Today’s news that inflation hit 9.1 percent in June comes a day after NFIB released it latest small business report, and the results are grim. Small business sentiment is down for the sixth straight month and hit its lowest level in nearly five decades. It’s yet another reminder that there could not be a worse time to raise taxes on American employers.

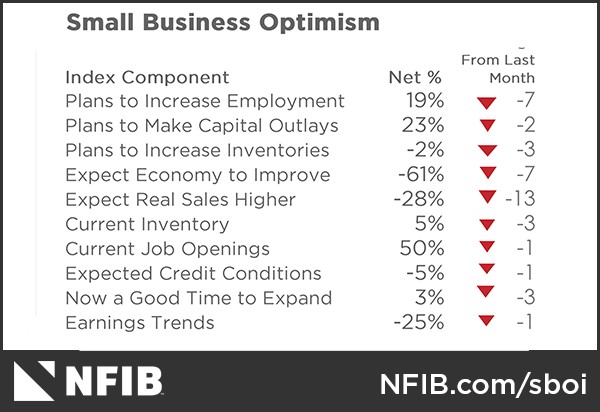

NFIB’s numbers show that employers continue to be extremely pessimistic about the economic outlook. The percent of employers expecting business conditions to improve in the next six months decreased 7 points to a net negative 61 percent, while the number of firms expecting higher real sales over that period were down 13 points:

The biggest issue facing small businesses? Inflation. That’s no surprise given the official numbers from the Labor department, which show that prices have been climbing for the better part of a year now. Today’s data was a continuation of that trend with the Consumer Price Index soaring 9.1 percent from a year ago and up 1.3 percent in just one month.

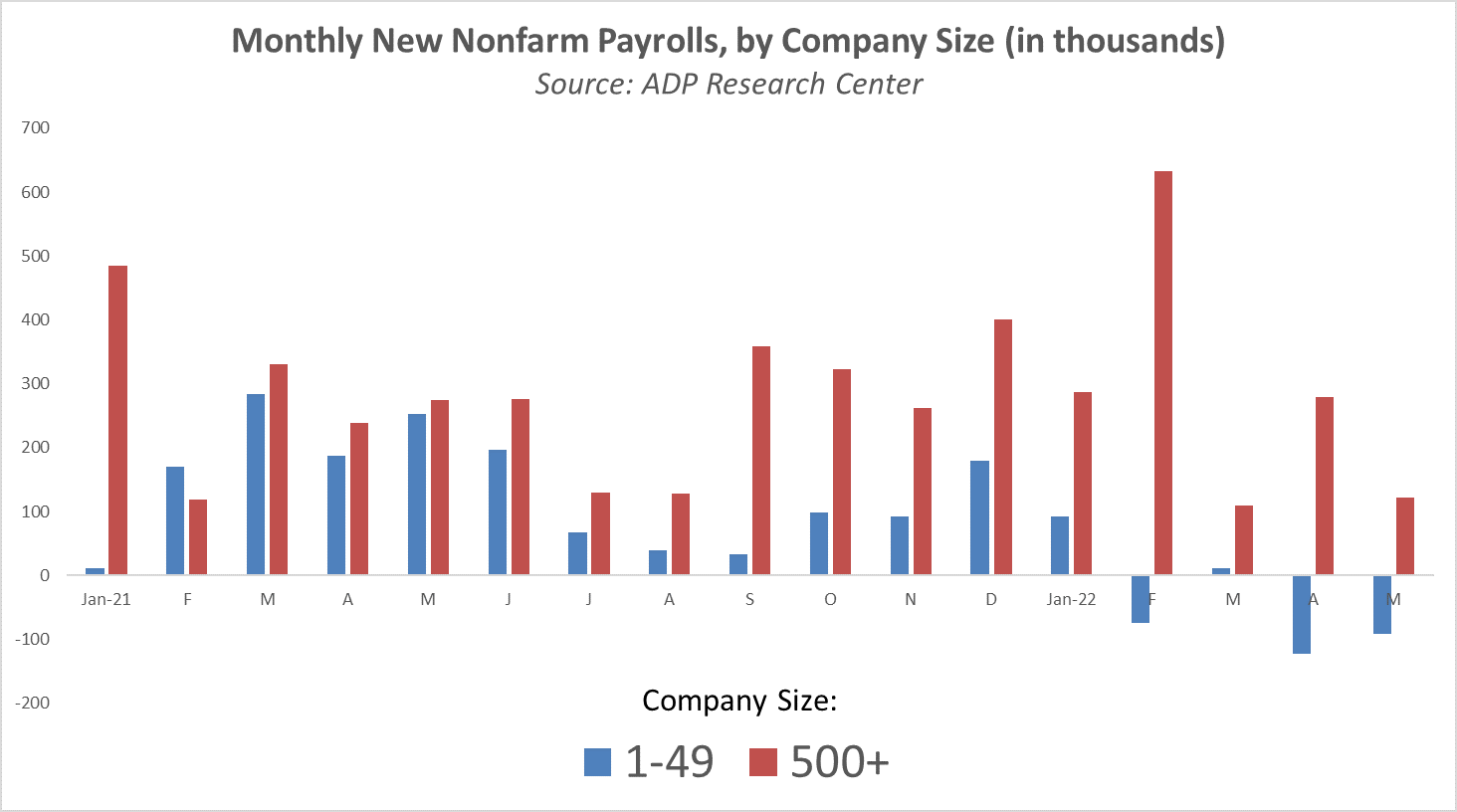

All this comes on top of the ADP Employment reports showing that while larger firms continue to hire and grow, the small business sector is contracting. The graph below shows monthly changes in employment for companies with fewer than 50 employees, versus those with over 500.

As you can see, smaller firms have lost employment in three of the last four months and have actually shed net jobs for the year. The overall economy may enter into a recession in the coming months, but it’s clear the small business sector is already there.

How does this all relate to tax policy? Last week we learned that Senate Democrats were putting the final touches on a new, $200 billion tax increase. Under the guise of “closing a loophole” and funding Medicare, the proposal would expand the existing 3.8 percent Net Investment Income Tax (NIIT) to include the income of active business owners.

We’ve written about this at length (see here and here), but the bottom line is that the NIIT was intentionally designed in 2010 to exclude active business income (i.e., not a “loophole”). Further, the revenues generated by the tax do not fund Medicare. That often-repeated talking point is patently false: NIIT revenues go to the general fund, not the Medicare trust fund.

Instead, according to data from the Treasury Department, this policy would put 1 million small and family-owned businesses at risk of seeing their effective tax rates increase by 3.8 percentage points, an 11 percent increase over the rates they pay now. That’s why 200 trade associations, representing millions of businesses and tens of millions of American workers, wrote to lawmakers this week urging them to abandon this harmful tax hike.

The Main Street business community is still reeling from the worst global pandemic in a century. In the face of a looming recession, 40-year high inflation, unprecedented supply-chain challenges, and chronic labor shortages, American employers need a lifeline, not a tax bill. It’s time to slam the brakes on this ill-conceived policy and help these businesses get back on their feet.