisdictions. Most recently, a District Court in Michigan ruled that the CTA violates the Constitution’s Fourth Amendment protections against unreasonable search and seizure. This is the second ruling on the merits that the law is unconstitutional and will help bolster the other cases.

Meanwhile, the Fifth Circuit – where the appeal of the Texas Top Cop Shop case is being litigated – is exploring what the new Treasury approach means for the future of that legal challenge. The court has asked all parties to submit briefs addressing whether the case should proceed in light of the enforcement announcement. The answer is an emphatic “yes” – the CTA is on hold for the moment but that relief depends entirely on who runs Treasury and is by no means a long-term solution.

Finally, the never-ending demand for personal and private business information is not limited to the US. Just this week, S-Corp filed comments with the United States Trade Representative highlighting how Australia’s new and ridiculously comprehensive world-wide reporting regime specifically targets US companies and amounts to a non-tariff trade barrier. As our comments note:

According to the Australian Tax Office, a “Public Country-by-Country (CBC) reporting Ultimate Parent Entities (UPE’s) need to report certain tax information on a CBC basis, to the ATO.” These reports are due as early as July 1, 2026.

…Few private companies will be willing to make the disclosures required by the new rules. This information effectively constitutes trade secrets that are extremely valuable. The ability to keep this information private is one of the benefits of being a private company and helps to offset the inability of private companies to access the global capital markets.

The concerns raised here are not theoretical. In response to the new rules, the S Corporation Association already has had member companies divest themselves of their Australian operations. Others are planning to do the same. The new reports will effectively block many US companies from doing business in Australia.

The USTR had requested feedback on how our trading partners use rules and other requirements to stifle competition, and this is certainly one of them. The new Administration likes reciprocal trade policies – what about reciprocal reporting barriers?

The recent Treasury announcement means domestic business entities don’t need to file under the CTA, for now, but the long term fight to preserve the privacy of individuals and businesses continues.

Main Street 199A Resources

Latest update on all the studies, data, and other information S-Corp has compiled in support of the 199A deduction – including the new CRS METR estimates we posted on Monday. The materials below span more than a decade of work and highlight the central role the pass-through sector plays in the American economy, and the importance of the Section 199A deduction to these businesses.

Rate Analysis Tells the Full Story

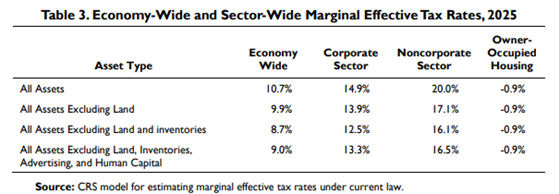

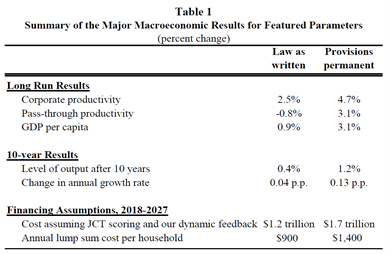

The Congressional Research Service is out with a new study that demonstrates precisely why Section 199A permanence needs to be part of the 2025 tax package. The chart below explains why:

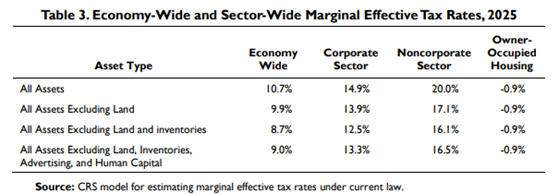

Under current law, C corporations enjoy a marginal effective tax rate – a metric that gauges the overall tax burden imposed on new investment – that’s a full one-quarter lower than the rate paid by pass-through businesses organized as S corporations, partnerships, and LLCs. That discrepancy is under current law, with 199A in place; if the deduction is allowed to expire, that gap will grow dramatically.

Two key takeaways here. First, the estimated tax rates cover all pass-through income, meaning the 28 percent figure is an average that includes lower rates paid by small pass-through businesses. For owners in the highest tax brackets, the actual rate gap is even larger. Second, the effective tax rates on corporate dividends and capital gains are just over 3 percent—far below the 23.8 percent headline rate. This is primarily because many C corporation shareholders pay little or no tax, a small portion of corporate income is distributed as dividends, and capital gains benefit from deferral.

These low rates contribute to the disproportionate tax burden on family businesses. Public C corporations benefit from reduced tax rates due to their shareholder composition, while family business owners—who are typically subject to full taxation—bear the full impact of double taxation.

