Main Street business tax treatment was a big theme during the Ways & Means Committee’s first hearing of the year. Its purpose was to look at the state of the economy, but key members kept raising the question of how to best treat pass-through businesses in tax reform. Carrying the flag for S corps was our longtime S-CORP Champion Dave Reichert (R-WA):

Reichert (1:53:00): In another area where we have the ability to boost our economy – through tax reform, as has been mentioned, and which would benefit businesses large and small — what about pass-through businesses…which face a high marginal tax rate in addition to high compliance costs. How do you see the change in the tax code specifically helping those small pass-through businesses?

Economist Martin Feldstein: I think that’s a major challenge that you face as a committee and in Congress in dealing with tax reform. That lowering the corporate tax rate, where both the President and Republicans have said ‘we’ve got to get down into the twenties,’ will still leave pass-through businesses, who file through their personal tax returns, facing much higher tax rates, so somehow that has to be dealt with. And by treating the business income of individuals differently from other things, so that in effect they get the advantages of the lower tax rate that come with corporate tax reform.

Rep. Vern Buchanan (R-FL) also focused on the challenge faced by pass-through businesses:

(2:22:00): I want to bring up something my colleagues mentioned earlier, about corporate rates being the highest in the world…I think we agree that we need to do something with corporate rates. My concern is pass-through entities. You touched a little bit on effective rate, and how when you add everything the effective rate is 40 percent or more, and if you add in state income tax, the average is 49.6. So if you look to move corporate rates from 35 to 28 to 25, whatever they’re thinking about doing there, I don’t know how you can be competitive in terms of pass throughs.

One statistic I got is 99 percent of the companies registered in Florida and other places are small businesses, obviously a lot of them pass throughs. And 60 percent of job creation comes from these businesses, and many of these start-ups. In terms of reducing the rate, if you’re a pass-through company and you have seventy employees, and you’re giving half your money back to the various governments, it’s pretty hard to be able to grow your business, add equipment, add jobs, when you’re giving half of [your money] away. My point, to the professors here today, is to ask what effect lowering the rates on C corps and pass throughs would have on the economy and on creating jobs….

Economist Doug Holtz-Eakin: It’s bad tax policy to treat business income differently depending on whether it’s a pass through or a C corporation. And that would drive you to organize your business based on tax considerations rather than business considerations; that’s the hallmark of the tax system interfering with the economy.

And finally, Representative Todd Young (R-IN) weighed in:

(3:00): I’d like to talk about tax reform…but specifically focusing on tax reform for our smaller businesses and younger firms.

I do have some concerns, going back to the small and younger firms that, about some intimation by the President and by others in this town that we may only consider corporate reform, rather than the individual code so that those pass-through entities like S corporations and LLCs get the benefit of simplification, on one hand, and rate reduction, knowing that many of them pay over half of their profits in taxes, when you combine the taxes at different levels of government.

It bears reminding that, over the past decade, more than six out of every ten new jobs created in this country have been through these smaller firms, and this is where over half of jobs currently exist in this country.

Bottom Line: Key members of Ways and Means, starting with the Chairman and working down from there, are fully aware of the economic importance of pass-through businesses and the threat that “corporate-only” tax reform poses to them.

