Today’s meeting between Congressional leaders and the President is the first of many to come in what might be termed the post-disinflationary world.

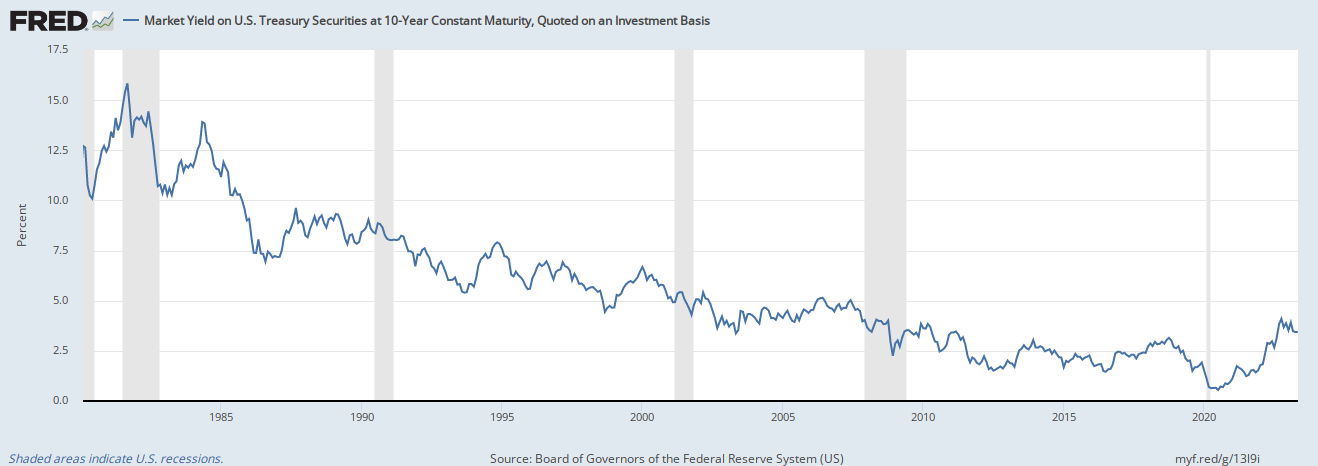

Interest rates peaked at 16 percent in the early 1980s and, following the Volker rate hikes and a nasty recession, the US embarked on an unprecedented 40-year disinflationary period where rates went from record highs to record lows.

Well, that’s over. Rising prices and record deficits are back and, absent a change of course, they are not going to get better. Hence the importance of today’s meeting.

