As our members know, S-Corp wears two hats when it comes to advocacy – one is defensive where we protect S corporations from bad tax policy. The other is proactive and seeks to improve the S corp rules.

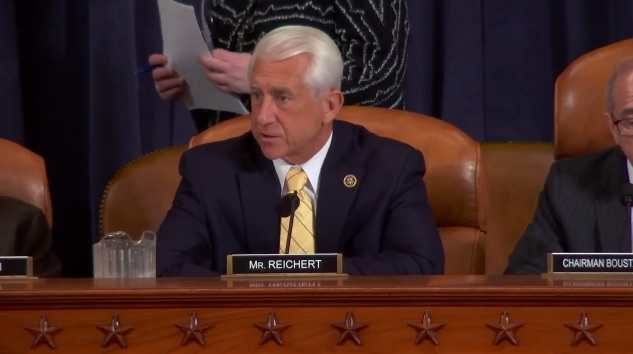

Both hats were on display this week before the House Ways & Means Committee. First, Rep. Dave Reichert (R-WA) discussed his S Corporation Modernization Act which makes a number of improvements to the S corporation rules, including opening the door to foreign investment into S corporations. As Rep. Reichert told the Committee:

“I’ve heard from a seventh-generation family-owned company and the struggles it has faced based on the nationalities of the spouses of the family members, including family members who have had to sell their stock in the company because of current restrictions. With the number of burdens our business owners face, does it make sense to maintain yet another hurdle simply based on who someone decides to marry?”

Allowing S corporations to attract foreign investment has been an S-Corp priority for years. The current restrictions simply make no sense, particularly if the fix is done through an ESBT structure in which the Treasury can be certain taxes will be paid. We’ve come close to getting this policy enacted in the past, and with Rep. Reichert’s leadership, we look forward to seeing it move through Congress soon.

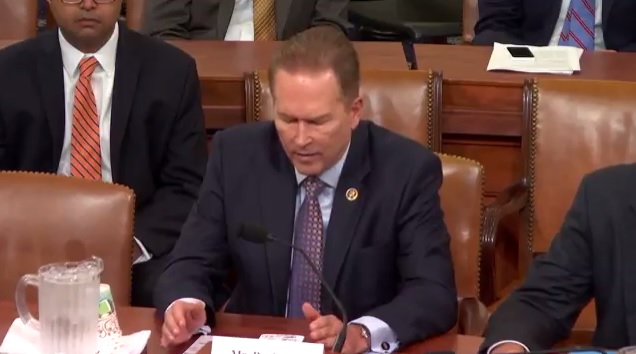

Second, Rep. Vern Buchanan (R-FL) was able to educate the committee on the importance of tax rate parity. For a decade – between 2003 and 2012 – all forms of business paid the same top rate. Today, as a result of the Fiscal Cliff and Obamacare, C corporations continue to pay the same 35 percent top rate, but the rate on pass throughs is nearly 45 percent!

In response, Rep. Buchanan has introduced legislation – the Main Street Fairness Act – which would restore rate parity by capping taxes on pass-through businesses at the top C corporation rate:

“Today, the average business in Florida, a pass through, [pays] 43 percent, big corporations are at 35 percent. In many places in the country, state and federal is over 50 percent. My bill simply says lower those tax rates to nothing higher than corporate rates going forward.”

What’s the prognosis for these efforts? Shortly after the hearing, Ways and Means Chairman Kevin Brady (R-TX) announced that he was committed to restoring regular order in the Committee, stating:

“Today’s hearing demonstrates that we are serious about considering tax legislation through an open and transparent process. We’re committed to introducing bills, considering them and moving them to the floor. The fact that over 30 Members are sharing their ideas today is a testament to our new process – and to our return after so many years to regular order.”

Does this mean a markup of member-driven proposals is in our future? That remains to be seen, but the fact that the Committee is giving members an opportunity to speak about their respective efforts is promising, and we will continue to work with our friends on the Committee both to protect S corps from bad policies and to fight for improved rules.

Business Community Unites Against 385 Regs

Speaking of bad policies, some of the largest business trade groups in the world have sent Treasury a letter calling on the agency to rethink the proposed section 385 regulations it released last April 4th. You can read the whole letter here, but the core of the letter’s message is contained in these two paragraphs:

Based on Treasury’s April 4 press release, the proposed 385 regulations are designed “to further reduce the benefits of and limit the number of corporate tax inversions, including by addressing earnings stripping.” Nonetheless, even a cursory review of these regulations clearly indicates that they go far beyond cross-border mergers and apply to a wide range of ordinary business transactions by global and domestic companies both in and outside the United States.

Indeed, the proposed 385 regulations affect all aspects of both a company’s capital structure and the funding of its ordinary operations and fundamentally alter the U.S. tax rules on intercompany debt by overturning the well-established facts and circumstances analysis used by the courts and the Internal Revenue Service (IRS) to determine whether an instrument is debt or equity. Whether an instrument is debt or equity has significant, collateral consequences to business operations that go well beyond the interest deduction on the instrument and include the legal classification of an entity, eligibility for withholding tax exemptions under tax treaties and the ability to file a consolidated tax return. These issues present a severe impediment to the use of intercompany financing for even normal operations and will significantly increase the cost of capital and limit the amount of capital available to invest in the United States.

We noted in a previous post that these regulations pose a particularly acute threat to S corporations. All the concerns listed above apply to S and C corporations alike, but S corporations also face the possibility that they could lose their classification and be forced back into the C corporation world.

The comment period for these proposed regulations ends on July 7th. We intend to submit extensive comments and hope that others do as well. Our message is simple – these regulations were not well thought out and need to be pulled.