Resources:

- CRS: Model Estimates of Marginal Effective Tax Rates on Investment Under Current Law

- S-Corp: CRS on Marginal Rates

The Importance of 199A

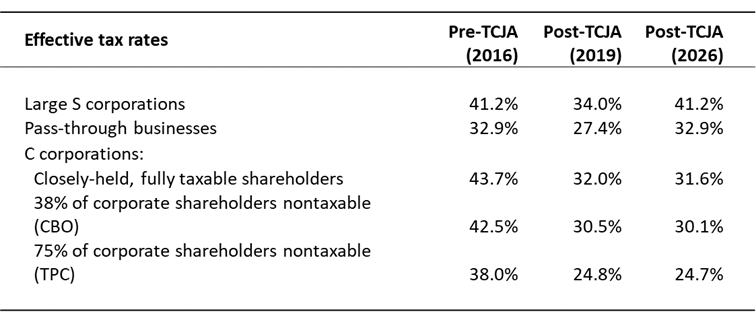

Our recent study by EY’s Robert Carroll demonstrates how the 199A deduction is vital to Main Street parity. The key takeaway is summed up in the table below – the TCJA established rough parity between public corporations and pass-through businesses, but only as long as section 199A is in place. Without 199A, pass-throughs lose out to large, public corporations regardless of what assumptions you make about their size or shareholder makeup:

EY’s numbers aren’t an aberration. Numerous economic studies from the CBO, Treasury, and the private sector all come to a similar conclusion – the effective marginal rates faced by corporations and pass-through businesses post-TCJA are roughly equivalent, but only with section 199A in place. Without section 199A, the comparative rates aren’t even close:

| With 199A Deduction | Without 199A Deduction | |||

| C Corporation | Pass-Through | C Corporation | Pass-Through | |

| DeBacker & Kasher — Market Returns (AEI) | 19.0% | 20.0% | 19.0% | 27.0% |

| DeBacker & Kasher — Above Market Returns (AEI) | 16.0% | 21.0% | 16.0% | 30.0% |

| Barro & Furman (Brookings) | 26.0% | 31.1% | 26.0% | 35.5% |

| Treasury (2021) | 18.9% | 24.2% | 23.2% | 26.4% |

| EY (2023) | 24.8% | 27.4% | 24.7% | 32.9% |

| CBO (2024) | 17.0% | 21.0% | ||

Resources:

- Ken Kies (Op-Ed, Tax Notes): The Ryder Cup and Section 199A – Really!

- EY Study: Relative Tax Treatment of Pass-throughs and C Corporations

- S-Corp: The Importance of 199A

- S-Corp: The Main Street Defense of the 199A Deduction

- S-Corp: Nichols Explains 199A in Tax Notes

- Joint Trades Letter on 199A Permanence

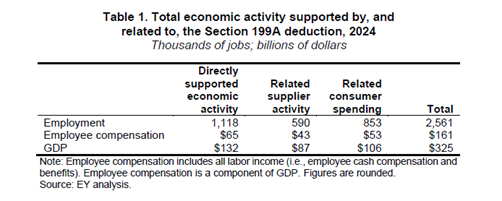

Section 199A Sunset Puts Millions of Jobs at Risk

Section 199A supports millions of jobs – jobs that will be put at risk if Congress allows the deduction to sunset. That’s the key take-away from last year’s EY study on the economic footprint of Section 199A.

What did EY find? Section 199A supports 2.6 million jobs, contributes $161 billion to employee compensation, and adds $325 billion to the national economy:

These results highlight the importance of Section 199A and how the expiration of the deduction threatens these jobs. Absent congressional action, 2.6 million jobs will be at risk.

Bottom Line:

- The Section 199A small and family business deduction supports 2.6 million jobs in the United States.

- Allowing 199A to sunset puts all those jobs at risk, resulting in less employment, lower wages, and a smaller economy.

- Congress needs to protect Main Street and the people who work there by adopting the Main Street Certainty Act and make permanent the 199A deduction.

Resources:

- EY Study: Economic activity supported by the Section 199A deduction

- S-Corp: 199A EY Study Briefing Recap & Recording

- Congressman Smucker Press Release

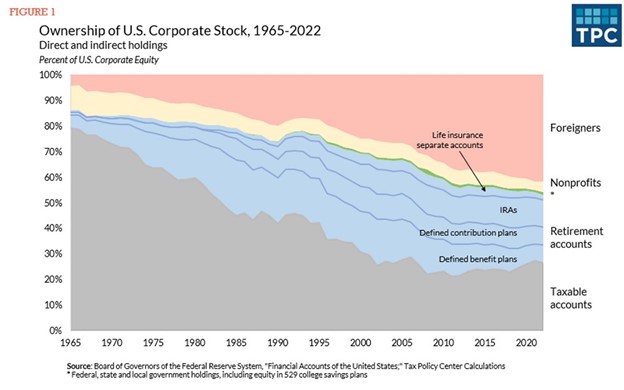

Public Corporations and the Double Tax

On paper, C corporations face steep tax rates due to the so-called double tax. This theoretical double tax has fooled many observers into believing that public corporations face effective tax rates approaching 40 percent.