Tax Reform Challenge in One Chart

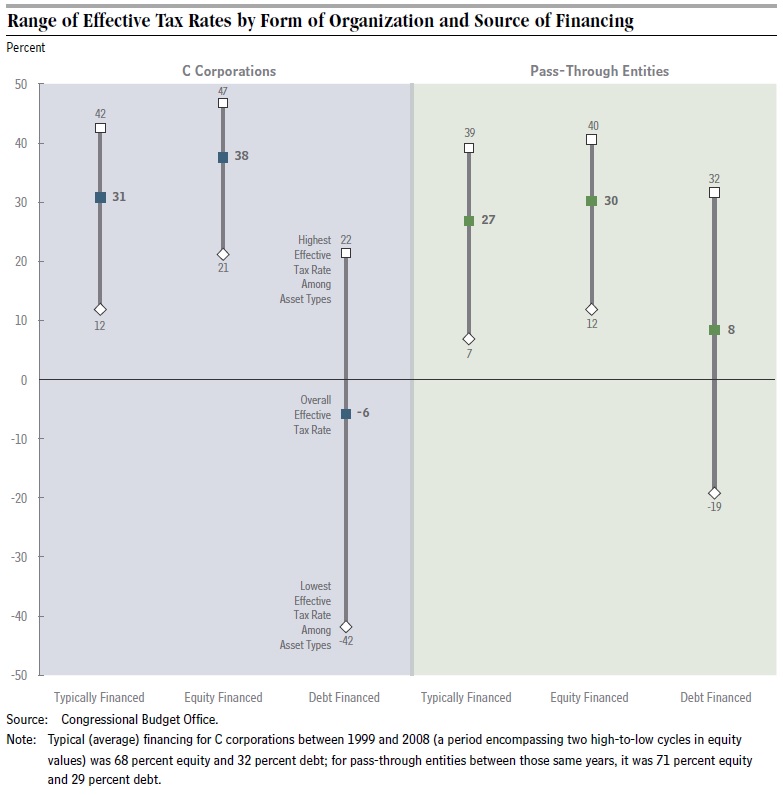

If you’re looking for an illustration of how the tax code fails to treat business income equitably, look no further than this chart on effective marginal tax rates from the CBO (click to enlarge).

Keep in mind that the chart shows effective marginal rates, so it captures the tax on new income from a new business investment, not the average tax paid by businesses on their existing income. If you’re looking for effective rates on existing business income, you should look at the effective rate study we released back in 2013. (Spoiler alert: S corps pay the highest effective rate.) Moreover, since sole props tend to be less profitable and are taxed at lower average rates, their inclusion reduces the effective marginal rate for pass-through businesses below what it would be if S corporations alone were examined.

These points aside, the chart has much to tell us.

First, look at the disparity between debt and equity investment. Returns on equity are taxed at high levels, while returns on debt financed investment are taxed at much lower levels. Debt-financed investment by C corps is actually subsidized under the current code! This disparity encourages businesses to over leverage. Not good. Any tax reform worth doing would seek to balance out the tax treatment of debt verses equity.

Second, look at the long lines showing the range of effective marginal tax rates. These signify the difference in effective rates depending on the industry and assets involved. The longer the line, the greater the disparity. The range of effective tax rates for C corps using equity ranges from 21 to 47 percent. The range for C corp debt is from 22 percent to negative 42 percent! Pass-through businesses also show significant ranges, if not quite as extreme. Once again, any tax reform worth doing would seek to shorten those lines and balance out the tax treatment of investing in different types of assets.

One of our concerns with the Camp plan released last year was that it did little to balance out either the debt verses equity differential or the differing treatment among asset types. In fact, the JCT analysis of the plan showed the Camp draft would have increased the effective tax burden on business investment. Tax reform should encourage, not discourage, business hiring and investment while balancing out the tax burden on differing industries and business structures.

If you want a sense of how difficult that task will be, look no further than this CBO chart.

It’s All About That Rate

Speaking of tax rates, Bloomberg’s Richard Rubin had a nice story this week outlining the challenge tax reformers face in trying to reconcile corporate and pass through taxation. S-CORP’s own Brian Reardon was highlighted channeling singer Meghan Trainor:

The administration’s proposals are an “absolute non-starter,” said Brian Reardon, president of the S Corp Association, a group of pass-through companies whose board of directors includes an executive from Tabasco sauce maker McIlhenny Co.

“Main Street businesses have to be an equal partner in this,” he said. “And what that means is rate parity. It’s all about the rates.”

It’s all about the rates, indeed. You can bet that’s going to be our major theme this year as Congress takes another look at tax reform.