Talking Taxes in a Truck Episode 47: Jared Walczak on the Wealth Tax Proposal That’s Forcing Californians to Flee

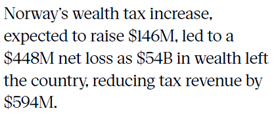

On the latest episode of Talking Taxes in a Truck, we’re joined by Jared Walczak, Senior Fellow at the Tax Foundation, to unpack California’s proposed wealth tax and what it signals for state tax policy nationwide. Walczak explains why the unprecedented 5 percent tax – particularly its aggressive valuation rules for founders with super-voting shares – could dramatically overtax entrepreneurs, invite serious legal challenges, and accelerate capital and job flight. Jared also zooms out to talk national migration patterns, as many states move to cut taxes and boost competitiveness while a small number double down on higher taxes, intensifying interstate …

(Read More)