Debt and Interest Rates

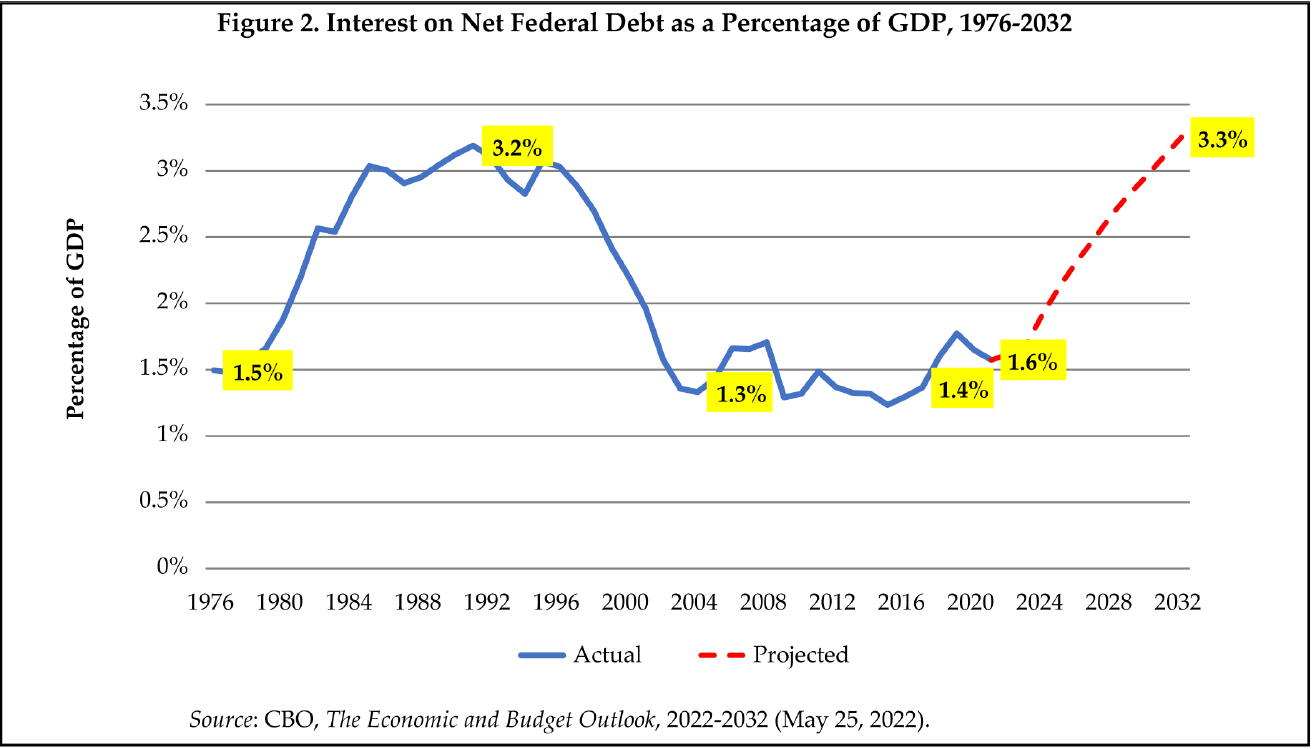

The debt situation is not good. Debt held by the public is right at 100 percent of our GDP and scheduled to grow sharply in the coming decade, up to 118 percent by 2033, which is right about the time the Social Security trust fund runs out of money. Meanwhile, the cost of interest on that debt is growing even faster, as rising interest rates compound the effect of rising debt levels.

The debt limit standoff is not helping. Last week’s Treasury auction of 30-day notes that mature after the current debt limit deadline demanded a record rate of 5.84 percent. It’s difficult to conceive of rates that high on short-duration bonds given that just a few years ago, 30-year mortgage rates were less than 3 percent.

We also need a new way to describe the inverted yield curve. The nearly 200-basis-point differential in yields is unlike anything we’ve seen in the past.

Can Congress use the next decade to constructively address our fiscal imbalance and the pending bankruptcy of Social Security?

Deficit Politics

What’s interesting politically is that when interest rates were high and monetary policy was tight, the deficit had some political punch. Voters – not all but some – voted based on the fear that unchecked deficits threaten our future. They could see how federal deficits impacted them directly through higher borrowing costs and taxes.

That potency went away with the financial crisis, as the monetary and fiscal response to the collapse of the mortgage markets was so massive it rewrote the books on what was possible. And it stayed away as we spent the next ten years not raising rates, not reducing the Fed’s balance sheet, and not cutting deficits, all without any apparent repercussions. The more the budget scolds warned about deficits and rising prices, the lower prices went. It is hard to be Chicken Little when the sky’s not falling.

But now the sky is falling. We have ten years to get our budget house in order. Expect to see deficits and rates take center stage again. From our perspective, today’s meeting is the first to test the resolve not of those who want to address the challenge, but those who deny there’s anything to worry about. Whatever cautionary tale is the opposite of Chicken Little, that’s where we are at.

Debt Limit

Where do things stand? House Republicans defied expectations two weeks ago and successfully adopted a package to 1) raise the debt limit sufficiently to keep things running for another year, and 2) reduce the deficit by nearly one-half trillion dollars though a package of spending caps, recissions of unspent COVID funds, and repeal of the electric vehicle tax credits from the Inflation Reduction Act. (There’s been lots written about just how expensive those credits will be – here, here, and here – way more than Congress originally estimated.)

The Administration, on the other hand, has repeatedly called for adopting a clean debt ceiling increase, arguing that the country’s finances should not be held hostage to a procedural vote. As White House Press Secretary Karine Jean-Pierre put it:

Business leaders and economists have warned that the threat of a default risks the livelihoods of American small businesses, retirees, and working families and would hand a massive win to China — and recent events underscore the need for Congress to address the debt limit as soon as possible. It’s time for Republicans to stop playing games, pass a clean debt ceiling bill, and quit threatening our economic recovery. The President welcomes a separate conversation about our nation’s fiscal future.

If we are right that deficit politics have regained their potency, then the fact that the House successfully passed a credible deficit reduction package increases the odds the ultimate package will include deficit reduction provisions. Survey results from the Winston Group back this up:

“Similar to what we saw in March, 48% of voters believe the President should negotiate with Congressional leaders while only 14% support the President in refusing to negotiate and insisting on a “clean increase” without conditions.”

The ball now is in the Senate’s court and all eyes are looking to the White House to see what President Biden will support.

Implications for S Corporations

For the business community, the challenge is clear. We have a ten-year window to address this and the earlier Congress acts, the less pressure there will be to raise taxes. In an environment where tax policy is driven by a misguided desire to target large employers and family businesses, there’s never been a more important time to get our fiscal house in order. A clean debt limit might make Wall Street feel better, but it only makes our ten-year challenge worse.