Last week, S-Corp President Brian Reardon joined a panel discussion on our SALT Parity efforts. Hosted by Tax Analysts, the webinar sought to explain why these laws are necessary, who benefits, and what effect current proposals in Congress might have on them.

For those new to the issue, the SALT deduction cap imposed by the Tax Cuts and Jobs Act put S corporations and partnerships at a competitive disadvantage – C corporations could continue to fully deduct their SALT as a business expense while pass-through business owners were subject to the new $10,000 cap.

As such, restoring the federal SALT deduction for pass-through entities – what we call “SALT Parity” – has been a priority for S-CORP and the Main Street Employers coalition ever since.

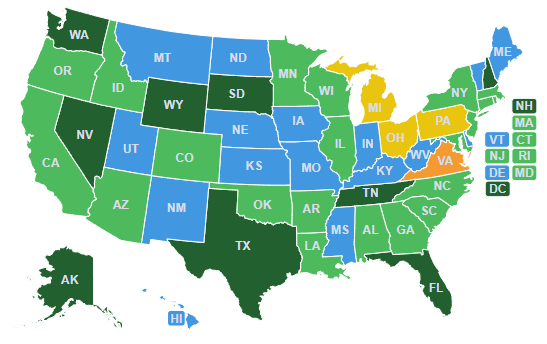

The legislative approach we’ve backed allows pass-throughs an election to pay their SALT at the entity level. Shifting the incidence of the tax restores the deduction at the federal level while maintaining revenue neutrality for the state. It’s a win-win that has been adopted by 21 states to date, with Michigan on the cusp of bringing that number to 22.

So are there any downsides to this approach? Tax Analysts President and CEO Cara Griffith asked whether SALT Parity legislation introduced added complexity to state tax codes. Here’s Brian:

I think it replaces complexity. SALT taxation to begin with is remarkably complex. My membership tends to be larger, multi-state S corporations so I’ve got S corporations that are operating in all 50 states and overseas as well, and they have entire tax departments and specialized consultants who do their SALT taxes because it is so incredibly complex. So I’m not sure that adding an election necessarily makes it more complex. It replaces one complexity with another, but it was already complex to begin with.

Much of the debate around the SALT deduction cap centers around who benefits, with battle lines drawn between high- and low-tax states. But as panelist Steve Wlodychak points out, the cap has a much broader impact than this narrative might suggest:

In a lot of blue states or red states – let’s take Texas for example – people there are paying extraordinarily high property taxes. But I don’t think anybody debates the fact that if you’re paying a property tax, at least at the business level you get the deduction, but it still hurts Texans just as much as it does anybody in New York or California. So the SALT deduction limitation I think has brought applicability around the country, and it’s not just limited to the blue states either. I think it affects taxpayers – I don’t want to say “equally” – but it does affect taxpayers all around the country in various different ways.

On the question of what effect proposals to modify the SALT cap might have on state laws, Brian explained:

This really applies to businesses of all sizes. There is not a floor on income in terms of who can benefit from this, so those folks will continue to benefit regardless of what they do on the SALT front. But again, as you see what’s going on in Congress, there’s going to continue to be a benefit. Right now the biggest challenge we have is that [the SALT cap] is going to sunset in 2026, so why are we doing this if it’s only a four- or five-year benefit? All the plans they have extend it out until at least 2031, if not making it permanent. That’s just going to make this policy this election much more valuable.

So the utility of SALT Parity laws is likely to remain relevant for years to come, and can benefit countless taxpayers. How much of a benefit? Our rough estimate shows that our efforts to date are saving S corporations and partnerships Nearly $4.6 billion a year, with another $1.4 billion to be saved if the remaining states take action.

Even for smaller firms, those savings can amount to several thousands of dollars each year. That’s a significant amount, particularly as those affected by the cap are often the same businesses that have been hardest hit by the pandemic.

Our SALT Parity map tracks the progress of states across the country in moving SALT Parity legislation. If your state is in green on this map, congrats. If your state is in blue, that means there’s no legislation under consideration. If you want to change that, give us a call. Your state’s inaction is literally leaving money on the table and costing your Main Street employers millions.

Or, as panelist Alysse McLoughlin, a partner at New York-based law firm Jones Walker put it:

I don’t see why any state would not pass this. It’s not hurting any state, and if there’s any taxpayer in your state that’s going to be helped by it, why not do it? …You’re only hurting your own residents really when you don’t make that change with that reform.