The reality, however, is that most corporate shareholders pay little to no tax, largely eliminating the second layer of tax. The Tax Policy Center has the latest data on this front, finding the percentage of taxable shareholders has declined from around four in five back in 1965 to only one in four today:

This means the effective tax rates paid by public corporations are significantly lower than the advertised rates (see the first section for the estimates). They also are far below what comparably-sized pass-throughs face. In an excellent defense of the 199A deduction, former JCT head Ken Kies addressed this issues back in 2021:

…In the United States it’s common to talk about the double tax on corporate earnings. As a general proposition, it’s not fake news: A corporation pays tax on its earnings and the owners of corporations — that is, the shareholders — generally also pay tax on any remaining earnings that are distributed to them.

Based on the best available data, it’s estimated that no more than 9 percent of annual corporate profits are subject to tax a second time, and no more than 14 percent will eventually be taxed upon later distribution (that is, as taxable pension or retirement account distributions). That means that only around a maximum of 23 percent of U.S. corporate earnings ever face a second layer of taxation.

So-called experts who ignore the reality of who owns public corporations today are doing a disservice to the public debate.

Resources:

- Tax Policy Center: Grappling with a Dwindling Shareholder Tax Base

- S-Corp: The “Experts” Get 199A Wrong, Part 2

- S-Corp: S-Corp: C Corps for Everybody?

Employment Numbers Confirm Pass-Through Importance

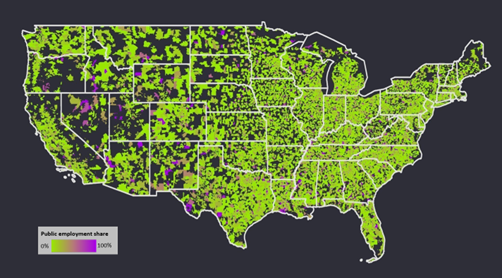

Individually- and family-owned businesses comprise the vast majority of businesses, they employ the majority of private sector workers, and they do so literally everywhere. They are the foundation upon which thousands of communities across this country are constructed.

Analysis shows just how many Americans are employed by individually- and family-owned businesses in each of the country’s 435 Congressional districts. The results are impressive and reveal just how important private businesses are to this nation. Below are a few highlights:

- Pass-through businesses, including S corporations, partnerships, and sole proprietorships, employ 62 percent of the American workforce;

- Private companies (pass-through businesses plus private C corporations) employ 80 percent of workers;

- For every worker employed by a public C corporation (27 million), there are more than four employed by a private business (113 million); and

- Of the 435 total Congressional districts in America, private companies are responsible for 80 percent or more of total employment in 316 of them.

Why does this matter? Because the expiration of the individual and pass-through tax provisions next year would disproportionately harm private businesses, putting those jobs at risk.

The Main Street Tax Certainty Act introduced by Representative Lloyd Smucker and Senator Steve Daines would make 199A a permanent fixture of the code, staving off a massive tax hike and providing these businesses with much needed certainty. It is supported by over 160 national trade associations and is cosponsored by more than 190 Congressmen and more than 30 Senators.

Resources:

- S-Corp: Mobile App

- EY Study: Employment Statistics Tool

- EY Study: Full Datasets

- Smucker 199A Permanence Bill (H.R. 703)

- Daines 199A Permanence Bill (S. 213)

- Joint Trades 199A Support Letter

199A Essential for Economic Growth

Pass-through businesses employ the majority of private sector workers (62 percent) so any increase in their taxes would have broad negative effects on the economy. A Brookings paper authored by Robert Barro and Jason Furman isolates the economic impact of the sunsetting TCJA provisions, including the 199A deduction, the lower individual rates, and expensing:

As you can see, the ‘law as written” column shows pass-through sector productivity under the TCJA is negative. This result is due to the sunsets starting in 2026, plus the TCJA’s base broadening provisions that remain in place. These provisions include the cap on interest deductions, forced amortization of R&E expenses, and the many other business tax base broadening provisions in the TCJA.

The result would be a significant tax hike on pass-through businesses – not relative to tax policy in 2024, but relative to tax policy pre-TCJA. After all the talk of supporting Main Street, going off the fiscal cliff next year means the Trump “tax cuts” would raise taxes on millions of Main Street businesses, just to cut them for Apple and Amazon.

Resources

- Main Street Employers Coalition: Section 199A One-Pager

- Brookings Institute (Robert Barro, Jason Furman): The Macroeconomic Effects of the 2017 Tax Reform

- S-Corp Advisor Lynn Mucenski-Keck: Small Business Committee Testimony

- S-Corp: Pass-Through Businesses & Tax Policy

- S-Corp: More on the Wyden 199A Bill

- S-Corp: A Modest Tax Hike? Not Even Close

- S-Corp: Tax Hike Premise Takes Another Hit

199A Offsets

One objection to Section 199A permanence is it would lose revenue at a time when deficits are large. This concern ignores the fact that the 199A deduction wasn’t adopted in a vacuum. In fact, it was paired with numerous offsetting provisions that raise lots of money – more than 199A costs, actually – and they primarily target upper-income business owners. These provisions include:

- SALT Cap

- Section 461(l) Excess Loss Limitation Rules

- Section 174 R&E Amortization

- Section 199 Manufacturing Deduction Repeal

- Section 163(j) Interest Deduction Cap

- Section 212 Deduction Limitations

As noted above, many of these provisions are permanent and will stay in the tax code even as 199A expires, resulting in a significant tax hike on pass-through businesses. That hike is not relative to the TCJA, but rather the tax code that preceded it.

When Congress addresses the fiscal cliff this year, we fully expect these revenue offsets to be part of the discussion, so for those policymakers worried about adding to the deficit, be assured that we have you covered.

Resources:

- S-Corp: The “Experts” Get 199A Wrong

- S-Corp: A Rate Hike by Any Other Name…Would Still Kill Family Businesses

- S-Corp: White House Shortchanges Main Street

- S-Corp: An Anti-Main Street Budget

- S-Corp: New Budget Continues the Assault on Main Street

Where the Jobs Are

The fight over section 199A has geographical implications too. In a 2021 Wall Street Journal op-ed, S-Corp President Brian Reardon wrote:

A new study from EY demonstrates that private companies supply the vast majority of business-sector jobs nationally—77% of them. Public companies supply only 23%. As important, private-company employment is spread evenly across the country while public-company jobs tend to be concentrated in a few cities and states.

The op-ed references a study showing just how important private companies, including small and family-owned businesses, are to the large swaths of the United States. While public company employment is concentrated on the coasts and city centers, private business employment is spread more evenly across the country, including 22 states where private companies account for more than four out of five workers.

For members of Congress representing those states and districts, pay attention. Getting the balance right between private and public companies is critical to the economic future of your community.

Resources

- Op-Ed, WSJ: The Democratic Plan to Soak Main Street

- S-Corp: Where the Jobs Are

- EY Study: Distribution of Private and Public Company Employment Across the United States

Voter Support

The Gazette featured an op-ed on how Americans really feel about raising taxes on individually- and family-owned businesses and farms:

Contrary to what the White House might tell you, a new poll conducted on behalf of the S Corporation Association confirms that American voters do not support aggressive tax policies or those that target individually- and family-owned businesses and farms.

The results of the survey referenced above were later presented on a webinar by David Winston of the Winston Group, but they speak clearly to the debate before us as well. American voters do not support taxing Main Street.

One reason voters oppose raising taxes on Main Street businesses is they see these tax hikes as inflationary:

Over half the country (52%) believes a tax increase would increase inflation, rather than decrease (11%) or have no impact (19%). Among independents, 55% believe it will increase inflation (7% decrease, 17% no impact).

Keep in mind these findings are from late 2021, well before inflation spiraled out of control.

Resources

- Op-Ed, The Gazette: Biden’s Tax Hikes are Unpopular and Congress Knows It

- S-Corp Webinar: What do Voters Really Think About the Biden Tax Plan?

- Survey Findings

Conclusion

The 2025 fiscal cliff presents an existential crisis for private companies and the workers and communities that rely on them. Absent action, the expiration of the TCJA’s pass-through provisions would accelerate the consolidation of economic power and decision making into the C-suites of a few thousand public companies, leaving thousands of communities worse off.

For anyone still on the fence, we urge you to read the materials outlined above. For those who already understand how critical this fight is, it’s time to engage. Individual and family-owned businesses are the bedrock of local communities nationwide and they work hard to improve the lives of their employees and neighbors every day. That message won’t be heard, however, if family businesses stay on the sideline.

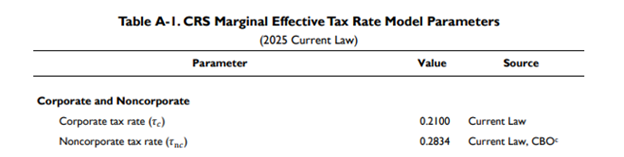

CRS on Marginal Rates

As Congress puts together the big tax bill, CRS just produced another reminder of why making the Section 199A pass-through deduction permanent needs to be part of the package. This chart says it all:

The rates reflected here are important because they measure the overall tax burden imposed on new investment. As CRS notes: “The marginal effective tax rate (METR) is a forward-looking measure that estimates… the share of the rate of return on a prospective investment that is paid in taxes over the life of that investment.”

So under current law, C corporations enjoy a marginal effective tax rate that’s a full one-quarter lower than the rate paid by pass-through businesses organized as S corporations, partnerships, and LLCs. That’s now, with 199A in place. If we go off the cliff, that gap is going to grow dramatically.

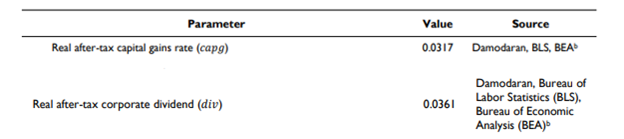

What parameters did CRS use to drive these numbers? Here’s the statutory rates they used:

And here are their estimates for effective rates on corporate dividends and capital gains:

A couple points of emphasis. First, the rate estimates include all pass-through income, so the 28 percent statutory rate is a blend reflecting all the individual rates, including the lower rates paid by small pass-through businesses. For companies whose owners pay the top rates, the gap is larger.

Second, the table shows the effective rates on corporate dividends and capital gains are just above 3 percent, or a fraction of the 23.8 percent statutory rate. That is largely due to all those C corporation shareholders who don’t pay taxes, the low percentage of corporate income paid out as dividends, and the deferral benefit of capital gains.

These low rates also explain why the double tax hits family businesses hard. Public C corporations enjoy discounted rates because so many of their shareholders pay little or no tax, whereas the owners of family businesses are almost always full taxpayers. They really do pay the full double tax.

So just in time for the tax debate, our friends at CRS provide strong evidence as to why Congress needs to act. Absent 199A and rate permanence, Main Street businesses just won’t be able to compete.

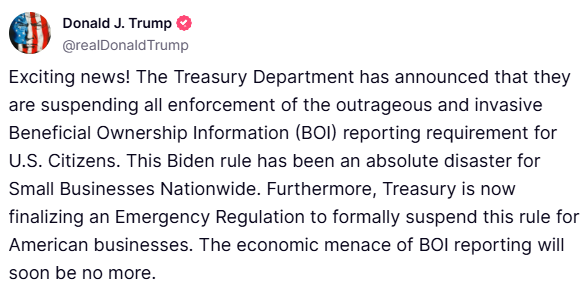

Treasury Expands CTA Relief

The millions of businesses that rode out the recent roller-coaster of court rulings and chose not to file their CTA reports to date should be feeling pretty good right now. Fresh on the heels of FinCEN’s announcement that it was pausing enforcement of the Corporate Transparency Act pending the enactment of new regulations, the Treasury Department yesterday shed some additional light on what the new reporting regime will look like. Here’s the press release:

The Treasury Department is announcing today that, with respect to the Corporate Transparency Act, not only will it not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines, but it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect either. The Treasury Department will further be issuing a proposed rulemaking that will narrow the scope of the rule to foreign reporting companies only. Treasury takes this step in the interest of supporting hard-working American taxpayers and small businesses and ensuring that the rule is appropriately tailored to advance the public interest.

So anyone concerned about the Trump administration’s position on the CTA – particularly after FinCEN appealed a ruling that had prevented the reporting requirements from taking effect – can breathe a sigh of relief. Here’s how President Trump reacted to the announcement yesterday:

And Treasury Secretary Scott Bessent:

This is good news all around. Not only is Treasury taking aggressive action to limit the damage the CTA poses to the small business community, but it’s evident our concerns about the law are shared by some pretty important people.

There are, however, some open questions as to how things play out from here. The Administration clearly has the ability to amend regulations issued by their predecessor, but what about the underlying statute? And what about the many court cases pending that challenge the CTA based on fundamental constitutional issues?

Our plan is to press forward in supporting the court challenges while working with Congress on repeal language. Yesterday’s announcement provides the business community with immediate relief from this onerous and unconstitutional data grab. Now it’s our job to make that relief permanent.